If I Already Have A Personal Loan Can I Get Another One – Taking a loan in Singapore is one of the most popular options if you are in financial trouble and need money to settle your bills. But “how much credit can I get?” the question arises.

Knowing how much you can borrow will help you determine the right amount to borrow and assess your ability to repay the loan.

If I Already Have A Personal Loan Can I Get Another One

Before you take out a loan, read about how much you can borrow, whether you can take out multiple loans, what to consider before taking out a loan, and where to apply for a loan.

Application Process For Personal Loans

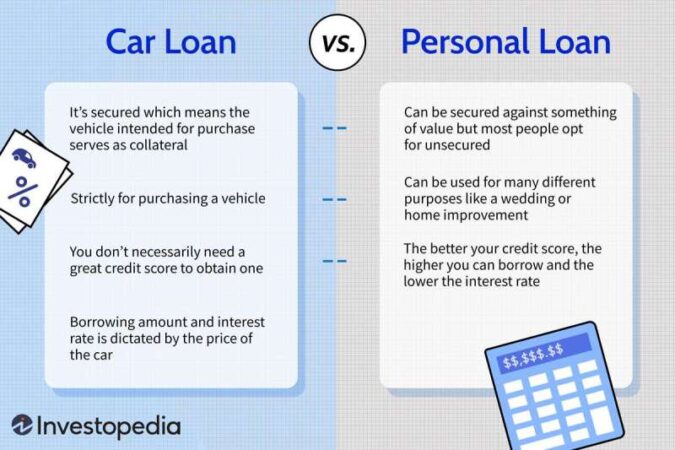

A personal loan is an unsecured loan that you can use for whatever you want. Unsecured means the loan is not tied to anything like your car or home. If you can’t repay the loan, the lender can’t take your property.

However, defaulting on a loan affects your credit score and increases your chances of getting a new loan.

After your loan application is approved, the loan amount will be paid into your bank account or in cash.

The loan has a fixed interest rate and repayment period. Personal loans are amortized, meaning you have to pay back the interest and the loan amount.

How Much Personal Loan Can I Take In Singapore?

Each month, over the repayment period, which can be up to five years, you must pay back a portion that includes interest and principal.

Please note that fees such as processing fees may apply at the time of application. Generally, the loan amount you receive after approval is the original loan amount without any fees or charges.

Mr. Cohen wants to get a loan of 15,000 dollars. The fixed interest rate of the loan is 4.7%, the repayment period is five years, and the service fee is 2%.

For example, if you take out a wedding loan and use it to pay off your student loans, you haven’t done anything wrong.

Hdb Loan Vs Bank Loan

Circumstances such as medical or family emergencies may require resources that are not readily available. To solve the situation, you can get a personal loan.

If you hope to get married but have no money. You can get a loan to make your dream wedding a reality.

You can get a loan to pay for your tuition, or you can pay off a student loan if you can’t repay the loan for some reason.

If you can’t pay your credit card debt, you can ask your creditor to pay off the debt. This is not recommended in the long run, as it will only lead to greater debt.

Ow To Get A Personal Loan With No Income Proof

If you have a lot of high-interest debt, you can get a low-interest loan to consolidate your credit, lower your monthly payments, and make paying off your debt easier.

A personal loan can be taken for any situation. But to avoid getting into unnecessary debt, be disciplined enough to use the loan wisely.

When it comes to how much you can borrow, it depends on several factors, such as the purpose of your loan, your ability to repay the loan, and the type of loan.

You can get up to six times your monthly income for unsecured personal loans. However, if you get a collateral loan, the amount you can get depends on the value of the collateral.

Can I Take A Personal Loan? Find Out With These 7 Questions, Money News

Another thing that can affect how much you can borrow is the debt limit for unsecured loans. From June 1, 2019, the Monetary Authority of Singapore (MAS) has closed unsecured loans, where a person can borrow up to 12 times their monthly income.

This includes all unsecured loans such as personal loans, education loans, home improvement loans and lines of credit and loans.

So, if you want to get a loan and you have taken an unsecured loan of up to 10 times your monthly income, you will be borrowing twice your monthly income.

Not everyone is eligible for a personal loan. Although the eligibility criteria may vary from lender to lender, the following are the main criteria for getting the best personal loans in Singapore.

How To Apply For A Renovation Loan In Singapore

Lenders will also want you to prove that you have a steady income and have been employed for at least a year. They can also check your credit history and meet certain criteria to qualify for a loan.

Technically, you can get many personal loans. However, it still exceeds the unsecured loan limit required by MAS, which is 12 times your monthly income.

Remember that banks and other financial institutions may be willing to lend you anywhere from two to six times each month.

Let’s say Mr. Cohen’s monthly income is around $6,000 and he has no unsecured debt. You can borrow up to $36,000.

Should You Take A Personal Loan In Singapore For Your Wedding?

Depending on how far the lender is willing to go while considering other variables, he can choose six loans of $6,000 or two loans of $18,000.

In short, you can get more personal loans until you reach the limit required by MAS.

Even when planning to get an affordable personal loan, keep the following in mind before and after applying.

Each lender has different interest rates on their loans. Shop for the lowest interest rates for personal loans in Singapore and contact lenders. In this way, the cost of credit will decrease.

Where To Get A Short Term Loan In Singapore

This is the length of the payment period. Find enough credit to pay off the loan.

If you take out a long-term loan, you can pay more in the long run. Some lenders may have lower loan amounts and faster repayment fees – find out what these are.

Find out what fees and costs are associated with the loan. Most lenders charge a processing fee of 2-3% of the loan amount. However, additional fees such as late payment, cancellation fees and early payment fees may apply.

You need to be able to repay the loan you are taking out, because defaulting will only lead to more debt. Make sure you have a steady income and don’t have a lot of debt.

Top 5 Benefits Of Taking A Personal Loan For Medical Emergency By Gurusone

What other options are there for the purpose of the loan you are trying to get? For example, instead of taking out a home improvement loan, you can take out a home improvement loan. The same goes for academic credit.

Banks have stricter requirements than lenders and they require you to have good credit before they will give you a loan. When you take loans from banks, the approval period may also be delayed. However, you can get more loans than cash.

Lenders can offer the best loans in Singapore because of their easy and fast approval times.

The rejection rate is also low, and you can get shorter payment terms compared to banks. That way, you’ll pay less interest in the long run.

Getting A Personal Loan And Its Benefits By Lfunders

Additionally, you can get a loan even if your income is below the “minimum $20,000” requirement that some banks require. However, in most cases you can get a loan for less than you can get from banks.

How much personal loan can I get in Singapore? You have the answer above. It all depends on the type of loan, the purpose of the loan and other factors that lenders consider.

If you want the best low interest personal loan in Singapore, Lending Bee has you covered.

With simple application requirements and fast approval, you can get a loan in less than an hour. Contact us to learn more or apply for an online loan and get started today.

Can A Student Get Personal Loan In India?

A self-described “multi-professional,” Ashley worked as a bank relationship manager for five years. Before the epidemic, he quit his job and became a freelance writer for about a year. Now she puts her love of writing and knowledge of banking and finance to good use in her role as head of content marketing. It hopes to help people make better financial decisions through content and campaigns.

Business Development Education Investing Livelihoods Loans Money Management News About Us Money Building Research & Development Self Improvement Self Promotion Informal.

Continue reading. What you need to know about money lending laws? What is effective interest on a loan and how is it calculated? What to do to get a personal loan in Singapore? Accredit Pte Limited is a new generation licensed lender with a sustainable model focused on consumer protection, awarded a pilot program by the Ministry of Law. With our branches all over the island in Singapore, we offer you money lending services.

Create creative digital solutions

How Many Personal Loans Can You Have At Once?

Can you get another car loan if you already have one, can i get another loan if i already have one, can i open a new bank account if i already have one, can i get another mortgage if i already have one, can i get a loan if i already have one, if i have a bachelor's degree can i get another one, if i already have a personal loan can i get another one, if i already have a bachelor's degree can i get another, can i get another car loan if i already have one, can i apply for another loan if i already have one, can you get another loan if you already have one, can i get a bsn if i already have a bachelor's