I Need To Pay Off My Debt – Do you have credit card debt? you are not alone. More than half of U.S. consumers have credit card debt. In the third quarter of 2021, Americans accumulated $17 billion in credit card debt. Some attribute the sharp rise in credit card debt to the end of stimulus payments and increased unemployment benefits. Heavy reliance on credit cards and the resulting credit card debt can become a monthly burden on you and your family. Looking for the best way to pay off credit card debt? See these tips:

You may have heard this tip before, but it can make the biggest difference in paying off your credit card debt. When you only make the minimum payment, your balance will continue to grow due to interest. If you have extra money at the end of the month, adding it to your credit card account can make a big difference. If you never have extra cash, you may want to consider creating a budget and prioritizing your credit card debt.

I Need To Pay Off My Debt

:max_bytes(150000):strip_icc()/chargeoff.asp-final-fb981c20a46244e4ba308e2babbb3153.png?strip=all)

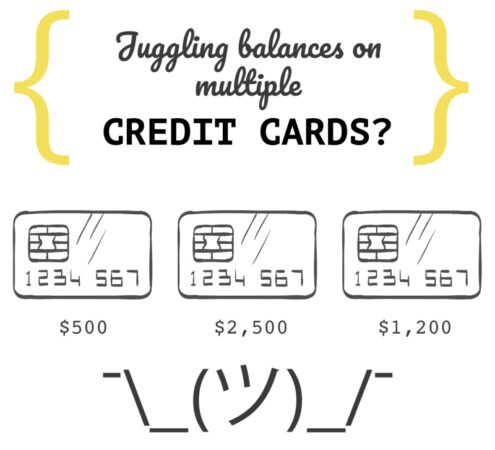

If you have debt on more than one credit card, check the interest rates on each card. Any account with the highest interest rate should be your “pay it off first” card. As with paying more than the minimum payment, paying off this card first will help prevent your balance from growing quickly due to interest.

Pay Off Credit Card Debts: My Tried And Tested Tips

One way to get out of credit card debt faster is to apply for a personal loan for debt consolidation. When you apply for a personal loan to consolidate your debt, you can use the loan funds to pay off (or pay off) your outstanding credit card balances, leaving you with a loan. Debt consolidation loans are a good option when loan interest rates are lower than credit card rates. Learn more about debt consolidation methods and compare debt consolidation to debt relief.

Getting a new credit card may seem like a no-brainer, but it can be one of the best ways to pay off your credit card debt. When you get a new card that offers a 0% APR* balance transfer offer, like the PCU Platinum Rewards Mastercard, you can transfer your existing credit card balance without paying interest while the offer is in effect. This means that any money you pay will be credited to the principal. This can result in faster debt repayment! If you’re looking for a rewards credit card in Nanuet, New Town, or Orangeburg, the Palisades CU Rewards Mastercard could be a great choice for you! Learn more about the benefits of shopping with a Palisades CU credit card.

If you have questions about paying off your credit card debt or would like to learn more about our 0% APR* balance transfer offer, contact us today! Palisades serves server community members in Rockland, New York, and Bergen County, New Jersey. Check out current credit card rates in Nanuet, Orangeburg, and Newtown.

Share: Share on Facebook: How to pay off credit card debt faster? Share on Twitter: How to pay off credit card debt faster? In January 2013, I decided I was tired of debt. We spend lavishly, but we don’t save. I decided to show you how we got out of debt (except for the mortgage) and became happier with more freedom and security. While this has nothing to do with decorating, I hope my success in this area will be helpful to you as well. I was listening to Big Magic this morning and the author, Elizabeth Gilbert, really discourages creative people from going into debt because it limits you. she says

Save? Or Pay Off Debt?

Even though I live on the edge, I was raised to never be in debt, and I guess that makes a difference. I think that makes me feel free. “

I think that’s important too. Here are the steps I took to get out of debt, the debt I owed, and how you can do the same.

My New Year’s resolution for 2013 was that I decided to get out of debt. Here is the amount owed (from lowest to highest, excluding our mortgage):

.png?strip=all)

Looking at that amount now, even if it’s all gone, makes me sick! In debt alone, our minimum payment is $862. We didn’t make a lot of money, so it seemed like every penny we made turned into debt. This isn’t fun!

Should I Pay Off My Mortgage Early?

I was ready to leave and really wanted to get out of debt, but my husband didn’t want to. His job is stressful and his income is the highest it has ever been. He didn’t want to take a big pay cut while he was trying to make money. We talked and talked (and did have disagreements on the topic), but eventually we came to a compromise – I let him try it for two months, and if it didn’t work for our family, we would stop.

First, I sat down and wrote down why I wanted to get out of debt. This makes me so angry, I never want to be in debt again and I am passionate about changing my life!

Get 30 days free on Kindle via this link and read on any of your devices. I’m giving you a million choices because this is a special book for me)

We haven’t had a savings account in a long time and it seemed crazy to have so much money in the bank. We always used to have a credit card linked to our checking account, so if we overdrawn it, it would go to the credit card. You have no idea how much I cringe as I write this, but here we are (everyone has to start somewhere)! A $1,000 emergency fund is a great safety net and the first change to living life without relying on credit cards

Should I Pay Off My Student Loans Early? Experts Tips On Repayment

Every two weeks I withdraw money from the bank and put it in an envelope. One week of product is $50. Christmas $80 per month. $20 for a date/dining out (Dave Ramsey says this category needs to stop, but part of my compromise with my husband is that we will still have a good time). Paying cash really helps me stay on budget! If there isn’t enough money in the envelope, I won’t receive it. At the grocery store, I am constantly calculating the price of each item on my grocery list. If I spend more than $50, I put stuff away. I am strong 🙂

To keep track of my expenses, I made an Excel spreadsheet and wrote down how much money we made and subtracted any bills. Then I subtract items like groceries, dog food, etc. from my budget. I then deducted the remaining balance to pay off the monthly debt (originally the monthly debt was $650). After that there was no money. Every penny goes toward an account, budget item, or debt. I hated budgeting at first, but then I grew to love it. Why because it’s freedom. It’s a plan through which you manage your money and tell it where to go. If I wanted to run a 5k, I would budget and then not worry about not having enough money. I was in the lead! Another thing I love about budgeting is that it keeps you moving forward into the next year. At first, I had a lot of “surprise” bills – car registration, tax bills, and 3 birthday gifts – all at once, so I had a hard time paying them all. Now I can look at my budget for the same month last year and get an accurate estimate of my electric and gas bills, as well as my annual bill.

This part was painful, but whatever we could cut, we cut. We bought cheap toilet paper, ate most of our meals at home, brought lunch to work, found the cheapest gas, and didn’t buy unnecessary clothes, makeup, or anything else (sob!). Where possible, we spend less or nothing. We got creative and borrowed books and movies from the library. Our dates included going to the park and throwing a ball to the dogs. Instead of working out at the gym, we went outside for a run. In fact, we’ve become the cheapest ones (which is why my house needs updating so much!).

We completely disconnected from the internet and cable TV! I called our operator and got a better price. I went from paying my insurance monthly to paying every 6 months when I switched companies, which saved a lot of money. We try to turn off the lights to save money

Should I Pay Down My High Interest Debt First Or Invest?

I need to pay off debt fast, need money to pay off debt, need to pay off debt, i need money to pay off my debt, need to pay off credit card debt, need help to pay off debt, need a loan to pay off debt, i need loan to pay off debt, need to pay off debt fast, i need to pay off my debt, i need a loan to pay off my debt, need loan to pay off debt