I Can T Pay My Credit Cards – Crime can happen to anyone. During times of financial challenges such as job loss or large unexpected expenses, many people may face this situation. If someone can’t pay off their credit card in full, the challenge can escalate.

It is important to understand that non-payment of credit card debt can result in interest and fees. Since the annual interest rate is usually around 25%, paying off the outstanding amount on time can increase your loan amount.

I Can T Pay My Credit Cards

The longer you carry credit card debt, the more likely you are to fall into a debt trap, which is a dangerous situation. On the other hand, you can find a solution to any problem. If you’re having trouble, we’ve got tips for paying off your debt.

Can’t Pay Your Credit Card Bills This Month? What You Can Do

Understanding credit card transactions is important to managing financial problems. In fact, credit cards serve as a tool for making purchases, paying bills and making payments.

A type of short-term loan extended by credit card companies. It gives you a fixed limit to pay bills and manage purchases.

When you make a purchase, the available credit or balance on the card is reduced and you must refund the amount spent.

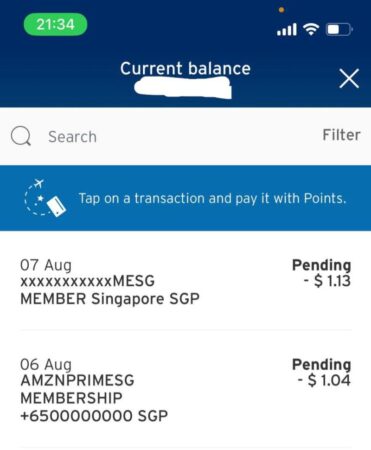

When using a credit card, transaction information is captured by an authorized bank, often called the merchant’s bank, for processing. If the credit card company approves the transaction, the transaction is completed, and the corresponding amount is deducted from the card.

What Happens If I Miss A Credit Card Payment

At the end of the billing cycle, the credit card company sends a statement to the cardholder with all transactions. This statement shows the balance and payment amount. Note that there is a short grace period for repaying the loan in which no interest is payable if repaid within this period.

However, carrying an unpaid balance on a credit card from month to month may result in additional interest charges. The card is based on an annual percentage rate (APR), which reflects the annual cost of carrying a balance. The APR includes additional costs such as interest on the loan and annual fees.

It’s important to note that many credit cards have a variable APR attached to the higher rate, which leads to more costs over time. As a result, the credit card holder may pay overtime fees if the balance is not paid off promptly.

As already emphasized, credit cards are not intended for additional credit. Therefore, it is recommended to explore other ways for larger expenses, such as a personal loan or a larger amount for loan renewal. These large loans typically have low interest rates and offer flexible payment options, minimizing the impact on your financial situation.

Credit Card Debt: More Americans Can’t Cover Everyday Expenses

Credit cards should be seen primarily as a way to pay, making shopping easier with the added benefits of discounts and rewards. Even in this case, it is important to ensure that the credit card balance is fully settled each month. Now, let’s dig deeper: What options are available if you’re having trouble paying your credit card bills? Here are the first thoughts.

If paying in full is a challenge, credit card companies often offer a minimum monthly payment. Failure to meet this minimum standard can quickly lead to negative consequences. Late payment fees will be charged, and your credit score may be affected, which may jeopardize your future ability to secure a loan from a financial institution.

In Singapore, most credit card issuers charge a minimum of 3% of the outstanding balance or S$50, whichever is higher. If you can’t pay the full balance, make sure you meet at least the minimum payment requirements.

Failure to meet the minimum payment may result in additional charges, with late fees of up to S$100 per month.

Here’s What Happens If You Don’t Pay Off Your Credit Card Debt

Even if a down payment is satisfactory, it’s important to proactively contact your bank. Engaging in discussions with the lender may lead to the possibility of arranging another payment date that suits your financial situation.

Done at the right time, balance sharing can help pay off credit card bills at very low interest rates, sometimes as low as 0%.

For example, let’s say you’re carrying S$6,000 in credit card debt and paying it off in full is a challenge. Also, you estimate that it will take about five months to clear the S$6,000.

Instead of letting your credit card balance grow quickly and out of control, consider keeping it in an account that offers an interest-free balance option.

Unpaid Credit Card Debt: What Are The Consequences?

Even when maintaining a balance of S$6,000, opting for an interest-free balance transfer usually gives you 6-12 months to pay off the loan and pay off the extra interest.

If you choose this method, it’s important to pay off the debt first before using the card for additional purchases. For example, if financial problems are hindering your ability to pay off debt, it may be worth restructuring your budget and cutting unnecessary expenses.

Consider practical adjustments, such as carpooling with your spouse instead of owning two cars or choosing home-cooked meals instead of eating out.

If using a balanced distribution proves challenging, another solution needs to be found. A suitable option in such cases is to opt for a personal loan, which provides flexibility in the use of funds.

Credit Card Debt Repayment Tips

Taking out a personal loan is a strategic plan to clear your credit card debt. In Singapore, personal loans typically have an interest rate of 7% per annum, which is much lower than credit cards that can collect rates of up to 25% per annum. Additionally, securing a personal loan from lenders with special offers can give you the opportunity to enjoy low interest rates and 0% tenure for a limited time.

After taking a personal loan in Singapore to repay the loan, it is important to know that regular monthly payments will be required until the loan is cleared. New order. Additionally, there is the flexibility to spread payments over a longer period to maintain a monthly balance and reduce the strain on your monthly income, extending the repayment period.

It is important to note that once a personal loan is secured, trying to pay it off early can result in prepayment. Since personal loan interest rates can vary between different lenders, it is wise to choose the one that offers the best terms. A good way to secure a low interest personal loan in Singapore is to use the services of a similar loan servicer. Not only do they facilitate the process of comparing different personal loans, but they also play an important role in guarding against the risks associated with unscrupulous lenders.

When your total debt, including credit card debt, reaches 12 times your monthly income or more, it’s important to pay it off quickly.

Pay Your Credit Card Bills Like A Pro

Delaying a decision can result in additional fees and penalties, making debt repayment more challenging and possible. Bankruptcy – Bad consequences for your financial well-being.

Debt consolidation involves combining all existing debts into a single loan. In fact, you get a new loan to pay off the outstanding loan, which is the only loan agreement in Singapore. It is important to note that debt consolidation specifically refers to unsecured loans, personal loans, refinance loans, and credit cards. Here is an example of how to use a debt consolidation loan.

For example, if your monthly income is S$4,000 and you pay S$10,000 on one credit card, S$10,000 on the second and S$20,000 on the third, most lenders will approve a personal loan equal to your debt, even if you have a total debt of S$40,000. . A monthly income (about S$24,000) is possible, but it may not be enough to pay off the loan in full. However, a debt settlement loan may be approved to cover the outstanding loan amount.

Debt settlement loans in Singapore often offer low interest rates and extended repayment periods. It not only gives you interest but also an opportunity to increase your score. Adjusting your budget is important because it limits how much debt you can go into unless debt consolidation is at a manageable level – typically less than eight times your monthly income in Singapore.

What Happens If I Stop Paying My Credit Card?

When dealing with debt, the first and most important step is to avoid accumulating additional debt. While the strategies above are designed to help clear credit card balances, achieving this goal can become a challenge as new debts continue to accumulate.

A good practice is to avoid further debt by keeping your card in a drawer and using it only after the current balance has been used up. This protection ensures that efforts are focused on debt settlement without disrupting additional financing.

Good management of loans and other debts requires planning and good financial management. It’s especially important to keep a low-interest credit card, like a high-interest loan.

Partnerships with leading banks and financial institutions make loan applications and comparisons easy. One application replaces multiple loan applications at this level. If you have unpaid debt, you can try to avoid the upcoming bills. You are worried.

Here’s Why I Stopped Volunteering My Credit Card To Settle The Bill First (especially When Dining Out With Friends)

How can i pay my credit cards off faster, can t pay credit cards, what if i can t pay my credit cards, how can i pay off my credit cards, can not pay credit cards, i can t pay my credit cards, how can i consolidate my credit cards into one pay, pay my credit cards, i can t pay my credit cards what will happen, can t pay my credit cards, what happens if i can t pay my credit cards, pay off my credit cards