How To Save Money When You Have A Spending Problem – If you’re currently looking for ways to build an emergency fund or are a little strapped for cash, try these 13 tips.

Whether you’re trying to save or build a country, folks, money is top of mind. If you’re currently looking for ways to build an emergency fund or are a little strapped for cash, try these 13 tips.

How To Save Money When You Have A Spending Problem

Cutting your cords can go a long way. Switch to a subscription service like Netflix, Hulu or Amazon Video. You’re probably already using at least one of these services, so there’s no additional cost to you.

How To Save Money For A House In 6 Months

Challenge yourself to not spend money on anything other than essentials like food, rent, and utilities for the next 30 days. Hold yourself accountable by encouraging your spouse or roommate to participate. This can save money if you’re adding a lot of items to your online cart.

One of the best ways to save money is to pay off your debt. But if you’re strapped for cash right now, stopping federal student loan payments may help you pay your rent. Under the CARES Act, federal student loans will be charged zero percent interest from March 13, 2020 through September 30, 2021. This is a great option to save money in the short term.

Save money by replacing lunch with leftovers and sandwiches. Continue to save money by cooking dinner more often to reduce takeout and delivery costs. Try new recipes or start a fun cooking challenge with your partner or roommate. It can lead to friendly competition with a delicious result.

Lowering your credit card rates can be as simple as calling your provider. Use your payment history and good credit score to negotiate a better rate. If your provider refuses to lower your rates, look for balance transfer offers. Transferring your existing balance to another card can help you save money on interest over time, so you can focus on paying off debt or saving extra money. If you’re having difficulty making current payments due to COVID-19, contact your provider to discuss your options.

Tips To Save Money In Singapore!

How many emails do you receive every day from retail companies offering you the latest promotions and telling you about deals you can’t miss? My guess is too much. Take 15 minutes to unsubscribe from this email, so you’ll be less tempted to buy something you don’t need. When you don’t get emails to remind you, it will be very easy to buy the latest trends. Your wallet and inbox will thank you.

Take the time to contact your auto insurance provider to find out what discounts (if any) are available to you. Due to the pandemic, many companies are offering flexible options. Geico, for example, is still offering “flexible gaming plans and/or special payment plans” for customers feeling the effects of the pandemic. And while you’re at it, see if you can reduce your premium as a result of driving or staying with the company for a long time. I never asked.

Even if you’re short on money, you can still find a few dollars to save. Try saving $10 or $20 every time you pay. It may seem small, but saving for emergencies and unexpected expenses is the first step. Make it easier by setting up an automatic transfer from your checking account to your savings account at your bank on payday. You always have money when you pay yourself first.

This is a no-brainer. Grocery items add up, especially if you buy more than usual because you’re spending more time at home. Discount stores and generic brands help you save money on your grocery bill. Keep Whole Foods While You Work Now; You can get your vegetables elsewhere. Bonus tip: Make a shopping list before you hit the aisles. Making sure you only buy what you need will keep your bills low.

How To Save Money From Your Salary?

Ideally, you’ll have your 401k contributions automatically withdrawn from your paycheck and you never have to think about it again. But if times are tough, make sure you can reduce your contribution for a short period of time. A few extra percentage points can make a big difference in your current budget. To continue maximizing your retirement, be sure to make at least your company’s matching contribution.

If you want to buy something, write. Whether it’s a new pair of shoes, a planner, or a household item, writing it down and waiting a few days can help you decide if it’s something you want or need. This trick helps you avoid impulse purchases. If after a week or two you are still considering the product and cannot live without it, continue purchasing.

Paying off your debt now will save you money in the long run. In the short term, you’ll save interest by reducing your principal balance, and if you pay off the loan, you’ll save the entire payment. If you want to save money on minimum monthly payments or interest rates, consider refinancing your student loans.

If you’re reading and feel like you spent big money on a book, don’t forget your local library. Additionally, most have online services where you can rent e-books or audiobooks. It saves you money and gives you access to thousands of titles to keep you busy.

Tips For How To Save Money And Improve Your Finances

Daniel Doolan Daniel Doolan is a communications expert and author passionate about business, women and healthy living. His writings and expertise have appeared in Career Contessa, Insider, Motherly, PopSugar, PRSA Strategy and Tactics, Thrive Global, and more. He holds a master’s degree in professional accounting from the University at Albany. By day, she works in corporate communications for a Fortune 500 automotive retailer, but her favorite role is by far the motherhood. To learn more, visit www.danielledoolen.com.

Looking for a fun way to save money? We have an idea. Envelope Challenge is a great way to earn fun money.

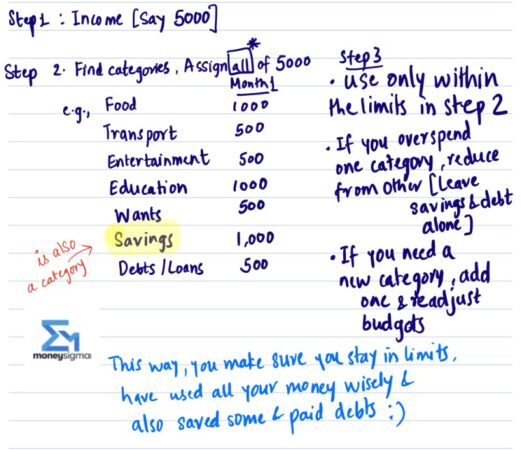

A budget works on four important rules you need to control your money and manage your finances in the long run. Here they are.

If you’ve spent many sleepless nights worrying about your mounting debt, I understand you. This is how I finally took action and paid off my debt in less than a year.

This Is How To Save Money • Everyday Cheapskate

Paying off your debt, increasing your savings, starting an investment, or looking at your entire financial situation? We have many financial apps for you.

You have the courage to ask for a promotion. But the question remains: How much can you ask for? How much of a raise should you ask for? Here’s the summary.

Is it time to negotiate a new salary? Whether you’re interviewing for a new position or negotiating a promotion, here’s how to determine and get exactly the salary you want.

Sometimes making an “irrational” career move, like taking a financial step, will help you move forward. Taking a pay cut is the best move.

How To Save Money While Your Pregnant 🫄🤰🏽🫄

By clicking “Submit” you agree to receive emails from Career Contessa and agree to the Web Terms of Use and Privacy Policy. According to CNBC, the average American household has $4,830 in a savings account. A survey by Bankrate.com offers some surprising insights into the financial security of American households, showing that 65% of Americans have nothing saved (20% don’t save out of their annual income). Only 16% of those surveyed claimed to save more than 15% of what they did; This is often recommended by financial experts. Look below to see 40 small ways to start saving money today!

The Bureau of Labor Statistics found that adults 65 and older spend an average of $46,000 a year, and Bankrate estimates that half of Americans won’t be able to maintain their standard of living after they stop working. In fact, more than 40 percent of Americans have less than $10,000 saved for retirement. That’s why it’s so important to start saving now. Even small steps towards saving money will contribute to a comfortable financial situation over time. Here are 40 tips to help ensure financial stability for emergencies, retirement, and peace of mind:

Take your time to unwind in the ultimate road trip escape. It could be a plane, train or car. The series focuses on old-fashioned road trips. Some miles down the road, some across the country or the ocean are the most beautiful landscapes or landmarks you’ve ever seen. Including how to prepare, fun on the road, and preparation on the road.

Home and Family Taking care of a home and family, and most importantly showing love, care and support, is a blessing that brings with it many responsibilities. But sometimes it can be overwhelming

Here Are 50+ Of The Best Ways To Save Money In 2023

How to save when you have no money, how to save money when you have a spending problem, how to save money when you have debt, how to save your money without spending it, i have a spending problem, i have a money spending problem, how to save money without spending it, how to cut spending and save money, how to save when you have debt, money spending problem, how to stop spending money and save, how can i save my money without spending it