How To Rollover A 401k From Previous Employer – You quit your job — but your 401k isn’t immediately following. Manage your 401k rollover request. Maybe roll it into an IRA. You may want to let another company handle it. People have the ability to let go of these labels. Bring your accessories and 401k deferral request.

Your 401k is probably sitting in an old account and not doing well. But a 401k rollover request can help put your retirement back into effect. Perhaps you’ve just started a new job and are receiving matching payments from your employer. good job! Roll old bills into it and earn more interest. Or it’s time to retire. There’s more to it than dusting off golf clubs and volunteering to watch the grandkids. Don’t forget about your retirement account during your working days. This can work for you even if your current job is relaxing, traveling and volunteering. A 401k rollover request can help make managing your retirement savings easier.

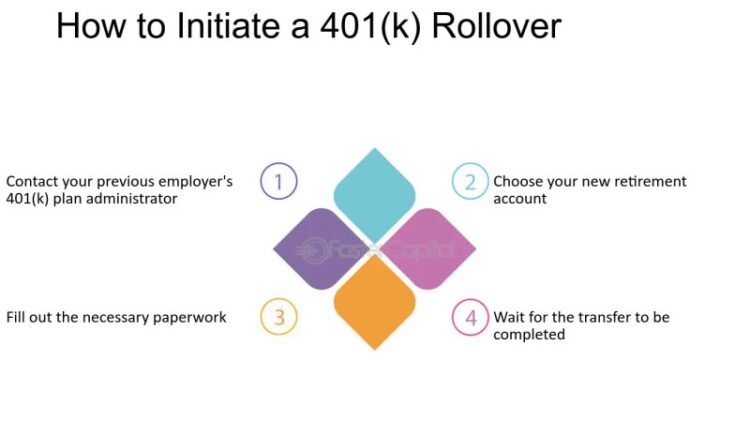

How To Rollover A 401k From Previous Employer

After reviewing your notice regarding distribution and income tax, I selected “Direct Pay” for my total account balance in the plan. In addition, I request that my account balance be transferred directly to an IRA or to the following designated plan (the “Receiving Plan”). I represent that the recipient’s plan is an eligible recipient’s plan for direct referral. My account balance should be sent to the address shown.

At What Age Can I Withdraw Funds From My 401(k) Plan?

I agree to make immediate disbursements of my account balance, and I waive any portion of the minimum notice period that may apply to such disbursement.

Start your 401k rollover request now and get RocketLawyer’s free 7-day trial of the legal services you trust at an affordable price. You’ll find: If you change jobs often, you may forget about your 401(k) fund. Read the following options to decide what to do with your old 401(k) from your former employer.

One thing to consider when changing jobs or approaching retirement is what to do with your old job savings plan. The more often you change jobs, the more likely you have a forgotten 401(k) with your previous employer over time. If you suspect you might lose your 401(k), you can search online for unclaimed retirement benefits. But the best way to find an old 401(k) is to take a direct approach — contact your former company’s HR department to see if they can help. If the company is sold or merged, contact the current parent company as your old 401(k) has been merged into the new entity’s 401(k) plan. Consider All Your Options Once you’ve found your old 401(k) plan, it’s time to think about how it might work for your retirement goals. For many investors, retirement savings accounts, including those accumulated from past jobs, comprise the largest portion of their retirement funds, so it’s important to avoid rolling all of your 401(k) options into one person. Retirement Account (IRA).

It’s important to understand the impact each choice has on your investment. Questions to ask yourself during this process might include: What fees and costs did your old 401(k) have compared to what you would pay if you rolled over to an IRA or new employer plan? Fees may include investment-related fees, sales fees, commissions, planning fees, management fees or others. What 401(k) investment options does your new employer offer? Are these investments right for your goals? How much choice does the new employer plan give you to choose and manage investments? What are the penalties if you take early withdrawals from your chosen 401(k) or IRA? The plans offer services such as investor advice and investment planning tools. When you turn 72 (70 1/2 for those born before July 1, 1949), 401(k) plans and IRAs may require you to take required minimum distributions. (RMD) If you’re still working at age 70 1/2, you generally don’t need to take RMDs from your current employer’s plan. From your retirement account to 401(k) options, check out the pros and cons of each option. Leave it where it is. Leaving your 401(k) with your former employer may allow your money to grow tax-deferred, but you won’t be able to continue making contributions. Also, if you leave your employer between the ages of 55 and 59 1/2 and gain access to low-cost institutional investments, you may be able to withdraw without penalty. The downside of this plan is that it is difficult to keep track of multiple accounts at different companies. These days, the average person changes jobs every three to five years in their career, so consider matching multiple 401(k) accounts. In addition, your former employer may have passed on certain plan administration fees or enrollment fees and may charge you for them. Include it in your employer’s plan now. You may be able to rollover the old account into your current employer’s 401(k). Deferred tax continues to accrue until any income is recorded. The plan’s investment options may include low-cost and institutional-level products, which means you can store more money in your account and pay less. Another advantage of joining the new plan is that if you need the money before you reach 59 1/2 and quit your job after age 55, you can withdraw it from the old one without penalty. . Employer’s 401(k). Before you decide to move your money into a new 401(k) plan, be aware that your investment choices may be limited in the new plan and there may be tax consequences if you hold valuable shares in your old employer’s plan account. Roll yours into an IRA. One of the options for your 401(k) is to take your old plan or plans and roll them over to an IRA. Like a 401(k), it can continue to be tax-deferred until you withdraw your money, and you can make new contributions within the regular IRA limits to keep growing. Also, account maintenance fees are usually very low. However, unlike most 401(k) plans, with an IRA, you can make many investment choices, including mutual funds, ETFs, stocks, bonds, options and more. You may be able to take penalty-free withdrawals before age 59 1/2 to cover things like education expenses, health insurance premiums or buying a first home. On the other hand, you may incur business-related expenses, including commissions, and you may not be able to access the same investments you made in your employer’s plan. Also, a 401(k) may allow you to take penalty-free distributions from your most recent plan after age 55. With cards, cash may be the least expensive choice for several reasons. If you contributed to a previous employer’s 401(k), paying off accumulated debt or paying a down payment on a future purchase like a car or home can be challenging. However, the long-term impact of your 401(k) money is just as important. Fees, taxes, and penalties can greatly reduce the amount of money you receive when you liquidate your 401(k). The amount you withdraw is subject to a mandatory 20% deduction for federal income tax, and a 10% early withdrawal penalty if you’re under age 59 1/2. You may be liable for gross income taxes on your distributions, as well as state and local taxes depending on where you live. After all, a big advantage of a tax-advantaged 401(k) account is that it allows your pre-tax contributions to grow tax-deferred. Over time, your income can generate its own income, which will help you accumulate more money. Alternatively, if you withdraw from your 401(k), you may not be able to make up for your lost income over time. When it comes to your old 401(k), you have choices, each with their own advantages. Consider the options and choose the one that will help you maximize your retirement savings. If you choose to roll over your old 401(k) accounts into a TDAmeritrade IRA, our financial advisors can help you through the process, from helping with goal planning to guiding you through your investment choices. When this happens, consult a financial advisor. When it comes to retirement, you have choices. Learn more about rolling over your old 401(k) and decide if it’s the right decision for you by calling 800-454-9272 and speaking with a new account representative. Find answers to your questions about IRAs here. TDAmeritrade does not provide tax advice. Before deciding whether or not

How To Rollover An Ira To 401(k) In 2024

How do i rollover my 401k from a previous employer, should i rollover my 401k from a previous employer, how to rollover a 401k from previous employer, how to rollover 401k to new employer, find my 401k from previous employer, 401k from previous employer, roll over 401k from previous employer, 401k rollover to new employer, transfer 401k from previous employer, fidelity rollover 401k from previous employer, find 401k from previous employer, rollover 401k from previous employer to new employer