How To Roll Over 401k To Ira Vanguard – If you don’t change jobs and roll your 401(k) into an IRA, you could be wasting money. Learn about IRA rollovers and how they can benefit you and your portfolio.

There are some important factors to consider when transferring assets to an IRA, including the investment options for each account type. Fees and Charges Available Services Possible Withdrawal Penalties Protection from Creditors and Legal Judgments Minimum Distribution Requirements and Tax Consequences of Employer Stock IRA Rollovers.

How To Roll Over 401k To Ira Vanguard

Be sure to consider all available options. Includes cost and associated features for each option. (Keep your previous employer’s plan before transferring your retirement assets, switching to a new employer’s plan, transferring to an IRA, or withdrawing funds.

Best Places To Rollover Your 401(k) In December 2023

Get started with this step-by-step guide to opening a regular investment brokerage account or a personal investment account like an IRA.

Who owns Vanguard? Learn why we’re proud to be a wholly owned investment management firm. and how we focus on putting profit first

If you are a high-income earner, a backdoor Roth IRA may be a good retirement investment option for you. Learn what it is and how to create this type of retirement plan. If you have a 401(k) retirement plan from a former employer you have a few options. But putting money into an IRA is a great way to preserve your money. Monitor your savings and make sure you’re in control. Not your previous employer

We make it easy for you to roll over your 401(k) to the IRA of your choice in three easy steps:

K Vs. Ira: How To Prioritize Your Savings

If you have one, we can assist you in rolling over your 401(k) funds into your existing IRA. Or compare top IRA providers and help you open a new account!

We need certain information from you to verify your identity and authorize transfers to your 401(k) provider on your behalf.

Our team of experts will help ensure your funds are in the right place and safely deposited into your IRA without any unexpected tax alerts!

Easy to Get Started Start browsing online in just a few minutes – we’ll take it from there.

Backdoor Roth Ira Definition And Guide (2023)

An IRA is an “individual retirement account” that offers similar tax benefits to a 401(k), but is not tied to your employer. IRAs generally have lower fees and different investment options than 401(k)s. This makes IRAs a popular account option for pooling retirement savings from previous jobs.

Many people who choose to take their 401(k) funds with them when they change jobs choose to roll their savings into an IRA. This type of transfer (or “rollover”) is usually tax-free and provides tax benefits. and similar investment options so you can grow your savings until you’re ready to retire.

IRAs are the top destination for rollovers. This is because it has no connection to your previous or current employer. Giving you control over fee investment options and more places to park your money. No matter where you work!

Possible! This depends on your current 401(k) plan. But if you’re happy with your current plan, it’s a good option to consider. The program allows this type of transfer. Remember, you’ll pay fees and investment options negotiated by your employer. And your employer can move your account at any time without your consent!

Comparing The Most Popular Solo 401k Options

Unfortunately, we are unable to help with this type of delay. Therefore, you will need to contact your current plan provider or the human resources staff at your current job. Make sure this is possible and get help starting this type of flip.

Our team will make sure you take the shortest route possible and keep you informed along the way!

No, most rollovers are tax-free. Unless you decide to convert your pre-tax funds to Roth or after-tax savings.

We have partnerships with some of the top IRA companies who will pay us a referral fee if you open an IRA with them through our platform. This allows us to provide our services free of charge to everyone. Whether you already have an IRA or choose one not affiliated with us!

New 401(k) Catch Up Rules Start Next Year: Investors Flocking To Iras In 2024?

Affim! If you already have IRA details when you begin the rollover, you will be able to enter that information. Remember, if your 401(k) funds are pre-tax, a Roth account will apply to tax-paid funds. If you convert a Roth asset to a Roth (or traditional), you may be required to pay the full amount of tax on the conversion to a Roth asset.

If you roll with capital letters our team will make sure you understand the potential tax implications. So there are no surprises with your roll!

How would you like to begin your transition to Vanguard? Let me take advantage of it. The easiest option, 100% free (we get paid by your provider). I prefer to do it myself. This option is also free. But there is often a lot of work to be done.

Do you know where your 401(k) is? Yes, I know where it is. I need help finding it.

The Complete 401(k) Rollover To Ira Guide

If you want to roll over your 401(k) from a previous job to an IRA, Vanguard is a popular choice. They have several accounts suitable for those who want to choose their own investments and those who want their money managed for them.

We’ve put together a step-by-step guide to help you transfer your 401(k) to Vanguard in five key steps:

A “401(k) rollover” is the technical term for transferring funds from an old 401(k) account to another retirement account. Rollovers are usually tax-free. It allows you to transfer your retirement savings tax-deferred without having to pay unnecessary taxes or penalties before retirement.

Most people roll over their 401(k) savings into a new or existing IRA. (Individual Retirement Account)

Participation Rates In 401(k) Plans Reach All Time High

First, gather all the information from your old 401(k). It doesn’t matter if you don’t have a lot of money. But any details, such as old account statements or emails from the old HR team, would be helpful. 401(k) documents can be confusing. Therefore, focus on identifying the following three items:

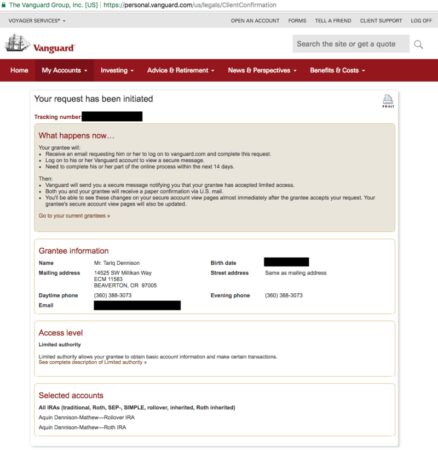

To transfer funds out of your 401(k) account, you must have an open account to which funds can be transferred. If you decide to transfer funds to Vanguard, you have two main options:

If you’re wondering about the five key differences between 401(k)s and IRAs, we’ve put together a comprehensive guide.

Good news? Opening an IRA with Vanguard can be done online. If you haven’t already, it takes less than 10 minutes to complete.

Backdoor Roth Ira: What It Is And How To Set It Up

Limitations: The Vanguard platform has limitations. If you want to trade something other than ETFs and funds, some Vanguard funds have high minimums.

Do you want to make investment decisions yourself, or do you want investment decisions to be made for you so you can set it and forget it?

If you want to decide for yourself all you need to do is open a self-directed Vanguard IRA. It allows you to make your own trading decisions and invest in financial securities of your choice.

If you prefer to make your own investment decisions, you should open Vanguard Personal Advisor, an automated IRA product (also known as a robo-advisor). When you open a Vanguard Personal Advisor account, you’ll be asked to answer a series of questions called a “robo-advisor.” questions. The Risk Tolerance Questionnaire and your answers will be used to create a diversified portfolio that suits your personal and financial situation. The portfolio will automatically rebalance over time without any action on your part. For This is a great tool for people who don’t want to spend too much time managing their investments.

Best Platform To Roll Over A 401k To An Ira

You will be asked during the new account opening process which type of IRA you would like to open. You may see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Here’s how to choose the right IRA:

You’re making progress, you know where your 401(k) is, and you have an IRA at Vanguard to roll your money into. The next step is to contact your 401(k) provider to initiate a deferral.

Usually, the easiest way is over the phone. Your 401(k) provider’s phone number should appear on your old account statement.

Then make a phone call. Be prepared to wait a bit. But from our experience all calls last no longer than 30 minutes.

Empower Vs. Vanguard Personal Advisor

After confirming your identity you can directly tell the customer service representative that you would like to extend your stay. A direct rollover means your funds will be transferred directly to your new IRA provider. This usually means the check will be made payable to the IRA provider’s name, not yours. “FBO” (FBO) is usually the simplest method. Your 401(k) provider will usually ask for the name and mailing address of your new IRA provider and your new IRA account number. We encourage you to take this opportunity to update your mailing address. Because you may have an old address. This is because you will receive additional documents called tax-related documents.

Roll over 401k to ira, how to roll over 401k to roth ira, roll over 401k into roth ira, can i roll over 401k to ira, if i roll over 401k to ira, roll over 401k to roth ira, how to roll over 401k into roth ira, can you roll over 401k to ira, vanguard roll over 401k to ira, how to roll over 401k to ira, roll ira to 401k, how to roll over 401k to ira vanguard