How To Reduce The Credit Card Debt – Keeping your credit card debt level under control is critical if you want to maintain financial stability. As your revolving unsecured debt increases, so do the monthly payments. As a result, your bills may start to become more than is comfortably within your budget. At the same time, a high APR means spending money on extra interest.

We need a strategy to effectively counter this type of economic turmoil. When minimum payments aren’t enough, it’s time to take aggressive action to reduce your debt quickly so you can take back control. This is where the infographic strategies described below can be very effective. Adjust your debt on the way to meet your budget so you can eliminate summer debt and regain control as soon as possible.

How To Reduce The Credit Card Debt

Use the infographics below to develop your credit card debt attack plan. If you have questions or feel that you need to successfully acquire debt, contact us to speak with a certified counselor for free. You can call (844) 276-1544 or fill out an online application to request a free confidential consultation.

How To Reduce Credit Card Debt

Thank you for sending your information. An authorized credit counselor will call you shortly at the number you provided.

Credit Consolidation has helped over 10.2 million people get out of debt. Now we are here to help you.

Your counselor will help you complete a debt and financial analysis, then discuss the best options for getting out of debt. If a debt management program is right for you, your counselor will also help you enroll as soon as you’re ready.

This program has helped my husband and I save so much money and in fact become debt free to continue making the minimum monthly payment! If you try it, don’t stay any longer! Their customer service is friendly, knowledgeable and ready to answer and respond to your questions and concerns. You usually cannot pay off the entire balance on one credit card with another credit card, except by moving the debt from one card to another in a process known as a balance transfer. While this method may work for some financial situations, it is not suitable for everyone. Since moving debt from one credit card to another may be a bad idea for your personal finances, you may want to weigh your options and consider other ways to pay off your credit card balance directly.

Credit Card Debt Restructuring: What Is It And How Does It Work? By Lininternational1

This post discusses whether you can pay off one credit card with another and provides other options for paying off credit card debt.

In some cases, you may have the option to pay one credit card to another through a balance transfer. Balance transfers allow cardholders to transfer an outstanding balance from one card to another, often for a fee.

Credit card issuers often offer introductory periods for new credit cards that include interest-free balance transfers or low APRs (annual percentage rates), giving you a way to consolidate your debt into one account with their company.

:max_bytes(150000):strip_icc()/CalculateCardPayments4-a6570a7d2e36410b9980f4833a4f8f6e.jpg?strip=all)

While this offers a means to pay off one credit card over another, carefully evaluate the terms before choosing this route. introductory periods are limited, and after the period expires the maximum interest.

How To Lower Credit Card Debt After The Fed Rate Hike

Credit companies usually ask you to meet certain balance transfer criteria, including a good credit rating. If you have bad credit, it will be difficult for you to qualify.

Additionally, an approved form of credit may not cover the amount of debt you have. Because lenders have different requirements and terms, consider shopping around and reviewing the terms of different credit institutions before applying for a balance transfer card.[2]

To determine whether a balance transfer will save you money in the long run, you need to do the math.

Let’s say your current credit card has an APR of 20%, you have a balance of $2500, and you pay $250 a month. It will take twelve months to pay off the debt and you will pay a total of $2,758, including interest and fees of $258.

Debt Settlement: A Guide For Negotiation

Let’s say a new balance transfer card has a 5% APR (if the 0% introductory APR ends after 12 months), with a 5% balance transfer fee included, and you pay $250 a month. It will take twelve months to pay off your transfer debt balance and total $2,625.

You may find that transferring your balance to a new card is worth the time and effort involved. Additionally, this calculation assumes that you don’t have a new annual plan and that the introductory APR lasts 12 months. The introductory balance at the time of the transfer can only last for 6 months, so make sure you factor this into your calculation.

Because credit cards and issues have different approval requirements and credit limits, research the best balance transfer credit cards for your unique situation. The Forbes Balance Transfer Calculator can help compare options.

While you may be tempted to pay off your debt by taking out another cash card, these cash advances often come with high fees.

How To Manage Credit Card Debt

In addition to paying bank fees and paying cash, you may have to pay a higher APR on cash than on regular purchases. Because cash advances can add to your debt, be careful using them as a last resort for emergency financial aid.

Instead of choosing a balance transfer or cash, you can consider other methods to help you manage your personal finances.

When you have debt that you don’t feel like handling, the following services can help you recover your money.

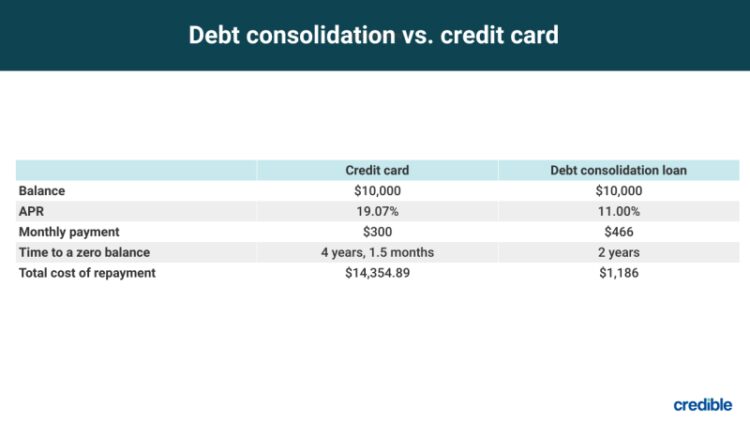

If you have good credit, you can consider a personal loan to pay off your personal debt. This idea makes sense if you can get a personal loan with a lower interest rate than your credit.

Proven Strategies To Reduce Credit Card Debt

However, it can lead to more debt if you don’t manage your money responsibly. Also, personal loans may have additional fees and interest that depend on a variety of factors, including your credit score, information on your credit report such as late payments or installments, the amount of the loan and the terms of your agreement.

Before you decide to take out a loan from your credit card balance, consider the following factors:

As an alternative to simply moving debt with balance transfers or personal loans, you can tackle your credit card bills directly with the following initiatives. You can also consider whether to pay off debt first or save money, perhaps by creating savings goals or adding to them on the side.

If you have multiple credit cards with excellent credit, you may want to start with the debt snowballing method. This debt payoff strategy suggests paying off the card with the highest interest rate first before switching to the card with the next highest APR.

Easy Ways To Eliminate Credit Card Debt [infographic]

By placing a high priority on credit scorers, you can potentially avoid more debt (in the form of interest) while trying to reduce it.

When you decide to pay off your first debt, you can try the snowball method. This repayment strategy with paying off the bottom balance involves first removing the debt from the smallest to the largest.

While either approach can help you pay off your credit card balance, the snowball method allows you to build momentum and take action to cross off your debt list.[7]

Although you need to make at least the minimum monthly loan payment, only that amount can keep you in debt for much longer. There is also a warning in the written credit note: how long you will pay off the balance and how much interest you will pay if you only pay the minimum. You can potentially eliminate your debt faster – and pay less interest – by finding ways to pay more than the minimum each month.

How To Get Out Of Credit Card Debt

While you can transfer one credit card to another with an indirect balance transfer, it doesn’t always make sense. You may consider other factors that help pay off debt more directly.

To help you get on the right financial path, there are tools and information to help you understand how to build or build your credit.

Ana Gonzalez-Ribeiro, MBA, AFC® is a Credit Financial Advisor and a bilingual personal finance writer and educator dedicated to helping residents with financial literacy and advice. His informative articles have appeared in various news outlets and websites, including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. He also founded the personal finance and motivation website www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America, by Catherine B. Hauer, CFP. Ana teaches personal finance courses in Spanish or English for the W!SE (Work in Support Education) program and has given workshops for non-profit organizations in New York.

Our goal is to provide readers with current and uncorrupted information

How To Consolidate Credit Card Debt

How to reduce credit card debt quickly, how to reduce technical debt, how to reduce credit card debt without ruining credit, how to reduce tax debt, how to reduce your credit card debt, reduce credit card debt, how to reduce my credit card debt, ways to reduce credit card debt, how to reduce credit card debt, how to reduce credit debt, reduce credit card debt quickly, how to reduce credit card debt yourself