How To Reduce Debt And Save Money – Too much debt can cause financial hardship in a number of ways. You may find it difficult to pay your bills; Or your credit score makes it harder to qualify for loans like mortgages or car loans.

If you carry a lot of debt. There are several steps you can take to quickly alleviate this problem and get on a healthy financial path.

How To Reduce Debt And Save Money

Debts include mortgages; student loans; This can include credit cards and other forms of personal debt. Too much debt can be stressful. Without debt, you can find a better financial situation and more options.

Better Money Habits You Need To Start Doing In 2022

View all your loan statements and bills and fully understand how much you owe each month, as well as how much interest you are paying on various debts.

Make sure your monthly debt obligations and essential expenses are less than your income. If you cannot pay your essential bills; You may need to take action, such as negotiating with lenders or getting more income.

Instead of adding more money to your debt, think about the debt you want to pay off first.

By using the absorption approach, by focusing on high-interest debt first, you will save the most money in the long run. However, some people prefer to pay off the smallest amount of debt first because it motivates them.

How To Save Money While Paying Off Debt

Check your credit rating and review your credit report for inaccuracies. You can get it from all three credit bureaus (Experian, Equifax, and TransUnion) or from AnnualCreditReport.com. You are entitled to receive a credit report at least once a year.

Your credit report can help you understand how your debt affects your credit score. You can see if you have a lot of late payments or if you have a high credit utilization ratio; This means you use as much credit as you have.

If your credit rating allows it. higher Get a loan with low interest and consolidate your debts in this loan. This can speed up your debt repayment process by reducing interest.

You could consider a 0% interest balance transfer on one of your credit cards. In this way, Depending on the offer, you can get from six to 18 months. If the balance is not paid in full before the offer expires. Keep in mind that you will pay the credit card interest rate on the balance.

Catch The Wave Method To Save Money And Reduce Debt

If you have a house and property. You can use a home equity line of credit (HELOC) to pay off high-interest debt. Interest on lines of credit is much lower than credit cards.

Where possible; Double what you pay on your debt, especially high interest debt. Paying more than the minimum amount will speed up the repayment time.

By increasing the payment amount; You will increase the overall rate at which your debt is reduced and reduce any interest you pay.

Cutting unnecessary expenses is a key part of getting out of debt. Review your regular expenses and include food Separate the essentials, such as housing and utilities, from the non-essentials, such as entertainment or clothing.

The Benefits Of Repaying Debt For Your Startup

Try to close your credit cards. Closed cards reduce the total amount of credit available to you and increase your credit utilization ratio, which can harm your credit score.

Meeting with a certified counselor or financial advisor can help you understand all of your options for getting out of debt. Professional advisors can help you choose the best strategies for your situation.

A credit counselor can also help you meet with creditors. But beware of debt experts who charge high fees.

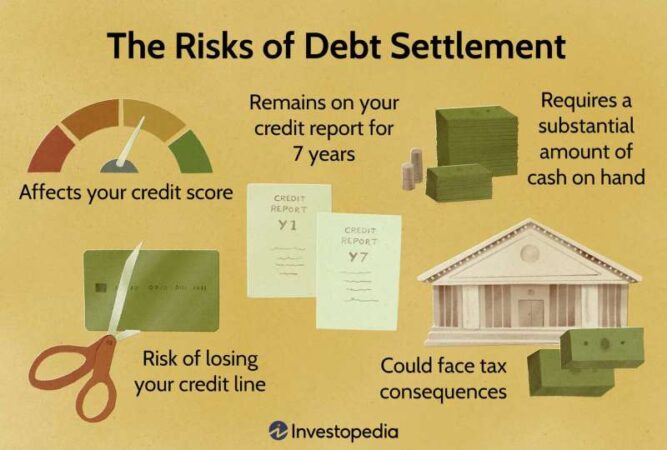

If you’re still struggling to pay your debt off your income, there are other options. If you fall behind on your payments. You can try debt settlement with a reputable debt settlement company.

Debt Relief Tips How To Reduce Consolidate Or Stop Debt Payments All Together

With this strategy, you negotiate with lenders to reduce the amount you owe in exchange for agreeing to pay off a portion of your balance. However, one of the downsides of debt settlement is that it can affect your credit score for years.

You can get out of debt at once, but you need to budget and plan. First, always make the required minimum payments on your credit cards and loans. Then put the extra money aside to pay off more debt and save for your goals.

If your mortgage debt is too high There are a number of steps you can take to reduce it. First, you can refinance your mortgage at a lower rate depending on market conditions and how much you can afford. You can also make an additional payment on the loan principal, which will shorten the loan period and reduce interest costs.

If you have multiple student loans. Consider refinancing your loans in one payment at a lower interest rate. Research loan forgiveness programs if you have federal student loans. Filing student debt bankruptcy is difficult.

Ways Treasury Can Save Money & Boost Revenue In 2023

If you can’t pay the debt, you have to declare bankruptcy, which can damage your credit rating and prevent you from getting loans or credit for years. Carefully consider all your options and weigh their pros and cons. Consult a professional financial advisor for more specific guidance on debt repayment options for your situation.

Writers must use primary sources to support their work. These include white papers, government information; Includes original reporting and interviews with industry experts. Where appropriate, we cite original research from other reputable publishers. Our editorial policy is specific; You can learn more about the standards we follow when creating unbiased content.

The offers in this table are from affiliates who receive compensation. How would this offset affect the appearance of the records? Market. Living debt free does not cover all the deals out there. It’s a term that’s been around for years, but it’s finally catching on for many people. Here are some ways to improve your cash flow so you can live debt free:

When you are debt free the main focus will be on improving your cash flow. You will want to review your spending habits to see which ones are increasing your spending and which ones you can cut back on. Here are some ways to do it.

Envelope Challenge: What It Is & How It Saves You $5000

1. Create a budget: This means making small adjustments, but creating a budget and sticking to it. This will help you focus on the big picture and help you stay on track with your debt-free goals.

2. Cut costs: One of the best ways to improve cash flow is to cut costs. That is, groceries, transportation, rent You can find ways to save money on utilities, etc. You can also find ways to cut costs on unnecessary goods and services.

3. Invest in yourself – Investing in yourself is one of the biggest priorities when getting out of debt. First, you’ll want to learn about money management and long-term investing. This will help you build wealth that will help you pay off debt and improve your overall life.

Living debt free doesn’t mean cutting costs. It’s about creating a budget that fits your needs without sacrificing cash flow.

Debt Reduction Strategies That Will Save You Money

Debt-free budgeting means starting with your current income and deducting necessary expenses. It can be difficult, but you need to have a plan before you start anything.

There are many ways to create a debt-free budget, but one of the most important steps is to focus on your sector: Create a debt-free budget. This will help you determine where you are spending and how you can reduce your debt repayments.

There are many resources to help you create a debt-free budget, such as Lisa Mason Ziegler’s Debt-Free Home Affairs Bible or Vicki Robson’s Financial Peace Wife. You can also find online tools like a debt free kitchen calculator or a debt free shopping list.

Regardless of the resources you use, make sure you can create a debt-free budget before you cut back. It helps speed up the process and make your life more convenient and affordable.

Debt Management Guide

If you want to reduce your debt to a manageable level, you need to focus on assessing your financial needs. This section will help you understand your financial situation and find ways to improve it.

2. The more assets you have, the more you can accumulate. The less money you have to repay the loan.

3. The more debt you have. The more money you will need to repay the debt. The more money you can save.

4. Avoiding debt requires making tough decisions about what to give up to reduce your financial burden.

Debt Settlement: A Guide For Negotiation

5. Different goals may require different levels of debt-free, so it’s important to be realistic about what you can achieve. will give

How to reduce tax debt, how to reduce expenses and save money, how to reduce bills and save money, how to clear debt and save money, how to reduce spending and save money, best way to get out of debt and save money, how to pay debt and save money, how to get out of debt and save money, how to reduce technical debt, how to eliminate debt and save money, ways to reduce debt, how to reduce credit card debt