How To Prepare A Profit And Loss Statement – Creating a profit and loss statement can be difficult, but using a template can help simplify the process. We’ve created a step-by-step guide to creating a small business income statement using Microsoft Excel.

On this page, Step-by-step instructions to create a profit and loss statement in Excel; You’ll find expert advice on customizing the template and free small business profit and loss templates, including 12-month statement templates.

How To Prepare A Profit And Loss Statement

Our tutorial breaks down the process of creating an Excel small business income statement into three easy steps so you can get started using our customizable templates.

How To Do A Profit And Loss Statement In Excel

Instructions are included to customize your template using native Excel formulas. For additional resources and tutorials, See our guide to writing a comprehensive income statement.

Pam Prior, creator of Profit Concierge™, says that when creating a P&L for small businesses, “use the categories that work for you and work for you.” Our template helps you understand the basic structure of your income statement, so you can adjust your profit and loss statements to the specific needs of your small business.

“The point of preparing an income statement is to look at it in context,” says Pryor. “You want to have a column for each month so you can see the story unfolding over time and when the numbers are useful to you. The value of Excel can be entered in a column for 12 months and clearly visible. What you need to know is that Excel is a plus; minus.”

Once you learn how to create a report for a month using the template instructions below, you can easily create reports and create a 12-month statement. It allows you to see trends and make predictions for your business. In addition, Excel includes instructions for customizing statements for your business.

How To Make Projected P& L/budgets

The most suitable for your business; Browse and download our full collection of free Profitability Templates to find fully customizable templates. For template options focused on small business; Check out our free small business income statement templates.

Before you begin, make sure you have your credit card and bank statements. Although this lesson uses a monthly reporting period, You can use these instructions for a quarterly or annual reporting format.

Tip: By establishing a consistent file naming system, you can easily find and retrieve any statement. Enter the reporting end date in the document title. Example: Company Name_P&LStatement_Feb22

:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png?strip=all)

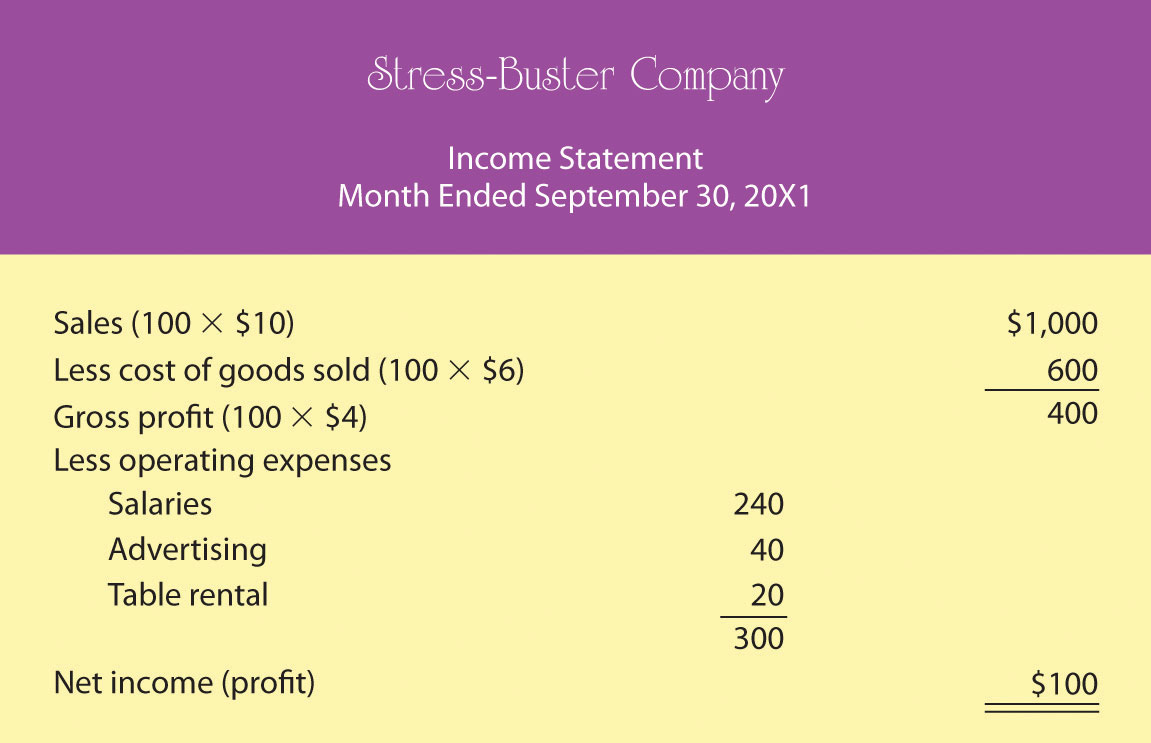

To calculate gross profit, You must first calculate your total revenue or gross income and your total cost of goods sold (COGS). Subtract the total number of products sold from your gross revenue to determine your gross profit:

How To Write A Profit And Loss Statement

This template contains formulas that automatically calculate these calculations when you enter data in the appropriate fields.

By following the steps in this section, You’ll learn how to enter expenses for a reporting period and customize the template for your business by adding and deleting expense lines. Before you get started, you can calculate your expenses using our free small business expense templates.

Once you’ve completed your profit and loss template and recorded your total income for the period, Use this easily customizable template to create the expense categories that work best for you. The following tips will help you customize the most common templates:

Maintaining a profit and loss statement in Excel will allow you to make informed business decisions that will improve your profit potential over time. Keep a detailed record of each reporting period by creating a column for the month or quarter.

Free Printable Profit And Loss Statement Templates [pdf, Word, Excel]

Maintaining financial statements is important to track financial trends over time. retention by keeping profit data for multiple reporting periods in one column; Use Excel for forecasting and strategy.

“Forecasting takes time away from the past few months’ income statement to look into the future and make informed decisions,” says Pryor. “You can then make these informed decisions in two situations. first, Look at actual data over time to predict the future; Second, See how your business performed that month as you expected. It helps you really understand what drives your business.” The entire exercise only takes 10-15 minutes and can help your small business turn a profit, explains Pryor. “If you do this exercise faithfully for three or four months, you will make money in your business.”

Once you have completed the monthly template according to our instructions, Enter data directly into an Excel spreadsheet or accounting software. View in context your company’s financial history and maintain a profit and loss statement for the financial year.

This basic income statement template covers financial records over 12 reporting periods. To calculate your small business’s gross profit and gross income over a 12-month period, your income; Track cost of goods sold and expenses. Review your information and make informed financial decisions for the future of your business.

Profit And Loss As Per Schedule Iii For Manufacturing Companies (facto

Track your small business expenses throughout the year. This free template includes individual columns to organize income and expenses. Your business income; cost of selling goods; cost Break down categories in this easy-to-use template with formulas that calculate gross profit and net profit. Compare each month’s finances in the context of the entire year to improve your financial strategy.

Once you have years of P&L data, our free, You can use a customizable three-year P&L template. For more resources, Check out our selection of free financial business plan templates for creating and maintaining a complete financial data system for your small business.

Empower your people to go above and beyond—and adapt as needs change—with a flexible platform designed to meet the needs of your team.

The platform allows you to schedule tasks from anywhere; capture It makes it easy to manage and report, helping your team to be more efficient and accomplish more. Report on key metrics and shareable reports designed to keep your team connected and informed; Get real-time insights to act with dashboards and automated workflows.

Free Profit And Loss Templates (monthly / Yearly / Ytd)

When teams are clear about what they’re doing, there’s no telling how much they can do in the same amount of time. Try it for free today! We would like to clarify that we do not currently have official line accounts internationally. We have not established an official presence on the Line messaging platform. Therefore, All accounts representing International Online should be considered unauthorized and fake. CFDs are complex instruments. 71% of retail client accounts lost money trading CFDs with this investment provider. Leverage can make you lose money quickly. How this product works and can you afford the risk of losing money? CFDs are complex instruments. 71% of retail client accounts lost money trading CFDs with this investment provider. Leverage can make you lose money quickly. How this product works and can you afford the risk of losing money?

A profit and loss statement (P&L) is a company’s income, A financial report that summarizes costs and profits. Investors and other interested parties are asked how the company is doing and whether it is profitable.

The income statement is calculated by subtracting total expenses, including taxes, from the company’s total revenue. If the net result, known as net profit, is negative, the company incurs a loss and if it is positive, the company makes a profit.

Profit and loss statements are important to investors and traders because they provide in-depth information about a company’s performance. In general, A negative profit or loss is seen as a warning; Continuity means that there may be something fundamentally wrong with the company’s operations.

Comparative Income Statement: Examples, Analysis And Format

However, An occasional negative earnings statement won’t deter investors if they believe the company has good long-term prospects. Twitter, for example, didn’t turn a profit until the fourth quarter of 2017. Investors are holding on to the company because they believe in its potential and ability to eventually turn a profit.

Income statements usually show a company’s assets; Considered in conjunction with a company’s balance sheet, which reports on loans and equity—and the statement of cash flows—that shows changes in balance sheet and earnings.

Income statements are a fundamental form of analysis because they allow traders to assess whether a company’s stock is worth buying or speculating on. This is because profit and loss statements provide fundamental insight into how a business operates and can indicate whether a business is profitable. With this information, The merchant can make the decision.

Simplified profit and loss statement, how to prepare a profit and loss statement, construction profit and loss statement, quickbooks profit and loss statement, create profit and loss statement, profit and loss statement software, how to prepare profit and loss statement for self employed, restaurant profit and loss statement, how to prepare profit & loss statement, how to create a profit loss statement, prepare statement of profit and loss, prepare profit and loss statement