How To Pay Your Mortgage Off Quickly – Once they settle into a home or have a little more financial flexibility, many homeowners start to wonder, “Should I make extra mortgage payments?” Finally, making extra payments can save on interest costs and shorten the length of your mortgage, bringing you closer to owning your home.

Although the idea of paying off your mortgage faster and living your own home mortgage-free may sound good, there may be reasons why it doesn’t make sense to make more principal payments.

How To Pay Your Mortgage Off Quickly

“Sometimes it’s good to make an extra mortgage payment, but not always,” says Christy Sullivan of Sullivan Financial Planning in Denver, Colorado. “For example, paying an extra $200 a month on your mortgage to downsize from 30 years to 25 years on a home you expect to live in for the next five years won’t help. You’ll make that extra monthly payment and you’ll never know the benefit.”

Principal And Interest: What Is The Difference For Mortgage Payments?

While many would agree that the thrill of a mortgage-free life is liberating, you can achieve it in more ways than one. So how do you know when to pay a little extra principal on your mortgage each month? It depends on your financial situation and how you manage your discretionary funds.

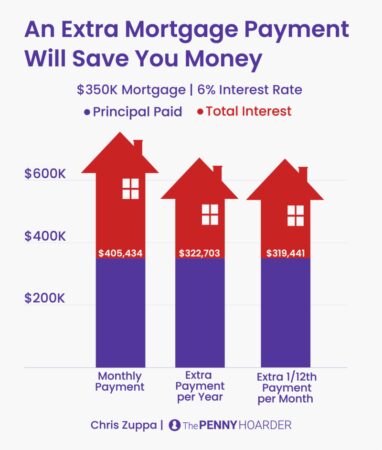

As you may know, paying extra on your mortgage does not lower your monthly payment. Additional principal payments only help shorten the length of the loan (since your payments are fixed). Of course, paying extra principal actually saves money because you effectively shorten the term of the loan and stop making payments sooner than if you were making the minimum payment. However, this happens only after a certain (and still longer) period of time.

“If you have an additional mortgage payment plan that ends within your mortgage term that allows you to enjoy mortgage-free living for five years or more,” says Sullivan.

Pay more each month, pay off your loan faster and save thousands in total interest. You’ll be surprised how quickly your savings can grow by paying a little more each month.

Set Of Happy Birthday Hope It’s A Lotto Fun Mailers

Because your interest is calculated on your remaining loan balance, making more principal payments each month will significantly lower your interest payments over the life of your loan. By paying more principal each month, you reduce the increased principal balance and the interest it accrues.

“If the mortgage has an adjustable rate, we recommend paying more each month or refinancing when the rate is lower,” says Peter Tedstrom of Brown & Tedstrom Wealth Management.

Unlike fixed-rate mortgages, ARM loans will reset over a predetermined period depending on the loan program. Paying more principal increases the principal amount and saves interest before the reset period. This increases the possibility of refinancing with an adjustable rate loan as the home equity increases.

Making more principal payments shortens the length of the mortgage term and allows you to build equity faster. Because your balance is paid off faster, you’ll have fewer total payments, resulting in more savings.

Ways To Pay Off Your Mortgage Quickly

(Example: Your loan amount is $500,000 with a 6% interest rate and a 30-year loan term. If you pay an extra $150 in principal each month, you can expect to save about $81,426 and pay off your mortgage three years earlier.)

Now that you understand the power of paying extra principal on your loan, what is your plan of action? Check out these tips to pay off your mortgage faster.

This could be one extra mortgage payment per year, two extra mortgage payments per year, or one extra payment every few months. Regardless of frequency, your future self will thank you. Continue these extra payments over an extended period and you’ll knock years off your term.

Quick tip here: There is no better day of the month to pay off your mortgage. Whether you make 1, 15, or somewhere in between, the principal and interest amount will decrease over time.

Repay Your Home Loan Quickly With These Experts’ Tips

Did you get a big commission check at work? Were you the beneficiary of an inheritance? In any case, it’s always smart to apply these “emergency” funds to your mortgage.

Depending on your budget, you can increase your mortgage payment up to the next higher amount of $100. For example, pay $1,500 instead of $1,450 or $1,200 instead of $1,125. Putting this strategy into practice won’t break the bank, but it will help you own your home faster.

Imagine no more mortgage payments. You’ll have the flexibility to travel, explore new hobbies or retire earlier than expected. It’s surprising how much more breathing room you have in your budget without accounting for mortgage payments.

Now it’s time to do with the debt, for good. We are talking about credit cards, personal loans, car loans and student loans. Paying off your mortgage early gives you the opportunity to tackle other types of debt and improve your overall financial profile.

How To Pay Off Your Mortgage Without Stress

Why stress over the constant ups and downs of the housing market? Once you pay off your home, you no longer have to worry about the value of the home. It is also comforting to know that your family is taken care of during a financial crisis.

Ultimately it depends on your specific situation. Some homeowners may choose to put extra money toward their mortgage, while others will add those funds to an investment account. Again, consider your goals and feel free to talk to a financial advisor before making a decision.

Before you start making extra principal payments on your mortgage, it’s best to consider your overall financial goals. Think about how long you plan to stay at home. Anticipate any money you may need in the future (college tuition, vacations, new/used cars, home repairs). And determine any current debt you still owe.

Evaluating your current financial situation and your future goals (and expectations) will help identify the ideal use of additional funds, or perhaps prove that paying more on your mortgage is worth it.

Understanding Amortization: The Role Of Principal In Debt Repayment

If you’re having a hard time with credit card debt like many Americans, you may not have enough cash available to make extra payments on your mortgage. Your credit card rates will be significantly higher than your home loan interest rate, so it makes sense to pay off your credit card debt first. Credit cards typically cost more to borrow with an average variable interest rate of 16%.

It may seem strange to skip the extra principal payment and complete a mortgage refinance, but it can save you more and put the extra money you pay toward your principal toward other options. The idea is that you can lower your current rate without resetting your term. Your deduction points will run out faster than you think.

Talk to a mortgage professional to see if this might make sense for your situation. Another option is to refinance from a 30-year mortgage to a 15-year mortgage. By doing so, even if you don’t make additional mortgage payments, you’ll cut the term in half and save thousands of dollars over the life of the loan.

Save for emergencies. We recommend setting aside three to six months of living expenses in savings in case you lose your job or have unexpected expenses. Without that financial backup, you could be putting your mortgage at risk, along with the extra mortgage payment you’ve worked so hard for.

What Is A Short Sale On A House? Process, Alternatives, And Mistakes To Avoid

Regardless of how long you plan to stay in the home, you can make more money by using extra principal payments and investing that money. “You’d be better off putting an extra $200 a month into an IRA,” says Sullivan.

Think about how long you want to stay in your home. If you haven’t realized the benefit of making an extra down payment before you plan to sell your home, investing the extra money you’ve already paid may be a wise choice.

“In an economy with low interest rates, mortgage rates are expected to be at least two percentage points below the yield on a medium-risk investment portfolio,” says Tedstrom.

The short answer is, it depends. Some homeowners want to check the possibility of lower mortgage payments in the future by paying down the principal now. You may strongly feel that it is worth reducing the term of your loan. Or you want to independently build assets and save change. It’s basically about some financial and home ownership goals that will help you save time, money, or a little of both.

Mortgage Payoff Calculator: Accelerated Mortgage Payment Calculator With Extra Payments

Not every homeowner will benefit from additional mortgage principal payments. Before anything else, use the additional mortgage payment calculator above and see how much you can save in the long run.

(Disclaimer: American

How quickly can i pay my mortgage off, how to pay off your mortgage quickly, how quickly will i pay off my mortgage, how quickly can i pay my mortgage off calculator, how quickly pay off mortgage, how to pay off your debt quickly, best way to pay off mortgage quickly, how to pay off mortgage quickly, how to pay off your mortgage early, how to pay off your credit card quickly, pay off mortgage quickly, how to pay off your mortgage