How To Pay Off Student Loans With Grants – Can you pay off your student loans early? Even if the answer is yes, there are many reasons why you shouldn’t pay off your student loans early. Paying off your student loans early requires a stable income and other factors to consider. Once you understand these things, you can pay off your student loans sooner. Unlike other loans, student loans have lower interest rates and can help you focus on other goals like buying your dream home, a new car, and more. If you still want to pay off your student loans early, keep reading this blog. We will provide you with all the information you need.

Let’s discuss when is the best time to pay off student loans early. When it comes to paying off student loans, you have to check a few boxes. These boxes are some basic indicators to help you figure out if you’re in the best position to pay off your student loans early.

How To Pay Off Student Loans With Grants

If you’re already investing for retirement and on track to meet your long-term goals, it might make sense to put some extra money up front to pay off your student loans.

Grants To Pay Off Student Loans

If your income is high enough to save for other financial goals and still have money left over, it may make sense to pay off your student loans faster than usual.

If you don’t have credit card debt or other high-interest debt, it may be a good idea to pay off your student loans early.

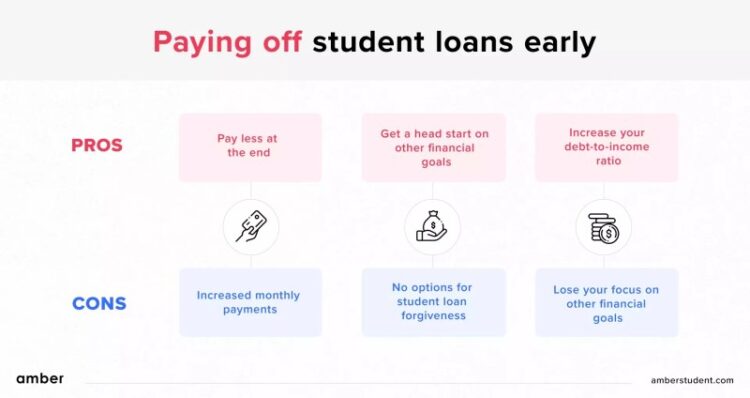

Whether you should prepay your student loans is a real question. Before you decide to pay off your student loans early, we need to talk about the pros and cons.

Can you pay off your student loans early? The answer is yes, but there may be problems with this decision. They are listed below to help you decide.

Playing The Financial Aid Game

Student loan repayment terms vary greatly based on factors such as the loan amount, interest rate, repayment terms, and the borrower’s financial situation. On average, it takes between 10 and 30 years to pay off a student loan. However, some people may be able to pay off their loans faster through aggressive repayment strategies or higher incomes, while others may take longer to pay off their loans if they have lower incomes or are struggling financially. to pay

Now that we’ve told you the pros and cons, we hope you’ve made up your mind. If you decide to prepay your student loans, there are several ways to pay them off early. Learn how to effectively manage your student loans.

Paying more than the minimum student loan amount helps lower the principal balance and pay it off faster.

Find ways to earn more money to pay off your student loans. For example, work as a babysitter, drive for Uber or Lyft, sell used items online, or donate plasma. Even the smallest things can make a big difference. In addition to your side hustles, be sure to follow our 5 ways to achieve financial stability with our web stories.

Paying Off Student Loans

Making bi-weekly student loan payments results in 26 1/2 payments per year. This means that you will pay off the loan in full 13 times a year instead of 12 times a year.

Consider using any money you receive (whether from a tax return or a financial gift) to pay off your student debt.

If you can find a lower interest rate, refinancing can help you pay off your loan faster. If you lower your interest rate, you can easily lower your loan principal balance.

As we’ve provided ways to help pay off your student loans early, we’ve also included some tips.

Examining 3 Of The Arguments Of The Student Loan Forgiveness Debate

It’s easier to plan for financial security if you have some cash on hand. By tapping into these funds, you can reduce your debt or put them into a savings account or other savings plan. But how do you decide which one is better?

If you’re earning more interest than you’re paying off your student loans, consider a savings plan. This allows you to pay off the loan gradually over time without overextending yourself. At the same time, if your return on capital is less than the interest on your student loans, you should be careful about reducing your debt load.

Creating a personal debt budget can prevent you from overspending if necessary. A personal student budget allows you to keep track of your expenses in an organized manner while making regular payments. With more, you’ll have a better chance of switching between important and non-essential responsibilities and simplifying your monthly/annual budget. It is possible to pay off your student loans early without affecting your lifestyle or appetite.

If you’re having trouble creating a budget, our blog on how to budget for students will definitely help.

What Grants Can Go Toward Paying Off My Student Loans?

Loan consolidation is the most popular method of paying off fixed-rate debt. If you have a large number of student loans, loan consolidation allows you to consolidate them and repay the amount based on the average interest rate of the consolidated loans, which will help you pay off your student loans faster. .

These are all the basic things you need to know about paying off your student loans early. Thorough research and then deciding on how and when to repay the loan is also very important and an important part that cannot be ignored. If you want to learn more, here are some tips to make paying off your student loans easy! Before applying for any loan, check the student loan eligibility criteria and required documents and plan better. Taking out a student loan may be your only way to pay for college. But that doesn’t mean you have to pay off your debt for the next 20 years.

Investing extra money to pay off your student loans can help you save thousands of dollars in interest and get out of debt faster!

This article explains 6 creative ways to pay off student loans, ways to earn extra money, and how low-income people can reduce their student loans.

Supreme Court Strikes Down Student Debt Cancellation. Now What?

In a perfect world, you could just use a scholarship or grant to pay for college, meaning you wouldn’t have to pay anything back after you graduate.

Unfortunately, people don’t live in a perfect world, so they have to build their investment portfolio through a combination of loans, grants, and scholarships.

But it takes an average of 20 years for borrowers to pay off their student loan debt! Additionally, a typical student loan in the United States will accrue $26,000 in interest over that period.

Translation: If you can pay off your student loans early, you can save thousands of dollars.

Supreme Court Rejects Biden’s Student Loan Forgiveness Plan

For reference, your debt-to-income ratio is simply the portion of your total monthly income that you can put toward your monthly debt payments.

This ratio is important because lenders use it to decide whether they are willing to extend credit to you.

For example, if you need a loan to buy a new car, your lender will want to look at your debt-to-income ratio to make sure you can afford the monthly car payments.

Assuming you can afford to pay off your student loans early, you’ll also benefit from the fact that there are usually no penalties for paying off your student loans early.

Federal Student Loan Debt Relief And New Mexico Students And Grads

Some lenders include clauses in the loan agreement that penalize you for paying off the loan early. But you can’t get that with a federal loan — so you’ll only save money if you pay off your loan balance early.

In general, paying off student loans quickly is a good thing. That being said, there are some minor drawbacks to consider before paying off your loan balance.

You can deduct up to $2,500 of interest on your tax return each year. Once the loan is repaid, you won’t need to pay interest, which means you won’t be able to claim the interest on your tax return.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg?strip=all)

Another thing to consider when paying off your student loans quickly is that you have to make sacrifices in other areas.

The Process Of Making Your Final Student Loan Payment

For example, you may need to empty your savings account to pay off a loan. This means you won’t have an emergency fund in case you’re hit with a big unexpected expense.

One solution to this is to make sure you have a reasonable amount of money saved up and put it away before you start paying off your student loans early.

Finally, paying off student loans early can prevent you from saving for early retirement. It might not seem like a big deal in your 20s, but it’s something to think about.

Let’s face it: College graduates don’t start making six figures the day after they move out of their dorms.

Worried About When Student Loan Repayments Resume? These Programs Could Help

In general, many students enter the world of work with relatively low incomes, and when this does not happen,

Can you use grants to pay off student loans, free grants to pay off student loans, grants to pay off student loans for single mothers, apply for grants to pay off student loans, grants to pay off old student loans, grants to pay off student loans for nurses, how to get grants to pay off student loans, teacher grants to pay off student loans, grants to pay off student loans after graduation, are there grants to pay off student loans, grants pay off student loans, grants to pay off student loans for teachers