How To Pay Off Payday Loans Fast – Payday loans have been around for years and some people oppose them while others support them. one thing is certain; If you need quick money to help with an emergency, a payday loan can be a quick option. You can access it as quickly as a day.

Payday loans are short-term loans and you are expected to repay them with your next paycheck. Most loans have online application requirements. However, payday loans always operate on the basic assumption that, as a borrower, you are desperate for money.

How To Pay Off Payday Loans Fast

Payday loans have higher interest rates than other lending channels. Some companies may have a flat fee that you pay monthly and that can cost you a lot. Others have higher interest rates, so if you don’t pay off the loan early, you’ll pay more each year than you would in interest if you used a credit card. Credit cards are a great alternative to payday loans because they are flexible. Learn more at https://crediful.com/synchrony-bank-credit-cards/.

Atd Money Payday Loan Online With Guaranteed Approval

Like most loans, payday loans are a quick way to lower your credit score. It’s hard to pay them. If you don’t make payments, they destroy your credit rating. Additionally, if you want to apply for a homeowner loan or startup loan in the future, it may be difficult to get approved. This is because lenders can request an inquiry, where they will access your credit report and see if you had a payday loan. This would be a red flag as they may see you as a threat.

There may be an agreement between you and the lender to set up automatic payments through the bank. What happens is that if the lender withdraws the funds to pay off the loan and an overdraft occurs, they will charge you a penalty. On the other hand, the bank will pay you for the failed attempt, which can cost you a lot of the small loan you need.

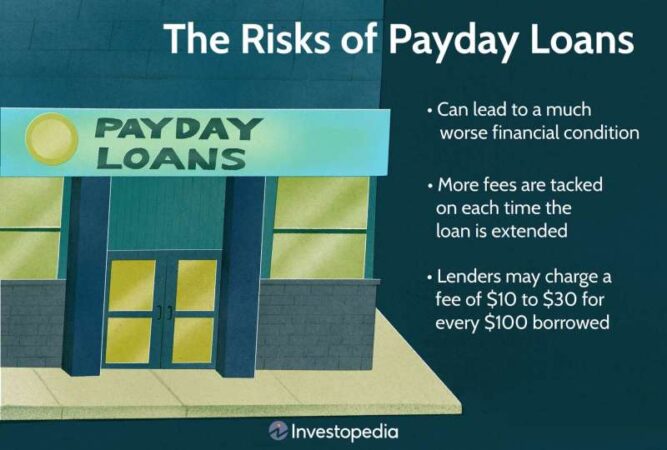

What happens if you can’t pay the loan when it’s due? Some of these lenders allow you to get a second loan with additional fees. This is a form of refinancing. However, this will mean that you will have a longer repayment period, which will be expensive as you will have to pay more interest. This can cause you to have to repay the loan over a longer period and put you in debt, which can be difficult to get out of.

Payday loans are always an option. Below are some tips that can help you on your financial journey.

Advantages Of No Credit Check Payday Loans

Payday loans can be a bad decision. Apply for such loans only through trustworthy companies as scammers are present everywhere. You may be giving away important information to people who have no intention of lending you money. Avoid those that require an upfront fee, as you may be stuck with something that may be difficult to get rid of.

Previous Post Top 4 Things to Do in London This Summer Next Post Protect Your Car from Damage with a Custom Printed Car Cover If you need to borrow money, you have a few options. For example, if you are confident that you will be able to make your next paycheck, you might consider a small amount of easy payday loan.

On the other hand, you may prefer a personal loan regardless of the application process as it will provide you with more funds, cost less, and involve a longer repayment period.

Personal loans and personal loans have the same essential features that are common to all types of loans. Money is borrowed for a fixed period of time, at a specific interest rate, and must be repaid by a fixed date.

How To Borrow Money Fast

Additionally, borrowed funds can be used for a variety of reasons, although payday lenders do not need to know their purpose, while personal loan lenders can.

However, these loans differ significantly in aspects that can have a large impact on the borrower: the approval process, the cost of the loan, the length of the repayment period, the risk of overdraft, etc.

Payday loan amounts tend to be relatively small: anywhere from $500 to, in some cases, $1,000. Additionally, lenders may require some proof of income, but will not require collateral to secure your loan. Generally speaking, they do not make any specific decisions about whether the borrower can repay the loan or not.

Typically, they will simply ask you to give them access to your financial account electronically so they can withdraw the money you owe on that date. Or they can request a personal, handwritten check for the outstanding amount, which they will deposit on a specific date.

How Do Payday Loans Work? Does It Work In India?

Payday loans require prompt repayment. Typically, this means within a few weeks or when the borrower receives their next paycheck or retirement check.

If borrowers fail to meet payment deadlines, they may face huge debts and financial problems. If this happens, lenders will have to deal with late payment fees, making it difficult to repay the loan.

People who take out payday loans often charge very high interest rates. This rate averages 400% and can reach up to 780%.

Each state that allows payday loans imposes its own laws to limit interest rates and lender fees to protect consumers.

Payday Loans Vs Quick Loans: Pros And Cons

According to the Consumer Financial Protection Bureau (CFPB), most payday loans are not repaid on time.

Single payday loans, with their nearly 400% APR, keep borrowers trapped in a perpetual cycle of debt.

A personal loan involves first visiting a financial institution that offers personal loans and then applying for the loan. If you wish, you can also contact the lender online.

Whether a lender will grant you a loan depends on your application and whether you agree to the terms of the loan. These terms will include the amount borrowed, interest rate, payment dates and typical tenure, late payment charges, etc.

Installment Loans And Services In Texas

If your loan is approved, the lender will pay you directly into your bank account or by check. Once the loan is funded, you can use the money however you want.

Personal loans can be secured or unsecured. For example, a lender may require you to provide collateral for any loan it makes. The lender will keep this guarantee if you do not repay the loan. Collateral can be some type of financial asset, such as a bond or certificate of deposit (CD). Or it could be a physical asset, like a car.

Some lenders may offer unsecured loans, but they may have higher interest rates due to the lack of collateral.

For consumers seeking personal loans, lenders typically require a certain credit score, income level, and debt-to-income (DTI) ratio.

Loan For Bad Credit Singapore: Is It Possible & How To Apply

Generally, the better your credit score, the lower the interest rate you will be offered for a personal loan.

Although payday loans don’t affect your credit when you borrow, they can be sent to collections if you don’t repay the loan. At this point, they may lower your credit score due to late payments.

Personal loans are generally cheaper than payday loans due to lower interest rates. Additionally, personal loans give the borrower more time to repay the loan than payday loans.

Payday loans can be more difficult to repay than personal loans, as the lender does not verify your ability to pay before granting you the loan. Payday lenders typically don’t evaluate your debt-to-income (DTI) ratio or consider your other debts before giving you a loan. Additionally, if you miss payments, payday lenders charge higher fees, which can increase the amount you already owe.

Payday Loans And Late Payments

Generally not. Payday loans are not reported to the three major national credit reporting companies when they are repaid, so they are unlikely to affect your credit score if they are repaid on time. However, if you don’t pay your loan, you may be referred to a debt collection agency and this will damage your credit score.

From August 14, 2023 to September 15, 2023, a national survey of 962 American adults who had taken out a personal loan was conducted to understand how they used their loan funds and how they planned to use their personal loans in the future. future. Debt consolidation was the most common reason people took out a loan, followed by home improvements and other major expenses.

Personal loans are almost always more expensive than personal loans. They can also be risky because additional fees can increase debt to a level that may be difficult to pay off quickly.

Personal loans will generally be the best loan option, even for small loans. And if you can’t get a personal loan, it’s a good idea to try getting loans from family members or your credit card before applying for a payday loan (until you’re completely sure).

See How To Get Out Of Payday Loans

Fast cash payday loans, loans to pay off payday loans, fast payday loans, payday loans fast approval, best fast payday loans, how to pay off student loans fast, help pay payday loans off, pay off payday loans, fast payday loans online, how to pay off loans fast, fast easy payday loans, how to pay payday loans off