How To Pay 100k In Student Loans – President Biden’s announcement this week that he would forgive up to $10,000 in student loans per capita was historic — if divisive.

As our April data showed, student loan debt in the U.S. has increased by $1.6 trillion over the past few years — more than American consumers owe on their car loans and credit cards.

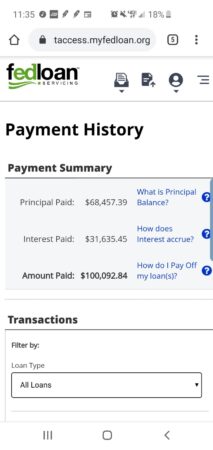

How To Pay 100k In Student Loans

Estimates show that Biden has paid off nearly $300 billion in debt, about 19% of all student loans. Student loans are distributed among the more than 46 million Americans who have a very large gap. Figures from the Department of Education (via NBC) show that only 15 million people would have to pay $10,000, so they would be debt-free if they earned less than $125,000.

Meet A Millennial With $250k In Student Debt 13 Years After Graduating

Biden’s announcement was well received by some groups, with many expressing appreciation for the $20,000 reduction in Pell Grants (for those in need of financial assistance). However, the expensive policy has been a source of both debate and celebration, with critics arguing that the debt payments are corrupting voters, defalcations, past injustices or the danger of hyperinflation.

We and our partners use cookies and similar technologies (“cookies”) on our website and in our newsletter for operational, analytical or marketing purposes to ensure that you get the best experience on our website and interact with us. We will do this. For more information on the use of cookies, see our notice. Click OK if you agree to the use of cookies or click Manage settings to manage your cookies. Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to below as “Credible,” is to give you the tools and confidence you need to grow your finances. Although we develop products from our partners who pay us for our services, all opinions are our own.

Paying off $100,000 or more in student loan debt may seem overwhelming, but it’s possible to reduce or even forgive all of your debt. (Shutterstock)

If you owe $100,000 or more in student loans, you’re not alone. Six percent of borrowers have more than $100,000, according to the College Board. A typical 10-year payment plan may seem like the fastest way to pay off your mortgage, but your monthly payments could be $1,000 or more.

How To Pay Off Medical School Debt: A Comprehensive Guide

Visit Reliable to learn more about student loan loans and compare rates from multiple student loan lenders.

Before you try to pay off your loans early, first check if you are eligible for the student loan forgiveness program. There are a variety of student loan forgiveness programs available, including

Another popular loan forgiveness program is the Public Loan Forgiveness Program (PSLF), which is only available to borrowers who have public student loans that are used full-time by a public or nonprofit organization. You must repay the loan on an income payment plan and make 120 qualifying payments on your loan to qualify.

Although federal borrowers seeking teacher forgiveness can be eligible for loan forgiveness for up to five years, borrowers working for forgiveness in the PSLF program are eligible for forgiveness after 10 years of repayment. Federal borrowers on other repayment plans are not eligible for forbearance for 20 to 25 years.

How To Pay Off $100k In Student Loans

If you are refinancing your student loans, as opposed to consolidating them, you can consolidate multiple student and government student loans into one large loan through a single lender. This is a great option for borrowers who have trouble paying off multiple loans with high interest or monthly payments. Financing into a single loan can lower your monthly payments or total interest.

For example, if you tried to pay off $100,000 over 10 years at 6.8% interest, your monthly payment would be $1,151. If you refinanced a new 10-year mortgage for $100,000 with an interest rate of 4.25%, you would have a monthly payment of $1024. This equates to a monthly savings of $126 and a lifetime savings of $15,171.

One of the disadvantages of refinancing student loans is that refinancing a federal loan into a personal loan means you lose all interest and protection now and in the future. For example, if you consolidate your student loans as your personal loan and apply for federal student forgiveness, you may not be eligible for interest. If you need to get government forgiveness in the future, refinancing your student loans may be a good idea.

To get rid of your debt faster, consider using the debt avalanche method, which focuses on paying off your high-interest debt. Paying off these debt-free loans will cost you more interest over the life of your loan. Remember that you continue to make monthly minimum payments on all your other loans; You will make larger payments on secondary loans.

Ways To Pay Off Student Loans And Save

Alternatively, you can also try the snowmobile style approach that involves paying down your student loan and work your way up. This may cause you to pay more interest in the long run, but it will help you pay off more of your personal debt, reducing that debt on your credit report.

For example, let’s say you have two 50,000 student loans over 20 years, one with an interest rate of 4% and the other with an interest rate of 6%.

If you started paying in August 2022, you will pay off each loan by August 2042. Now let’s say you want to pay off the loan faster by paying at least $500 per month on one of them.

If you add $197 a month at 4% on a $50,000 loan, you’ll pay $500 a month and pay off your loan by October 2032. Similarly, if you add $142 a month at 6% on a $50,000 loan, you will pay $500 per month and pay off your loan in March 2034.

Should I Pay Off Debt Or Invest?

Even if you pay 4% of the loan up front, you will have $12,000 left over. But paying off the 6% loan early will save you $16,000. That’s a $4,000 savings that you can add to your mortgage balance or put toward your savings.

If this method does not suit you, you can always improve. You can easily compare qualifying rates from multiple lenders using Trust.

If you’re thinking about refinancing your student loans, consider adding a good cosigner to get a better loan. Adding a cosigner to your application can encourage a lender to offer a lower loan rate because it appears to be lower.

The employer does not have to be a family member, but you must remember that if you pay late, miss a payment, or default on a loan, they have legal and financial responsibilities.

Actor Jesse Williams Teams Up With Scholarship Company To Help Pay Off $100,000 In Student Loan Debt

There are endless opportunities for you to make extra money through side jobs like running a ride-sharing company, providing digital services like photocopying, or selling products like art, collectibles, or other products online.

For example, if you get traffic that pays $25 an hour, you could earn $1,000 a month working a few extra hours a day during a five-day work week. By working on this side hustle for 10 hours each week, you will double the amount you put toward your debt each month.

Whether you choose to finance or pay off your debt with interest, one of the best ways to achieve this goal is to set a budget and stick to it. This can ensure that you have enough money to pay off your student loans each month and help you figure out where you can cut costs and pay more on your loans.

The best thing about a budget is that it changes as needed, which means you can change your plan every day if needed. You can use a spreadsheet, your financial institution’s data tracker, or a number of other free online resources that teach you how to budget. When planning your budget, be sure to cut unnecessary expenses and limit your credit card debt. After saving $100,000 over 25 years, I quit my job in business to fight for financial freedom. I have helped over three million poor women earn more, spend less and feel more secure.

How To Save Your First $100,000

The following article may contain links or content. This costs you nothing, and shopping or using our partners is a way to support our mission. I never work with a brand or brand that I don’t personally use or trust.

The average college graduate graduates with over $37,000 in student loans and as a nation we owe Sally Mae $1.3 million! How crazy is that?

I have met many people who believe that student loans are a way of life. They think they will die when their student loans are due

Paying off 100k in student loans, 100k in student loans reddit, 100k in student loans, how to pay off over 100k in student loans, pay off 100k in student loans, over 100k in student loans, how to pay back 100k in student loans, how to pay student loans in collections, how to pay student loans, how to pay off 100k in student loans, how to pay off 100k in student loans fast, how to pay off 100k in student loan debt