How To Make Cash Flow Statement From Balance Sheet – In this chapter, we use the example of a virtual company to complete the process of preparing a company’s statement of cash flows using the indirect method. Virtual’s comparative balance sheet and income statement are provided as a basis for preparing the statement of cash flows.

(Figure) Is there any significance to whether the net cash flow is derived from operating activities rather than investing and/or financing activities? explain.

How To Make Cash Flow Statement From Balance Sheet

(Figure) Are there activities related to operating, investing, or financing activities that are not reflected in the appropriate sections of the statement of cash flows? explain. If such activities had occurred in the company, how would they be reflected in the financial statements?

A Different Way To Present Cash Flow Statement

Oh yes. Some investment and/or financial transactions do not initially involve cash. Examples include the purchase of long-term assets paid off with long-term debt financing, the repurchase of long-term assets in exchange for company stock, and the repayment of long-term debt using assets other than cash. These non-cash investing/financing activities are disclosed in the notes to the financial statements or as a reference to the statement of cash flows, but are not considered an integral part of the statement.

(Figure) Use the following excerpts from Zwolleski Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

(Figure) Use the following excerpts from Yardley Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

(Figure) Use the following excerpts from Wickham Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

Cash Flow Statements And Using Them To Asses Startup Health

(Figure) Use the following excerpts from Tungsten Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

(Figure) Use the following excerpts from Stern Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

(Figure) Use the following excerpts from Unigen Company’s financial information to prepare the operating section (indirect method) of the statement of cash flows for 2018.

(Figure) Use the following excerpts from Mountain Company’s financial information to prepare the statement of cash flows (indirect method) for 2018.

What Is A Cash Flow Statement?

(Figure) Use the following excerpts from Openair’s financial information to prepare the statement of cash flows (indirect method) for 2018.

(Image) Use the EDGAR (Electronic Data Repository, Analysis, and Retrieval) search tool on the US Securities and Exchange Commission’s website to find the most recent Form 10-K for the company you want to analyze. Select a company and submit a brief that includes the following information:

LO 14.4 Prepare a comprehensive statement of cash flows using the indirect method The statement of cash flows is one of the three primary financial statements used by financial managers. Along with income and balance sheets, cash flow statements provide important financial information that informs an organization’s decision-making. While all three are important in evaluating a company’s finances, some entrepreneurs may argue that the statement of cash flows is the most important.

Business owners, managers, and company stakeholders use cash flow statements to better understand the value and overall health of their companies and to make financial decisions. Regardless of your situation, learning how to prepare and interpret financial statements can help you understand the inner workings of your company and contribute to its future success.

Prepare Cash Flow Statement From The Following Balance Sheet: Additional Infromation

A cash flow statement is a financial statement that shows how cash flows into and out of a business during a reporting period.

According to the Financial Accounting Curriculum: “The purpose of the statement of cash flows is to give a detailed picture of what happened to a business’s cash during the reporting period.”

Cash flow statements are useful when it comes to valuing a company and understanding how it is performing, as it provides information about the different areas of cash used or received by the business over a period of time. Therefore, these are important financial statements.

A typical cash flow statement includes three sections: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

Using The Indirect Method To Prepare The Statement Of Cash Flows

The first step in creating a cash flow statement is to determine the opening balance of cash and cash equivalents at the beginning of the reporting period. This value can be found in the income statement for the same reporting period.

Disclosure of cash balances is necessary when using the indirect method of calculating cash flows from operating activities. However, the direct method does not require this information.

Once you have your opening balance sheet, you need to calculate your cash flow from operating activities. This measure is important because it shows how much money a company makes from its operations.

The direct method of calculating cash flow from operating activities is a simple process that involves taking all cash inflows from operations and subtracting all cash disbursements from operations. This method lists all transactions that result in the payment or receipt of cash during the reporting period.

Cash Flow From Financing Activities (cff) Formula & Calculations

The indirect method of calculating cash flow from operating activities requires starting with net income from the income statement (see step 1 above) and making adjustments to “undo” the effect of deductions made during the reporting period. Some of the more common and consistent adjustments include depreciation and amortization.

The results are the same for the direct and indirect methods, but the process of calculating cash flows from operations differs.

Although the direct method is easy to understand, it is time-consuming because it requires accounting for every transaction that occurs during the accounting period. Most companies prefer the indirect method because it is faster and more closely related to the balance sheet. However, both approaches are adopted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

After calculating the cash flow from operating activities, it is necessary to calculate the cash flow from investing activities. This section of the cash flow statement contains the cash flow details related to the purchase and sale of long-term assets such as fixed assets and equipment. Note that this section only covers investment activities with free cash, not loans.

Three Statement Model Links

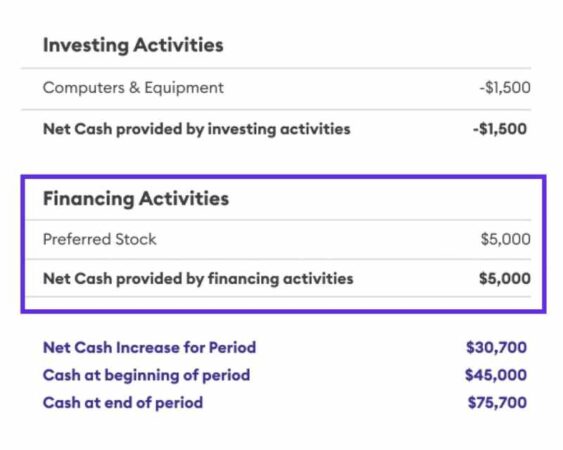

The third section of the cash flow statement deals with cash inflows and outflows related to financial activities. This includes cash flows from both debt and equity financing – cash flows associated with raising cash and repaying loans to investors and creditors.

When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS. Interest paid is included in the operating section under GAAP, but sometimes in the financing section under IFRS.

After accounting for the cash flows generated by the three main types of business activity, you can determine the final balance of cash and cash equivalents at the end of the reporting period.

The change in net cash during a period is equal to the sum of cash flows from operating, investing and financing activities. This value represents the total cash earned or lost by the company during the reporting period. A positive net cash flow indicates that more money is flowing into the company than it is going out, while a negative net cash flow indicates that it is spending more than it is earning.

Cash Flow Statement: What It Is And Examples

To help visualize each section of the statement of cash flows, here is an example of a hypothetical company created using the indirect method.

This statement of cash flows is for the period ended September 28, 2019. As seen at the top of the report, the initial balance of cash and cash equivalents was approximately $10.7 billion.

Total 53.7 bln. from operational activities in the reporting period. The investment activity section shows that businesses used a total of $33.8 billion in investment operations. The Financing Activities section shows that a total of $16.3 billion was spent on activities related to debt and equity financing.

At the bottom of the cash flow statement, three sections summarize the total increase of $3.5 billion in cash and cash equivalents during the reporting period. Thus, by the end of the year, the end of cash and cash equivalents will be 14.3 billion dollars.

How To Use The Indirect Method To Prepare A Cash Flow Statement

Whether you’re a manager, entrepreneur, or individual investor, understanding how to create and use financial statements is essential to making good business decisions.

The statement of cash flows is one of the most important financial statements to understand because it provides detailed information about how a company spends its cash and how it makes money. By learning how to create and analyze a cash flow statement, you can make better, more informed decisions regardless of your situation.

Interested in getting a tool to make better financial decisions and communicate them more accurately to key stakeholders? Explore Financial Accounting – One of three courses included in the Certificate of Preparation (CORE) program – learn how you can unlock critical insights into your organization’s operations and capabilities. Not sure which course is right for you? Download our free flow chart. The balance sheet and the statement of cash flows are two of the three financial statements that companies produce to report their financial performance. Financial statements are used by investors, market analysts and creditors to evaluate a company’s financial position and earnings potential. A balance sheet shows what a company owns and what it owes.

Cash flow on balance sheet, cash flow statement from balance sheet example, balance sheet cash flow, how to build a cash flow statement from balance sheet, balance sheet to cash flow statement, preparing cash flow statement from balance sheet, how to prepare cash flow statement from balance sheet, how to calculate cash flow statement from balance sheet, how to make a balance sheet from cash flow statement, balance sheet income statement and cash flow, cash flow statement balance sheet, make cash flow statement from balance sheet