How To Have Student Loan Debt Forgiven – At the same time, the covid-19 pandemic has caused historic levels of unemployment and economic hardship. Even before the pandemic, many student loan borrowers faced payments exceeding 10 percent of their household income or debt traps where they could not keep up with monthly interest payments (Farrell, Greig, and Sullivan 2020). The government measure has suspended payments and interest on federal student loans beginning in March 2020 to ease the financial burden caused by the pandemic. In addition to this temporary relief, policymakers have proposed federal student loan forgiveness, which accounts for approximately 92 percent of total student debt (Amir, Teslow, and Borders 2020).

In this approach, we use administrative bank and credit bureau data to determine how the benefits of different loan relief scenarios are distributed by household income, borrowers’ time remaining to repay their debts, and borrower and ethnicity.

How To Have Student Loan Debt Forgiven

We consider four scenarios: (1) universal settlement of up to $10,000 of each debtor’s balance; (2) debt relief of up to $50,000 for individuals earning less than $125,000; (3) elimination of up to $25,000 and excess of $100,000 for individuals earning less than $75,000; and (4) a settlement of up to $50,000 with income growth as in Scenario 3.

Student Loan Cancellation Update: How To Appeal For Forgiveness

From relevant bank and credit report data, we obtain borrowers’ student loan balances, annual income, and debt repayment patterns to evaluate various aspects of this hypothetical loan. First, how much debt will be paid off? Second, how is amortized debt distributed across the income distribution: how much goes to high- and low-income households? Third, how much debt is lost by people who go out of their way to repay their loans on time and fail to repay them in full? Finally, how are racial and ethnic disparities recorded?

We find that income deductions significantly reduce the total amount of forgiven debt and that foreclosures are less regressive, with all foreclosure scenarios and a more gender-equal distribution of forgiveness among borrowers. A $10,000 universal settlement will forgive a quarter of student loan debt, while a $50,000 settlement will forgive half of all debt. A $25,000 settlement cancels the same amount of debt as a $10,000 universal settlement. Experience is also highly beneficial to middle- and high-income families, but targeting income can delay the phase. This relative regression is due to the fact that higher-income families often have more debt associated with professional degrees or diplomas. Conversely, more aggressive income targeting does not necessarily mean that borrowers in the debt trap have a greater share of forgiveness or a longer-term focus. However, increasing the number of foreclosures slightly increases the percentage of forgiveness by borrowers with longer-term horizons. The share of foreclosures by gender and ethnicity is largely untargeted by income and reflects the share of total debt by race and ethnicity.

For example, a $25,000 payment on incomes between $75,000 and $100,000 will forgive as much total debt as a $10,000 total debt settlement (27 percent vs. 28 percent), but contribute to low-income borrowers. borrowers with a $50,000 write-off, more debt repayments (39% of total debt) and is somewhat regressive, but fully dedicated to low-income borrowers who face a debt trap or long-term outlook. lenders and black and Latino borrowers. .

It should also be noted that due to data limitations, several options available to policymakers are not considered here. For example, graduate school loan forgiveness can lower your non-recourse debt and lower your overall costs. Imputed interest forgiveness can also be progressive because people who can afford to pay off the debt are more likely to collect more of the interest.

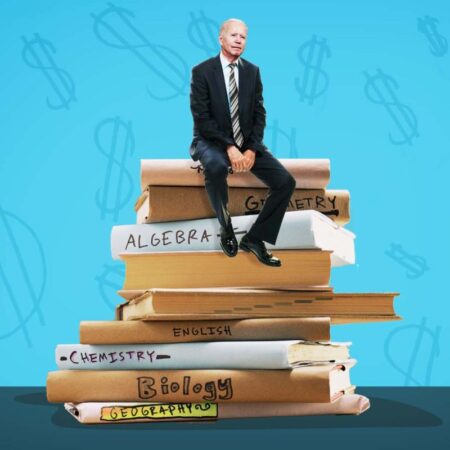

Supreme Court Rules Against Biden’s Student Loan Debt Forgiveness Program

Index Navigation Scroll to find 1

Find one: Considered discharge scenarios will forgive 27 to 50 percent of your federal student loan debt.

Figure 1 shows the total amount of amortized debt in each scenario. Since we’re only looking at household incomes in our checking account data, we translate the gross income thresholds of $75,000, $100,000, and $125,000 into income thresholds of $54,263, $72,350, and $90,438 by subtracting 20 percent of wages and adding 20 percent. . 7.65 percent.

It forgives minus the $50,000 income threshold (50 percent of the total tax), or $786 million from the $1.566 trillion base. More aggressive income limits, such as the $75,000 to $100,000 income exclusion, would significantly reduce total liability (39 percent of liability, or $606 billion) for the same potential $50,000 settlement for individuals. A $25,000 settlement with settlement would further reduce the total amount of debt forgiven (28 percent, $446 billion), and a $10,000 universal settlement would reduce it significantly (27 percent, $422 billion), despite significantly less forgiveness. to borrowers. . Together, these amounts would be between $9-20 billion and $1.283 billion in federal and private student loans, compared to 2012-2014.

Limited Waiver For Student Loan Forgiveness Ends October 31

Note: Total student debt is $1.6 trillion. Gross margin is translated into income margin based on a 20% federal tax rate and a 7.65% payroll tax. “Income limits” limit settlements to people who earn less than $125,000 a year. The phase-out gives full enrollment to people who earn less than $75,000 a year, and those who earn more than $100,000 do not phase out as their income increases.

Finding Two: Student debt relief provides relative gains for middle- and high-income families, although the repeal of income targeting is less regressive.

We find that loan relief does not apply to middle- and high-income families in all calculation scenarios because high-income families tend to have more student debt. But more aggressive revenue targeting can push the cancellation program even further.

The left panel of Figure 2 shows the share of total liquidation dollars for each income quintile and the income thresholds for each quintile.

Making Sure You Benefit From The Student Loan Cancellations

Two line graphs. The bar chart on the left shows the distribution of liquidation dollars across the income spectrum. The bar graph on the right shows the percentage of each quintile group that has completely eliminated student debt.

Note: Based on November 2016 balance. Earnings are household income deposited into your Chase checking account from December 2015 to November 2016. Income quintiles based on the entire Chase-Experian sample, including those without student debt. “Income limits” limit settlements to people who earn less than $125,000 a year. The phase-out gives full enrollment to people who earn less than $75,000 a year, and those who earn more than $100,000 do not phase out as their income increases. Gross margin is translated into income margin based on a 20% federal tax rate and a 7.65% payroll tax.

Based on $10,000 in universal compensation (shown in blue), only 12 percent of compensation dollars go to the lowest quintile (that is, the bottom 20 percent), and 23 percent to the highest earners. In the case of the $50,000 income threshold (green), the top income bracket is virtually unforgivable because the majority of people in the upper bracket exceed the gross income threshold ($90,438). However, the share of forgiveness granted to the lowest income households is slightly higher (14 percent), and the share granted to borrowers in the 3rd and 4th quintiles is even higher. It is a professional school of highly qualified families, medical education, etc. due to high balances such as higher debt is discussed in Figure 3 below. The $25,000 and $50,000 income mortgage and collateral scenarios are fairly evenly distributed across income groups, favoring borrowers in quintile 1 the most, while middle-income borrowers (quintile 3) are still in 1st place. quintile loans.

The right panel of Figure 2 shows the proportion of people in each quintile who have all their debt forgiven. Universal cancellation of $10,000 would completely eliminate student loan debt for 48 percent of the lowest-income group and 32 percent of the highest-income group. A $50,000 cancellation policy eliminates all debt for 87 to 90 percent of borrowers in the top three quintiles. Note that the two $50,000 policies produce identical results in this income range because the income thresholds in the scenarios do not affect the 1st and 2nd quintiles and most of the 3rd quintile. A $25,000 option is down almost as much as a $50,000 option (70–). 75 percent).

What You Need To Know To Claim Your Student Loan Forgiveness

This dynamic is not surprising given the distribution of residuals within each income bracket, as shown in Figure 3. For example, average debt

What student loan debt is being forgiven, how to get your student loan forgiven, get student debt forgiven, how to have a student loan forgiven, how to get student debt forgiven, how to have your student loan forgiven, was student loan debt forgiven, how to get student loan debt forgiven, will my student loan debt be forgiven, get student loan debt forgiven, student loan debt forgiven, is student loan debt forgiven