- How To Get Your Student Loan Forgiven

- Will Student Loan Forgiveness Pass The Supreme Court? What We Know

- Don’t Miss The Oct. 31 Deadline For Student Loan Forgiveness!

- Student Loan Forgiveness Application 2022: How To Apply, Who Qualifies And More

- Thanks To Union Advocacy, Student Loan Forgiveness Is A Reality

How To Get Your Student Loan Forgiven – The tweet was followed by news from the White House and Department of Education, though many questions remain.

As for the general public, most of those with student loans are happy with the news, although some wanted to get rid of a lot more debt. Some people without credit are happy that they are getting this relief, while others are unhappy that they paid off the loans or never got them.

How To Get Your Student Loan Forgiven

Only those earning less than $125,000 (single) or $250,000 (married) get it. If you’re single and earn $125,001, you’re over the limit and won’t get the exemption. The Department of Education said the income limit will be based on 2020 or 2021 tax returns.

Will Student Loan Forgiveness Pass The Supreme Court? What We Know

The forgiveness applies to loans held by the federal government. We know it will include Direct Loans for students and graduates and PLUS Parent Loans. FFEL loans administered by the Department of Education will qualify, but other FFEL loans and private loans will not be included.

UPDATE: August 30, 2022: Private FFEL loans may qualify. According to the Seattle Times: “The Department of Education is working with outside entities that track eligible FFEL loans to make cancellations available to borrowers who hold those loans. The department is encouraging people who don’t want to consolidate to ‘sit back’ and wait for word.” for this effort”.

People have asked me how much their student loans would be forgiven if they consolidated their student loans. There are no official guidelines for this yet, although I think if you have college loans you can max out the forgiveness at $10,000. I will update when more information is available.

UPDATE: September 6, 2022: Graduate student loans are now eligible for up to $20,000 in relief. See more information “How much will be forgiven?” in the next question.

Support For Student Loan Forgiveness Varies Widely Between The American Public And Those With Loans

Loans may need to be consolidated into a Direct Consolidation Loan, but borrowers should wait for official notification before proceeding.

UPDATE: September 6, 2022: The Department of Education is pushing for “federal private student loan loans through the FFEL, Perkins and HEAL programs,” to consolidate those loans into the Direct Loan Program.

Anyone with qualified credit who meets the income requirements gets $10,000 in forgiveness. If the borrower received at least one Pell grant while in school, $20,000 will be forgiven.

If a borrower has $8,000 in direct loans, they foreclose $8,000. They do not receive a check for the remaining $2,000.

Don’t Miss The Oct. 31 Deadline For Student Loan Forgiveness!

Graduate and Parent PLUS loans do not qualify for an additional $10,000 for Pell Grant recipients – they are capped at $10,000.

UPDATE: September 6, 2022: The Department of Education updated the guidelines and PLUS graduate and parent loans are now eligible for forgiveness up to $20,000. To receive the full $20,000, the borrower must qualify for a Pell grant. Here is a scenario:

Debra received a $15,000 loan for her undergraduate studies. Her parents received a $25,000 PLUS parent loan for Debra. Debra got married during her senior year and received a $2,500 Pell grant. He then went to graduate school and received another $20,000 in federal loans. After graduating, he consolidated his loans, then the COVID pandemic hit, and his loans have since been put on hold.

Debra: She has a total of $35,000 in combined debt and received a Pell grant, so she will get $20,000 in relief, leaving a balance of $15,000.

Student Loan Forgiveness Application 2022: How To Apply, Who Qualifies And More

Debra’s parents: Debra’s parents automatically qualify for the $10,000 forgiveness, but only when her parents received a Pell grant.

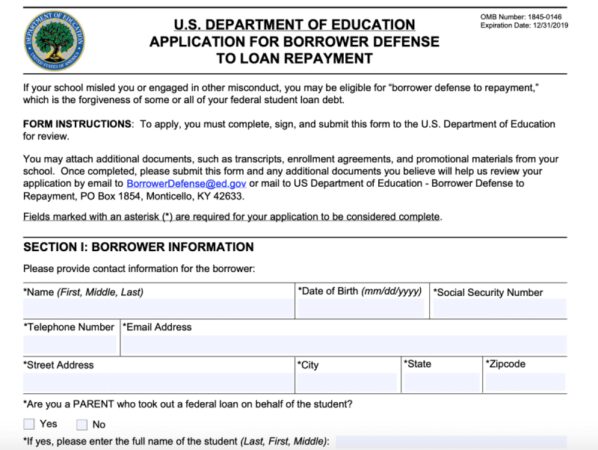

Be automatic I wouldn’t count on that, especially since no one has had to reverify their income in several years. Everyone else will have to fill out a form that hasn’t been released yet. Education Minister Cardona said it will be released before the end of the year.

Borrowers can sign up to receive updates when the application is open on the Department of Education’s subscription page.

The suspension of payments and interest has been postponed until the end of the year, so payments should start in January 2023.

Student Loan Debt Elimination

This timeline will allow the pardon to pass, but it also allows time for the economy (inflation) to cool, the holiday season to end, and the midterms to end.

First, this is not a new repayment plan. This is the proposed plan. There will probably be some changes if it is decided. The parameters of the plan are:

While the benefits are supposed to go to lower-income Americans, Penn Wharton’s budget model found that the plan benefits higher-income Americans. About 70 percent of the waiver will go to the top 60 percent of workers, with those earning between $82,400 and $141,096 receiving the largest portion of the total waiver.

According to Penn Wharton’s budget model, it will cost between $605 billion and $1 billion (this has been revised from the initial estimate of $300 billion). The Committee for a Responsible Federal Budget estimates it will cost about $500 billion.

Thanks To Union Advocacy, Student Loan Forgiveness Is A Reality

It is a debt owed to the federal government. This is, in fact, their first asset.

I hear all the time, “How are we going to pay?” We pay with what we have done. Last year, we reduced the deficit by more than $350 billion. This year, we are on track to cut more than $1.7 trillion by the end of this fiscal year. The largest one-year deficit reduction in US history. The point is this: there is too much deficit reduction to pay for programs—cumulative deficit reduction—to pay for programs over and over again.

I’m no economist, but from everything I’ve read (see here, here and here for example), we had a budget deficit of $2.78 trillion in 2021 and are projected to have a deficit of $1.41 trillion in 2021. 2022

Politicians claim they have reduced the deficit because they spent less than they (or their predecessors) did last year. So it’s technically true, but totally a hoax, and presidents of both parties are doing it.

Majority Supports Biden’s Student Loan Forgiveness In Washington

Look at it this way: If I earn $1,000 a year and spend $2,000, then reduce my expenses to $1,990, can I now spend $10 more because my deficit is reduced? If I do, I’ll never make it.

Canceled student loans will add to the national debt, which is ultimately paid by taxpayers.

Some groups, such as the fiscally conservative National Taxpayers Union Foundation, estimate the cost of the waiver to be about $2,000 per taxpayer.

This is a difficult question. No one is being sent money, so it’s not like sending checks during COVID.

How To Avoid Student Loan Forgiveness Scams

The average student loan payment is between $200-$300 and eliminating your debt usually means that money can now be used to buy more goods and services (which would increase inflation – more demand than supply).

However, these loans have not had a payment for more than two years (as of March 2020), so money is being saved or spent. Rising inflation has caused many borrowers to divert that money to housing, food and transportation expenses, so the money is already in the market.

I’m not an economist (I do personal finance – that’s not the same thing), so I could be wrong, but I personally don’t think this will have much, if any, inflationary impact.

There is speculation that colleges will look at this and realize that in a few years $10,000 will be removed, so they will raise tuition by $10,000.

How To Know If Your Student Loans Will Be Forgiven Under President Joe Biden’s Plan

I think it will be. Students, even if they don’t take advantage of the current forgiveness, can anticipate that the $10,000 forgiveness will be the standard going forward, so they can get more loans. In fact, I’ve heard from several people who wonder if they should rush out and get a Parent PLUS Loan or another student loan and get rid of their debt.

While I understand why they would be tempted to do this ($10,000 free), there is no guarantee that this forgiveness will hold up in court, and the deadline for forgiven loans is June 30, 2022. Also, I don’t think you should get a loan that you have no intention of paying back.

Of course not. Bankruptcy, PPP loan forgiveness, market segment grants, savings and loan rescues, TARP, AIG bailouts and others don’t either.

It is difficult to say. It took President Biden about a year and a half to do it because he wasn’t sure he had the authority to do it. Congress wanted him to do so. Nancy Pelosi also said the president does not have the authority to cancel student loan debt. He changed his mind and now says

Got Student Loan Forgiveness? How Federal Public Service Program Works

How to get your loan forgiven, how to get my student loan forgiven, student loan debt forgiven, get student loan forgiven, student loan forgiven, how to find out if your student loan was forgiven, how to have your student loan forgiven, how to get student loan debt forgiven, how to get private student loans forgiven, ways to get your student loans forgiven, how to get student loan forgiven, how to get navient student loans forgiven