- How To Get Student Loan Debt Forgiven

- How Biden’s Student Loan Forgiveness Plan Could Affect You

- Will President Biden Really Forgive Student Loan Debt?

- Are You Eligible For Public Service Loan Forgiveness?

- Here’s Who Will Need To Apply For Student Loan Forgiveness

- Student Loan Forgiveness: A Handout For The Rich

How To Get Student Loan Debt Forgiven – The $1.6 trillion student loan burden weighs on 45 million Americans. President-elect Joe Biden had an opportunity on his first day in office to ease some of that burden by taking bold action on the student loan crisis.

Since 2006, student loan debt has more than tripled in the United States. This may be due to slower economic growth and job losses during the Great Recession of 2008. High school graduates may have decided to enroll early to attend college.

How To Get Student Loan Debt Forgiven

Now, in the midst of a pandemic that has affected the US economy, we are seeing a new holiday affecting student loans.

How Biden’s Student Loan Forgiveness Plan Could Affect You

Monthly payments on most federal student loans were suspended in March with the passage of the CARES Act, which provided relief to about 42 million borrowers during the pandemic. More than 37 million of these borrowers have defaulted on their loans for several months.

However, student loan assistance will end this month and payments will resume in January. Other government protections linked to rising unemployment and a layoff moratorium set to expire this month will create more turbulence in the economy this year.

Biden’s proposal to forgive $10,000 for all borrowers as part of the COVID-19 relief could wipe out the loan balances of 15 million borrowers and reduce the balances of millions more. This proposal could eliminate up to $429 billion of debt. For borrowers who owe more than $10,000, Biden’s plan may not lower their monthly payments, but it may lower the amount they pay closer to their due date.

The idea has a great price. Taxing people to make up the deficit can hurt the economy. But whether the increase in debt forgiveness is greater than the increase in tax revenue depends on the legal details.

Will President Biden Really Forgive Student Loan Debt?

Student debt has hit the economy hard, and while small loan forgiveness isn’t a huge economic powerhouse, it can have its benefits.

Under the weight of student loans, many people delay starting a business, buying a home, or delay getting married or having children. By easing some of that burden and allowing borrowers to use the money they pay off student loans, Biden’s plan could provide an economic and social boost. .

Student loan forgiveness is often seen as putting money in the pockets of the rich. While the majority of student loan debt is held by people with graduate degrees, millions of low- and middle-income people still struggle with very little student loan debt. In fact, borrowers with small amounts of credit often have problems.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23983301/1417997644.jpg?strip=all)

According to an analysis of federal data by the Institute for College Access and Success, 52 percent of borrowers who defaulted within 12 years of entering college owed less than $10,000 . That’s because low-income borrowers can’t complete their education and then can’t get into high-level jobs that require a degree. TICAS stated that 49 percent of those who refused did not complete their training program. The answer can affect credit scores and collection efforts that may include tax refunds and Social Security payments.

Are You Eligible For Public Service Loan Forgiveness?

A $10,000 loan is not a good move for those who really need it, because the money benefits the rich. But that’s no reason to rule it out entirely. Giving money to the rich does not outweigh the benefit of giving money to the middle and lower class.

Biden has an opportunity to add new achievements to his plan by organizing the revenue. $10,000 is a huge first step that can impact millions of Americans, especially when combined with progressive education policies. Some Democrats are calling for stronger compensation programs, up to $50,000.

And for those who say that the student loan problem isn’t really a problem because “student loan payments are between $200 and $300” and it’s just a “problem” (looking at you, Brad Polumbo), I’ll just remember No you will get high profile jobs, and never.

In 2019, the median annual salary for graduate students was $51,347, which is around 2000, adjusted for inflation. The average household currently has about $48,000 in student loan debt.

Ways To Pay Off Student Loans And Save

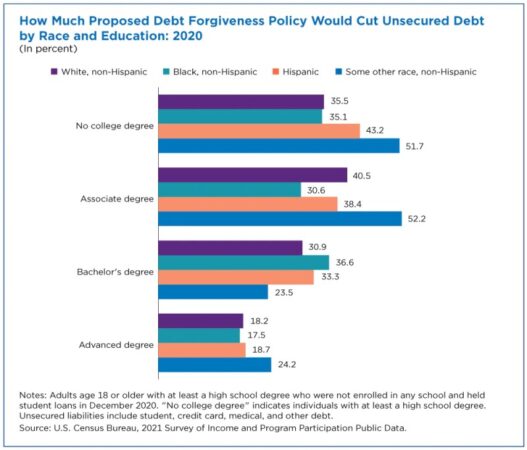

The student loan problem has hit blacks harder, with 85 percent of black college graduates having student debt compared to 69 percent of white college graduates. Recent black graduates earn 12 percent less than their white counterparts, at $18 an hour. Other factors include race and income disparities, such as the combination of interest rates and student loans, which forces blacks to take on more debt than their white counterparts. Biden’s plan would include loan forgiveness for those who attend black colleges and universities and earn less than $125,000 a year.

Biden has the authority to act boldly on student loans on Day One. By ending student debt, this administration can take the first step toward closing the nation’s wealth gap, strengthening the economy, and strengthening the right to higher education as a positive, not a negative, force in our society. Eliminate debt and debt. (Have information about your credit and financial situation ready) You must have more than $10,000 in debt.

Home » Smart Money Blog: Loan Help, Credit Repair & Financial Advice » Articles » How to Get Student Loans (PSLF Access) – Updated for 2022

Learn how to process your federal student loans in this easy-to-read guide. The purpose of this guide is to teach people how to get federal student loan debt forgiveness. Student loans are not forgiven. There is a long process.

Tax Won’t Go Up $2,100 To Pay For Biden Student Loan Forgiveness

And for many students, this lengthy student loan process can be confusing and overwhelming. Therefore, we have created this guide to simplify the whole process.

Here are 16 tips on how to consolidate your federal student loans, get a lower monthly payment on a payment plan, and get loan forgiveness.

Bad credit? Student loan consolidation is an option for you, so don’t worry. good credit Increasing student loan and federal loan options will only help to improve. So without further ado, let’s get this party started. You might want to grab a coffee for that!

Check out “Part Two” for help on student loans related to the Coronavirus, and here’s an infographic showing some of the news:

Here’s Who Will Need To Apply For Student Loan Forgiveness

Don’t want to tackle student loans on your own? Schedule a free consultation with a student loan help advisor at Smart Financial Services by emailing StudentLoanHelp@

Not all states are eligible, and applicants must have more than $15,000 in federal student loan debt to be considered for the program. Programs to help with credit cards, medical bills, savings accounts and almost any bad debt are available at (866) 376-9846. Click here to learn more about the nation’s best debt settlement program that has helped millions of consumers become debt free.

Before diving into the student loan relief guide below, review the summary and key points to know:

Before you can qualify for student loan forgiveness, you must first consolidate your federal student loans and find a payment plan that offers loan forgiveness.

How To Avoid Student Loan Forgiveness Scams

You will need your Federal Student Aid ID and Password (FSA-id) to consolidate your federal student loans. Visit Fsaid.ed.gov to download. (Click where it says “Create an FSA ID” and follow the instructions)

Access the Student Loan Consolidation Repayment Plan Estimator to get an estimate of your payments after consolidation. Before starting the integration process, get an idea of your options.

When you log in to StudentLoans.Gov, to start the student loan consolidation process, click where it says “Collect My Loans” and then follow the instructions.

After you click “consolidate my loans,” you’ll be prompted to review the federal student loans you want to consolidate.

Should Student Loan Debt Be Forgiven?

You can choose Navient, FedLoan Service, Nelnet, Great Lakes Education Loan Services, or any of the other services available.

These loan services often vary, but they all do the same thing, which is to keep your credit consistent.

You’ll go to the credit servicer’s website to set up your monthly payment on the new loan, get the latest information about when you can pay off the loan, get tax forms. Your credit service provider will send you reminders when it’s time to adjust.

Robert Farrington, founder and editor of The College Investor, said income-based payment plans are “the secret ways to get student loan forgiveness.”

Student Loan Forgiveness: A Handout For The Rich

The secret

Will my student loan debt be forgiven, did student loan debt get forgiven, how to have student loan debt forgiven, student loan debt to be forgiven, how to get debt forgiven, how to get a federal student loan forgiven, student loan debt forgiven, was student loan debt forgiven, get student loan debt forgiven, is student loan debt forgiven, student loan forgiven, how to get your student loan forgiven