How To Get Prequalified For A Home – Most property buyers have heard that they must be pre-approved or pre-approved for a mortgage when looking to buy a property. These are the two major steps in the loan application process.

Some names are used interchangeably, but there are important differences so that each buyer understands their home. It is absolutely the first step. It gives you an idea of the size of the loan you are likely to qualify for. Pre-approval is the second step and a conditional commitment to actually handing over the mortgage to you.

How To Get Prequalified For A Home

“The pre-qualification process is based on consumer data,” said Todd Kaderabek, an associate residential broker with Beverly-Hanks Real Estate in downtown Asheville, North Carolina. “Pre-approval data is verified for the consumer, for example a credit check.”

Get Pre Approved To Buy A Home

Getting prequalified involves providing the bank or borrower with your complete financial picture, including debts, income and assets. The lender checks everything and provides an estimate of how much the borrower can expect. Pre-qualification can be done over the phone or online, and there is usually no charge.

Pre-payment is quick and usually only takes one to three days to pre-pay. Remember that the loan pre-qualification does not include an analysis of credit reports or a detailed insight into the ability to purchase a home loan.

The initial level of pre-qualification allows all mortgage goals or needs to be handled. The lender will explain the different mortgage options and recommend the type that is most suitable.

Discrimination in a mortgage loan is illegal. If you believe you have been discriminated against because of race, religion, gender, marital status, use of public assistance, national origin, disability or age, you can take steps. One of these steps is to file a report with the Consumer Financial Protection Bureau or the US Department of Housing and Urban Development (HUD).

Get Your Home Loan Approved

Again, this is not a pre-existing amount guarantee as it is based on the information provided only. It is just how much the loan will take. A pre-qualified buyer does not carry as much weight as a proven buyer who has vetted more carefully.

But pre-qualification can be useful when it comes time to make an offer. “A prerequisite qualification is required with every offer on our market,” Kadrabek said. “Sellers are smart and I don’t want to sign a contract with a buyer who can’t fulfill the contract. That’s one of the first questions we ask a potential buyer: Have you met with the lender and determined what needs to be done. Before?” What is the status, if not, we advise the creditors of the options, if yes, we ask for a copy of the pre-existing letter and keep it on file.

The next step is getting pre-approved, and it’s more complicated. “Pre-approval is absolutely a good indicator of credit and loan ability, but pre-approval is a crucial word,” Kadrabik said.

The borrower must complete a formal mortgage application to receive pre-approval, and the lender must provide all necessary documents for comprehensive credit and financial goals. The lender then gives pre-approval up to a certain amount.

Mortgage Prequalification Vs. Mortgage Pre Approval

Going through the pre-approval process also provides a better idea of the interest you will be charged. Some lenders allow borrowers to withhold interest or an application fee to get pre-approved, which can be several hundred dollars.

Lenders will make a conditional commitment in writing for a certain amount borrowed, allowing the borrower to purchase homes at or below that price. This gives the borrower an advantage when negotiating with the seller, as they are one step closer to getting the actual mortgage.

The benefit of completing both steps – pre-qualification and pre-approval – before looking for a home is that it gives an idea of how much the borrower should spend. This prevents you from wasting time looking for valuable possessions. A pre-approved mortgage also speeds up the actual purchase process, letting the seller know that the offer is strong in a competitive market.

The borrower provides a copy of the purchase order and any other necessary documents as part of the completed underwriting process after selecting a home and making an offer. The lender hires a certified or licensed third-party appraiser to perform a home appraisal to determine the value of the home.

Why It Is Essential To Get A Mortgage Pre Approval

Your income and credit will be double-checked to make sure nothing changes from the initial approval, so there’s no time to go out and make big purchases.

The last step in the process is the credit obligation, which only proceeds when the bank approves the loan, as well as the house in question – which means that the property is appraised at or above the selling price. The bank may also ask for more if the lender brings up something that needs to be investigated, such as structural issues or a faulty HVAC system.

Being pre-qualified and pre-approved for a mortgage gives potential home buyers an advantage in advance of how much they can afford on the home. But most sellers will be more willing to deal with those who are pre-approved. Pre-approval also allows a borrower to close on a home faster, which provides an advantage in a competitive market.

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png?strip=all)

Yes, remember that you don’t have to shop at the top price. Depending on the market, you may be able to get the home you love for less money than you’re approved for, leaving you to put extra cash each month toward retirement, college for the kids, or something to check off your bucket list. .

Get Started: Get Pre Approved For A Home Loan

Preparation is different from prior approval. Preparation means that the mortgage lender has reviewed the financial information you have provided and believes you qualify for the loan. Pre-approval is the second step in the loan process, and is a condition of committing to borrow money for a mortgage.

Not always, but sellers and their agents can convince you that you are a serious buyer and likely to get a mortgage without problems.

Although they sound the same, pre-approved and pre-approved have a different meaning. Both are the initial steps in the mortgage process, with pre-being an indicator of the size of the mortgage that is likely to be approved, while pre-approval is an obligation to the lender’s words that you will be approved. mortgage Knowing the difference will help you move through the mortgage process more easily.

It requires writers to support primary sources for their work. Reports include white papers, government data, original reports and interviews with industry experts. We also refer to original research from other reputable publishers where appropriate. You can learn more about the standards we follow to present accurate and balanced content in our editorial policy. The material in this article is provided for general information purposes only and does not constitute professional advice. TERM HOME TRUST DOESN’T OWN AN EXPERT MOTHER THIS MATTER AND YOUR OWN OWN DEBT AND / OR PROFESSIONAL ADVICE ABOUT YOUR MONEY. TERM HOUSE SATISFACTION ASSUMES NOTHING, AND IN SPECIFIC LIABILITY FOR, THE USE OF ANY AND ALL INFORMATION CONTAINED HEREIN.

Home Loan Prequalification

When you decide to buy a home, you need to take the first step, you don’t need to go online and look at listings, or visit an open house. First of all, you need to know how much money you can qualify for a loan from a bank to buy a house. This is called “mortgage pre-approval,” and it’s really the first step you need to take to buy a home.

Many first-time buyers feel confused about the mortgage process. Here at Landmark Home Warranty, we always want to make buying and owning a home simple and easy, which is why we offer free coverage and comprehensive coverage for our new owners, as well as helpful guides like this one.

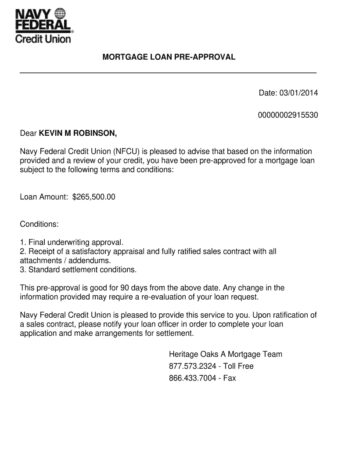

When you get a pre-approved mortgage, it means a credit union or bank that has looked at your finances and credit score and pre-approved the letter for you. This letter tells you how much money the mortgage lender has lent you to buy the house. But this does not mean that it is a legal contractual obligation. There is no guarantee that you will get this pre-approved rate, not that if you find another company with better competitors you won’t be able to get a loan with them instead. However, it is a physical document that you can use to set yourself apart from others in your home.

Many first-time home buyers are confused as to why a home must be pre-approved, since the guarantor is not actually giving the loan. Getting pre-approved to buy a home is beneficial for several reasons;

Guide To Getting A Mortgage In 4 Steps

If you’re pre-approved, bankers will look at how much money you make, your credit score and other financial information. They will tell you how much they are willing to offer you for a mortgage. You can use this information with your handouts and pre-approval letters to help you look at a home in that area.

How to get prequalified for a mortgage, how to get prequalified for a va home loan, how to get prequalified for home loan, how to get prequalified for mortgage, how to get prequalified, how to get prequalified for credit cards, how to get prequalified for a home loan, how to get prequalified for a home loan online, how to get prequalified for a home, how to get prequalified for a house, how to get prequalified for mortgage loan, get prequalified for home loan