How To Get A Student Loan Discharged – A Total and Total Disability Discharge, or TPD, is a way to discharge your student loans without going bankrupt, in addition to other types of student loan discharges. People with severe and chronic disabilities who have student loans may not be able to repay the debt due to their inability to work. Even if the Social Security Administration determines that you have a disability, the U.S. Department of Education may not notify you of your eligibility for student loan discharge. Our experienced student loan attorneys can help.

Additionally, we have a unique perspective on issuing TPDs because we are not only student loan attorneys, but also civil disability attorneys.

How To Get A Student Loan Discharged

Yes! If you can prove that you qualify for the Total and Permanent Disability Discharge Program and have student loans that qualify for discharge, you can get your student loan!

Episode 25: Disability Discharge Of Federal Student Loans With Heather Watkins & Persis Yu

William D. Individuals who repay federal student loans, including the Ford Federal Direct Loan (Direct Loan) program, the Federal Family Education Loan (FFEL) program, and/or the Federal Perkins Loan (Federal Perkins Loan), receive William D. . Perkins Loan) program loan or fulfill a Teach Grant service obligation based on your total and permanent disability.

To get TPD exemption, you must be able to prove that you are totally and permanently disabled, not just injured, and not working for a short period of time. In the event of the death of the owner of the student loan, the loan is cancelled.

In general, there are three different ways a person can show that they are totally and permanently disabled:

We will go into detail about the possible ways to show total and permanent disability.

Bankruptcy And Student Loans: A New Path To Financial Freedom

To show TPD based on receipt of SSDI or SSI, submit the next scheduled disability review to the Social Security Administration within 5-7 years of the last date of disability determination. If so, you can apply for complete and total student loan debt discharge. It is important to include all required documents with your application, as failure to provide these documents will result in rejection.

To be exempt from TPD, it is not enough for the Social Security Administration to establish that you have a disability. You must have a disability as defined by the Social Security regulations that is not progressive. In other words, you may be “disabled” but you are not automatically eligible for the TPD exemption.

This is where we enter. We will obtain the necessary documents to show that you are eligible for total and permanent disability.

If you’re on SSDI, your Social Security review period is less than 5 years, or you don’t have Social Security Disability, you must get certification from your doctor that you are totally and permanently disabled and unable to work. A very profitable activity. To qualify for a TPD exemption, this certificate must include a medically diagnosable physical or mental disability that meets certain time requirements.

Student Loan Discharge For Disability Discharge

A physician may include a physician (MD), rheumatologist, or psychiatrist licensed in the United States.

If you are a veteran with a 100% service-connected disability or if you are totally disabled based on an individual disability rating, you can apply for full and partial disability waivers. To apply under this type of TPD, you must provide all documentation that proves you are a veteran and 100% disabled. These books are usually available from the VA.

Applying for TPD comes with many complications and can be a tedious process. There may be several documents that need to be requested from other agencies and attached to your application. Also, if you need a doctor’s certificate, you must ensure that all the necessary words and information are on the said certificate. This can be a problem if you are trying to get a doctor’s certificate on your own.

That’s where our experienced student loan attorneys come in. We have extensive knowledge of the Student Loans Act and the Social Security Disability Act, so we can ensure that all necessary requirements are met and all necessary documents are in place. Apply for full and total disability.

Student Loan Forgiveness Apps Now Open Biden Administration Says

The US Department of Education will review your application and supporting documents to determine if you meet the requirements for TPD issuance. To be approved for a Veteran’s Total and Permanent Disability Discharge based on a service-connected disability, your student loan will be discharged without further review.

For a Veteran’s Total and Permanent Disability discharge without TPD, you are under the supervision of the US Department of Education and have the option of student loan repayment if you meet 3 events. Time to look at the previous year of release. An example of one such event is when your annual income 3 years after release exceeds your state’s poverty index value for a family of two, regardless of the actual size of your family.

There are other events that can reset your student loan obligation. Our experienced student loan attorneys can make sure your application and supporting documents are correct, meet the necessary requirements, and ensure you stay on track during the 3-year tracking period.

Don’t miss the chance to get a student loan due to incorrect documents or missed requirements during the monitoring period.

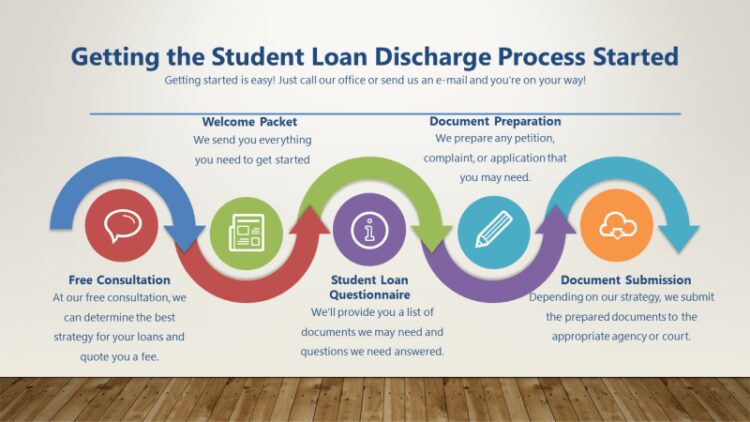

Starting The Student Loan Discharge Process

If your request for a TPD discharge is denied, you will be notified by letter of the reason for the denial and your student loan collection will continue. It is important to note that the process of applying for a full and permanent disability discharge can take time, so working with our experienced student loan attorneys will not only increase your chances of a successful TPD discharge, but also save you wasted time. A rejected application also comes with increased pressure.

TPD approval is one of the most widely used and effective management options offered by federal student loans. This is especially helpful for people with disabilities who are preventing them from finding gainful employment and struggling with student loan debt. ARM attorneys will guide you through the technical details of the application process and ensure that you stay on track when your TPD is issued.

Always feel free to ask questions and see if you have a case. Our intake team will review your information and help arrange a consultation with an attorney if necessary. An administrative discharge, or formal discharge, is a possible way to discharge your student loans without filing for bankruptcy. People with student loans are often unaware of discharge situations, so you need a student loan attorney to analyze your situation and make sure you meet all the requirements to be eligible for discharge.

This type of discharge is a great way to pay off your remaining student loan debt as long as you are accepted into one of the available programs. Some administrative approval provisions are easier to prove than others, but all require proper filing procedures and paperwork.

Student Loan Bankruptcy Discharge Guide: Know The Rules!

It’s amazing that the US Department of Education does not require student loan borrowers to be notified of student loan discharge options through administration fees! This is where an experienced student loan attorney can help. We will analyze your situation to determine which administrative exemptions apply to you and ensure that all the necessary materials are available to the right people.

Removal control programs are not known to people who know how to use them. However, there are many administrative discharge programs available for federal student loans. These programs differ greatly in terms of requirements and paperwork, but they all lead to the same result of paying off the remaining balance on your student loans.

In the event of the death of the owner of the student loan, the loan is cancelled. This is not much help to the deceased; However, if you are the parent of a student receiving a Parent PLUS loan, you may be able to receive a death benefit if the student dies.

The process of applying for a death certificate is simple and straightforward, but the required documents must be properly attached to the application, so it is important to understand the application. It is also important to note that the US Department of Education generally does not attempt to collect student loans locally.

Students Who Got Partial Loan Relief To See Full Discharge

If the person is enrolled in school at that time or later, it is said that he is in school there.

Student loan discharged, discharged student loan indebtedness, how to get a student loan discharged, can student loan be discharged in bankruptcy, how to get student loans discharged in bankruptcy, student loan discharged in bankruptcy, how to get student loans discharged, how to get my student loans discharged, easiest student loan to get, can a private student loan be discharged, how to have student loans discharged, how to get private student loans discharged