How To Get A 2nd Mortgage Loan – Our ratings and reviews are not influenced by our advertising relationships, but we may receive commissions from our affiliate links. This content is created independently of the editor. Find out more.

Home values are expected to increase nearly 10% in 2022, according to Realtor.com, with another expected increase of 5.5% in 2023. For people who already own their homes, this increase in value means an increase in equity.

How To Get A 2nd Mortgage Loan

A second mortgage is one you take out against the equity in your home. Your existing mortgage will remain in place and not change. You can use a second mortgage to pay for big expenses like paying off debt, remodeling your home, or to save money for your child’s college expenses.

Home Equity Line Of Credit

Understanding what a second mortgage is and when it’s best can help you decide if this option is right for you.

A second mortgage is a loan that you take out for the first mortgage. You use the equity in your home as collateral to get a second mortgage. Equity is the current market value of your home minus the balance on your existing mortgage.

If you take out a second mortgage, you now have two mortgages and two mortgage payments. They can all have the same creditor or different borrowers. You are responsible for making your monthly mortgage payments according to the terms of each individual loan.

If you are in default on your mortgage, the defaulter may withdraw or take other steps to satisfy the loan.

Second Mortgages In Ontario

A second mortgage works the same way as a first mortgage. You must fill out an application and submit documents to the lender about your finances and debts. The lender may require you to obtain an appraisal of your home to verify its value.

Loan requirements vary by borrower. Most lenders want the home to have at least 15% to 20% equity available. You can typically borrow up to 85% of the home’s current value after deducting the first mortgage balance.

A minimum credit score of 600 or better is also usually required, although some lenders may have lower requirements. Remember, the better your credit score, the better your interest rates and repayment terms will be. Most lenders also want to see a debt-to-income ratio of 43% or lower.

For example, if your home is worth $400,000 and you still owe $250,000, you can borrow up to $90,000 on a second mortgage ($400,000 x 0.85 – $250,000).

Reasons To Consider A 2nd Mortgage Loan

There are two main types of second mortgages: a home equity line of credit (HELOC) and a home equity loan.

A HELOC is similar to a credit card. The lender approves the line of credit based on your available capital. You can then use the money as needed, or take a lump sum or a smaller amount. This can be the best option if you have a long-term housing project with expenses to pay, or if you plan to use it in the future but are not sure when.

However, a home equity line of credit differs from a credit card in the draw period. The drawdown period is the frame within which you can get the money, which is usually 10 years from the drawdown of the credit line.

You only have to pay interest while drawing, but you can pay more if you want. After the draw period, you get more, usually up to 20 years, to repay the amount to the borrower plus interest.

What Is A Second Mortgage And How Does It Work?

Make sure you understand the terms and conditions of your HELOC and read the fine print on your documents before withdrawing the money. Ask your lender questions when you need to so you don’t risk your home being foreclosed on for violating your payment terms.

With a home equity loan, the lender gives you a percentage of the equity in one lump sum that you can spend as you wish. It’s like your first mortgage with predictable payments that are spread out over a number of years. The maturity of the loan is usually between 5 and 30 years.

You pay the home loan in monthly installments until you pay off the loan. Just like your first mortgage, the lender records the debt against the home. If you default on the loan, they can foreclose on your home.

A second mortgage is a great solution for paying off high-interest debt, consolidating multiple debts into one manageable payment, or renovating your home. But you have to consider the fees, costs and closing costs to see if it’s worth it. You can pay thousands of dollars up front to access the equity in your home through a second mortgage.

Defaulting On A Second Mortgage: What You Should Know

HELOCs offer variable interest rates that are usually better when interest rates are low. But with interest rates rising and rising, a home loan may be the most affordable solution. It offers a fixed interest rate and predictable payments.

Home equity and HELOCs can be long-term liabilities. If you sell your home before paying off the second mortgage, the loan balance is due immediately. Any remaining balance will reduce what you get from the sale, even if the repairs don’t increase the value of your home.

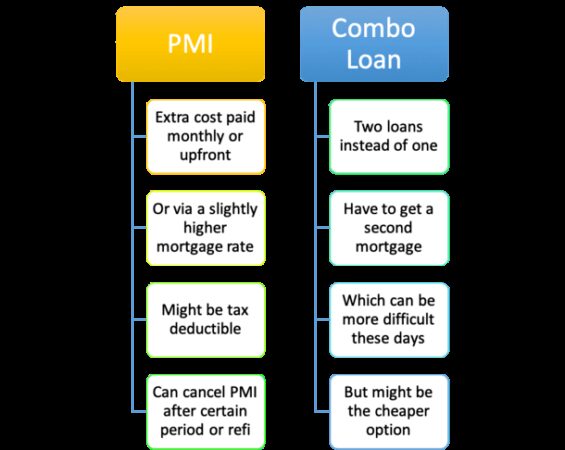

A payoff refinance is different from a second mortgage because it replaces the original mortgage with a new loan instead of adding a second loan. The amount you “pay” is added to the original loan balance.

Interest rates on a cash-out refinance are usually higher than a cash-out refinance, but they are lower than second mortgage interest rates. You also don’t have to worry about two separate mortgage payments and cash financing.

Second Mortgage: What It Is, How It Works, Implications

Since a refinance is a new mortgage, closing costs can be higher than a second mortgage. Consider your options, including interest rates, fees, and closing costs, to determine whether a second mortgage or cash-out financing is best for you.

If you have enough equity in your home, you can pay off your second mortgage by refinancing. A refinance loan replaces your first and second mortgages, so you only have one monthly payment instead of two.

If you have high interest debt, it may be a good idea to get a second mortgage to pay off the debt. However, remember that credit card debt is not secured debt, unlike a second mortgage, which is secured by your home equity. If you don’t pay your credit cards, the credit card company can’t come to your house, but if you default on your mortgage, the mortgage holder can take your house.

If you have debt, you want to make sure you have a plan to avoid more debt in the future. A program like Quicken may be the solution. Not only can you use it to create a realistic budget, but you can also discover new and better ways to save your money.

Nd Mortgage Lenders

When you apply for a second mortgage, the lender will perform a rigorous credit check to determine your credit score and assess your credit quality. Your credit score and history will also determine your second mortgage interest rate. Too many inquiries from lenders can hurt your credit score. Missing payments, skipping payments, or being late with your loan agreement will also hurt your credit score.

Second mortgage rates are usually higher than first mortgage rates, although they are still lower than credit card and personal loan rates. When your home goes into foreclosure, the second lien holder is paid off after the primary mortgage holder, putting the second mortgage at greater risk of not being paid in full, leading to higher interest rates.

A home equity loan and home equity line of credit are both types of second mortgages. Regardless of whether you get a home equity loan or a HELOC, the lender will place a lien on the home if no payment is made. If you don’t pay, the contractor can foreclose on the house.

The information presented here was independently compiled by the editors. To learn more, visit our About page. For many people, a home is the most important asset they own, and this asset can give homeowners access to financing when they need it. But what is the best way to use your home as collateral?

What Is A 2nd Mortgage And When Do I Use One? ⋆ United Home Loans

The first thing to understand about home equity is the different ways you can use your home to provide a cash injection—the primary two are a home equity line of credit (HELOC) and a home equity loan, often called a second mortgage. .

Equity is the difference between the value of your home and how much you owe on your mortgage. It’s important to understand home equity because it will affect the amount of money you can borrow.

As the name suggests, a HELOC is a line of credit that a lender offers you based on the value of your home, the amount of equity you have in it, and your credit rating. Like a credit card, you can use as much or as little of the money available in a HELOC as long as you make the minimum payment.

Refinancing 2nd mortgage loan, 2nd mortgage loan rate, 2nd home mortgage loan, 2nd mortgage loan calculator, how to get mortgage loan, 125 2nd mortgage loan, 2nd mortgage equity loan, 2nd mortgage loan, 2nd mortgage loan modification, 2nd mortgage va loan, how to get a 2nd mortgage loan, 2nd mortgage refinance loan