How To Calculate After Tax Cash Flow – When showing income and expenses, taxable income and income tax must be calculated. Calculating taxes can be complicated, but here we cover the basics. Often, the total amount subtracted from the total amount over a period of time gives the taxable amount. Cash flow before and after tax can be calculated as follows.

Operating expenses and capital expenditures minus revenue constitute pretax income. Also, after-tax income is equal to pre-tax income minus income tax.

How To Calculate After Tax Cash Flow

Consider a project with a projected budget of $28,000, operating expenses of $12,000, capital expenditures for the coming year of $10,000, and income taxes of $1,500. Then next year’s after-tax cash flow is available. Calculated:

Yield Based Flip And Partnership Allocation (generally For Wind Projects)

There are two types of investments for tax purposes. Under the US tax code, for tax purposes, an investor is allowed to recoup certain types of fixed investments, which means that the investor can claim a tax deduction for certain income. Types of assets that can be depreciated over their useful lives include (but are not limited to) buildings, machinery, equipment, and trucks. However, many types of property that lose value over time (having zero or little salvage value) can be repossessed. On the other hand, there are investments that cannot be deducted from income for tax purposes. Investing in a bank account or buying land are examples of this type.

Suppose an investor deposits $100,000 in a bank account with a 10-year term at 16% annual interest and will receive $100,000 at the end of 10 years. Calculates pre-tax and after-tax cash flows and investments. income tax 25%.

Investments such as bank accounts and bonds are not tax-deductible, so this annual income is fully taxable.

To determine the after-tax cash flow, it is necessary to determine the taxable income and subtract the tax from the pre-tax cash flow.

Present Value (pv)

Now imagine that the investor pays $100,000 for the machine at time 0, the machine starts producing, and the first year to 10 years has $38,000 in revenue, $12,000 in operating costs, zero surrender value, and income taxes. 25%.

In this hypothetical case, the investor is allowed to make gradual withdrawals from taxable income, recouping the fund’s “investment expenses” under tax law. One way to calculate the annual taxable amount is to divide the $100,000 capital cost equally over the 10-year depreciation period. The after-tax amount will also be determined. such as:

. Note that there is no actual carryover and the annual $10,000 (non-cash deduction) is included for tax purposes only. This amount for the year is called the non-reimbursable cost to adjust and cover the $100,000 capital cost during the free period. When taxes are calculated, the $10,000 will be returned to the investment for after-tax income.

A tax credit to recapture this income can only be used on certain types of assets as the taxable income will be lower and the tax will be lower. Investments allowed by tax law are divided into two types.

Discounted Cash Flow Analysis—your Complete Guide With Examples

1) Consumption income: These investments are allowed for tax purposes from the income and gross income of the year of origin.

2) Investments: These investments are allowed to be withdrawn gradually (amounts spread over a year) from income for tax purposes.

Amortization, amortization, and amortization are possible ways of calculating the distribution of investment costs over time.

Purchase costs and leases paid for the right to use natural resources, such as oil and natural gas, are examples of business expenses that can be offset against depreciation. Many other business expenses can be recovered through depreciation, such as business rent, research and development costs, trademark costs, and pollution abatement costs. Depreciation, amortization, or amortization is the gain on the pre-tax dollar cost or other basis of an investment over allowable tax credits over a specified period or over the life of the investment. If the property is sold unpaid, all or part of the depreciation reported in previous years can be carried back as taxable income.

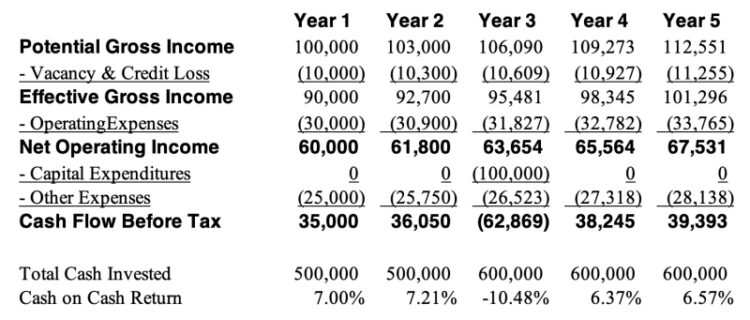

How To Calculate Cash On Cash Return For Your Cre Property

Note: This video and subsequent videos explain how to calculate tax credits and after-tax income. Tax laws allow investors to offset some of their unreported income with tax credits, which means the investor can claim a portion of their income as taxes. Types of assets that may be covered during their useful lives include, but are not limited to, buildings, machinery, equipment, and trucks.

If the property is worthless, it cannot be redeemed for tax credits. A good example is a bank account or real estate. After buying the land, it is believed that the price of the land will not decrease after a few years. Therefore, it is not allowed to get back the money paid for the land through tax relief.

So there are two main ways to invest, which can be offset by tax benefits. The first type is called disposable income. Depreciation means that it can be fully recovered in the year of production. The investor can deduct the amount, investment, total amount and income of the year.

Another type of investment is cash flow. Titles mean they can be tax-deductible for more than a year. So the difference between spendable investment and expendable investment is only a matter of time.

Solved Question 4 (40 Points): Calculate The After Tax Cash

Here we can see the business expenses that can be incurred. These may be deducted from operating expenses, exploration and testing expenses, production and exploration expenses, mining development expenses, oil drilling expenses, or gross income of the IDC. Depreciation, depreciation, and amortization are ways businesses generate income. Of course, they do the same thing.

But they have different types of debt – for example, acquisition costs, rental costs or fees for access rights and natural resources. These can be offset by depreciation, and expenses such as business rent and trademark costs can be offset by depreciation. So, the sooner investors recoup their costs, the better off they will be. The project will have a positive economic impact. For example, if there are no repayment restrictions, investors prefer to pay off all the debt, cash, in full in the year of repayment, because the faster you get the money, the higher its value. . than you will get in the future.

Depreciation, depreciation, amortization, and write-offs are long-term financial write-offs. ATCF can be written in equation form as follows.

As discussed in Examples 7-2 and 7-3, depending on the nature of the investment, the pre-tax and after-tax cash flow estimates may differ and may lead to different economic results.

Net Income After Taxes (niat): Definition, Calculation, Example

Stermole, F.J., Stermole, J.M. (2014) Economic Evaluation and Investment Decision Methods, 14th ed. Lakewood, CO: Investment Evaluations Co. Discount Rates: Finding Value by Showing After-Tax Income 1. An introduction to discount rates and their importance in valuation.

The discount rate is a fundamental concept of financial analysis and plays a very important role in determining the present value of future financial systems. It represents the level of return required by the investor to cover the time cost of the investment and the risk associated with the investment. Understanding the discount rate and its importance is essential for properly assessing the value of investments and projects.

1. Time Value of Money: The discount rate takes into account the concept of time value of money, which means that a dollar earned in the future is worth less than a dollar earned today. That’s because the money can earn interest or put it to work, creating more value over time. By discounting future cash flows to their present value, the discount rate reflects the opportunity cost associated with the investment.

2. Risk and Uncertainty: The discount rate also involves risk and uncertainty associated with the investment. High-risk investments often require high discount rates to compensate investors for losses and inefficiencies. On the other hand, low-risk investments are likely to be at a discount. The discount rate acts as a risk-adjusted rate, allowing the price to accurately reflect the level of risk.

Overview Of Cash Available For Debt Service (cads), Calculation

3. Determining the Discount Rate: There are several ways to determine the appropriate discount rate for the appraisal. One

How to calculate cash flow, how to calculate cash flow from assets, calculate after tax cash flow, how to calculate a cash flow statement, how to calculate before tax cash flow, how to calculate annual cash flow, how to calculate operating cash flow, how to calculate cash flow to creditors, calculate cash flow, how to calculate annual cash flow annuity, how to calculate cash flow to stockholders, how to calculate after tax cash flow from operations