How To Apply For Home Equity Line Of Credit – A home equity line of credit (HELOC) is a secured loan that provides a revolving line of credit using your home as collateral. If you’re looking for a flexible way to finance a large purchase, a home equity line of credit may meet your needs. Here’s what to expect as you make your decision and move forward with the HELOC application process.

A second HELOC loan is similar to a credit card in that your lender sets a maximum amount you can borrow. A HELOC is divided into two parts: the amortization period and the amortization period.

How To Apply For Home Equity Line Of Credit

During the grace period, usually five to 10 years, you can borrow less than your credit limit or as much as you want. Your minimum payments will be interest-only during that period, but you can choose to make principal payments over the life of the loan to avoid overpaying.

How A Home Equity Term Loan Might Save You From Cash Flow Issue Without Selling Your Property

After the maturity date, you enter an amortization period that typically lasts about 20 years. Your monthly payments will increase significantly as you pay off the principal and interest on the loan balance.

Because your home is used as collateral, meaning you risk losing your home if you default on the loan, you should only use a HELOC strategically for long-term wealth building (such as home renovations or renovations). Some common uses for a HELOC include financing higher education, consolidating high-interest debt, and paying excessive medical bills.

You should consider how changing interest rates can affect your finances later. A variable rate can cause your payment to change from month to month. If you can’t afford the highest lifetime limit or rate, a HELOC may not be the best option for you.

The steps for obtaining a HELOC are similar to buying or refinancing a home. Your lender will ask for the same documents and evaluate your creditworthiness before accepting your application and disbursing the money.

Home Equity: The True Value Of Your Home

Before taking out a home equity line of credit, it is important to carefully review your financial situation. You put your house on the line; therefore, you need to make sure that the purchase is affordable and that you can complete the contract by paying the monthly installments on time.

Calculate your home equity by taking the current market value of your home and subtracting what you owe on the mortgage. To qualify for a HELOC, that amount must be 20% of your home’s value, but some lenders may take a different approach.

You can write off up to 85 percent of your home’s value as a mortgage. For example, if your home is worth $300,000 and you have a $150,000 balance on your loan, you can set up a HELOC with a limit of $105,000:

Determine how much money you need for the project or purchase you want to make. Don’t forget to factor in additional loan costs such as application fees and closing costs. If there is a large difference between the calculated line of credit and the estimated cost of borrowing, you may need to look for other financing options that are more suitable for your situation.

Home Equity Loan Vs. Heloc: What’s The Difference?

Interest rates and collateral requirements vary by lender, so be sure to shop around for the best deal. Lenders require that you have at least 20% equity in your home and a credit score of 620 or higher. Lenders may look at your credit history, debt-to-income ratio or other methods to determine your risk and ability to make payments.

Compare rates from at least three lenders. Use these rates to negotiate better terms with your chosen lender. Your bank or mortgage provider may offer discounts to existing customers. Meanwhile, the new lender may offer a sale or discount rate to get your business.

You will need to submit additional financial documents with your application. Your lender will ask for personal and employer information, two years of income documentation, proof of home ownership and insurance, and a mortgage statement. Your lender should have access to documents related to any debts or liens on your home.

Just like when you buy a house, you will receive notices explaining the terms of the contract and additional requirements. Read carefully and don’t hesitate to ask the donor questions. This is your last chance to make sure the HELOC meets your requirements and that you understand all the terms of the loan.

Home Equity Line Of Credit (heloc) For Home Renovations

The insurance process can take hours or weeks. Your lender may also request an additional appraisal that speeds up the process. Be patient and plan for a long wait.

The final step is to sign all closing documents. You will then be able to access your funds within a few business days.

A HELOC can offer a flexible, low-interest way to finance a large purchase, but it must be used wisely. Keep in mind that a home equity line of credit is borrowed money that must be paid back with interest, not cash.

If you can’t make the required monthly payments or, in some cases, the payment amount at the end of the mortgage term, you risk losing your home. Consider the potential risks and benefits to see if a HELOC will help you in the long run. Home equity lines of credit (HELOC) are loans secured by the borrower’s home. A borrower can get an equity loan or line of credit if they have equity in their home. Equity is the difference between what is owed on the home loan and the home’s current market value. In other words, if the borrower pays off the mortgage and the value of the home exceeds the loan balance, the homeowner pays a percentage of that difference, or equity, usually up to 85 percent of the borrower.

Things To Know About Equity In The Home

Because home equity loans and HELOCs use your home as collateral, they tend to have better interest rates than loans, credit cards, and other unsecured debt. This makes both options very attractive. However, consumers should be careful when using it. Paying off credit card debt can cost you thousands in interest if you can’t pay it off, but if you default on a HELOC or home loan, you could lose your home.

A home equity line of credit (HELOC) is a type of second mortgage, similar to a home equity loan. However, a HELOC is not a lot of money. It works like a credit card that can be used repeatedly and paid in monthly installments. This is a secured loan where the account holder serves as collateral.

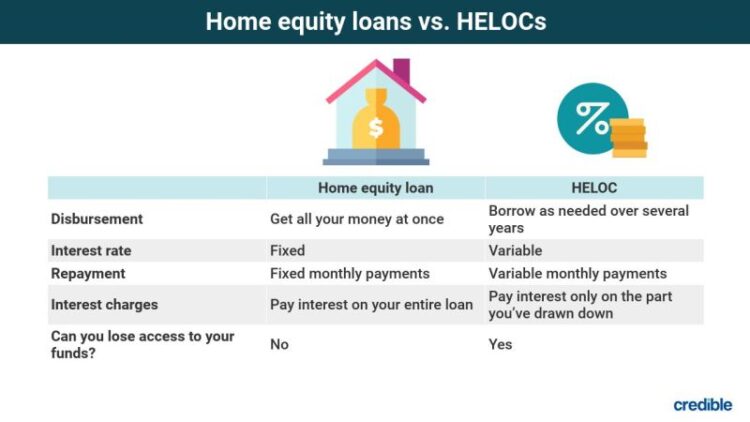

Home loans provide the borrower with an upfront amount of money, in return for which they must make regular payments over the life of the loan. Home loans have fixed interest rates. In contrast, HELOCs allow the borrower to draw as needed up to a certain credit limit. A HELOC has a variable interest rate and fixed payments.

Home equity loans and HELOCs give consumers access to funds that can be used for a variety of purposes, including debt consolidation and home improvements. However, there are clear differences between home equity loans and HELOCs.

How To Protect Your Home Equity Line Of Credits

A home equity loan is a term loan made by a lender to a borrower against the equity in their home. Home loans are called second mortgages. Loans require a fixed amount of money that they need, and if approved, they receive this amount in advance. Home loans have a fixed interest rate and a fixed payment schedule over the life of the loan. A home equity loan is also called a home equity loan or equity loan.

To estimate your home equity, estimate your property’s current value by looking at the recent average, comparing your home to recent home sales in your area, or using a price calculator from websites like Zillow, Redfin, or Trulia. Note that this estimate may not be 100% accurate. When you receive your bill, add up the total balances of all your home equity loans, HELOCs, mortgages, and other debts. Subtract the total balance you owe on anything you think you can sell to get the stock.

The equity in your home acts as collateral, so it’s called a second mortgage and works much like a fixed-rate mortgage. However, there must be enough equity in the home, meaning the down payment must be sufficient for the borrower to qualify for the home loan.

The loan amount is based on several factors, including the combined loan-to-value (CLTV) ratio. Typically, the loan can be up to 85%.

What You Need To Know When Applying For A Home Equity Line Of Credit

How to apply for home equity loan, how to get home equity line of credit, how to get a home equity line of credit, apply for home equity line of credit online, apply for home equity line of credit wells fargo, requirements for home equity line of credit, how to apply for a home equity line of credit, where to apply for home equity loan, apply for equity line of credit, apply for home equity loan, apply for home equity line of credit, best place to apply for home equity line of credit