How To Apply For An Fha Home Loan – Whether you’re ready to buy your first home, looking to upgrade your home, or downsize to accommodate, you have big decisions to make. What do you want your home expenses to be? That you may not know, but the arrival is pledged to you a lot of good.

The home buying process usually begins with a meeting with a mortgage loan officer who will help you make your decision. That initial group can be held in person, over the phone, or online. You must submit a mortgage application and meet the mortgage lender’s eligibility criteria before you are officially ready to buy a home.

How To Apply For An Fha Home Loan

Unless you’re eligible for a loan or plan to buy a home in a rural community where USDA loans are available, you’ll likely have to choose between two popular mortgage options – FHA vs. conventional mortgage loans.

Fha Loan Requirements For 2024

This guide provides a breakdown of each type of loan to help you decide if one of them is the best for your home buying needs. Read on to find out everything you need to know about FHA loans vs. conventional loans.

Before we can discuss the difference between an FHA loan and a conventional loan, we need to look at each in detail. A conventional mortgage is a type of home loan that is not guaranteed by a government agency, such as the Veterans Administration or the Federal Housing Administration. but the loan is backed by a private individual such as a credit union or bank.

Custom home loans come in two types – conforming and non-conforming. Conventional mortgages are popular.

Conventional mortgages conforming to the requirements of Fannie Mae or Freddie Mac. (Fannie Mae and Freddie Mac are known as government-sponsored enterprises or GSEs).

The Fha Loan: In Focus

With a conventional mortgage, the lender can sell the loan to GSEs in the future. This frees up borrowers’ money to take out new mortgages for other home buyers, rather than having their own mortgage on the books for up to 30 years.

Nonconforming mortgages, by comparison, are not the fear of Fannie Mae or Freddie Mac. Therefore, GSEs cannot be sold after your loan closes.

There is a greater risk for the original creditor. As a result, you have to meet higher standards to qualify for non-formal mortgages.

To qualify for a conventional home loan, you must meet a series of Fannie Mae or Freddie Mac requirements. Some lenders may also add additional stipulations that the lender imposes before approving the loan application.

Fha Home Loan

An FHA mortgage is a type of home loan backed by the federal government. Specifically, the Federal Housing Administration FHA guarantees the lender that it will own your mortgage if you stop making your mortgage payments.

If you default on your mortgage, the lender can claim insurance for the remaining unpaid balance (principal only) on the loan, according to the Federal Housing Administration.

You pay the FHA mortgage insurance premium with your FHA home loan loan. Because of mortgage insurance, the lender’s risk is less with FHA financing compared to other types of mortgages, including conventional home loans. Therefore, lenders can do business with borrowers who have lower credit scores and lower payments than usual.

To qualify for an FHA loan, you need to meet several requirements (not to mention potential FHA lender overlap).

Fha Loans In California For Homebuyers

Here is a comparison guide that you can use as a cheat sheet to compare the two credit rating options.

Mortgage insurance requirements: Avoid PMI with a 20% down payment or zero PMI once you have 22% home equity

Mortgage insurance: FHA mortgage insurance for the life of the loan if the down payment is 10%. Cancel after 11 years with a 10% deposit.

But nothing is perfect with a mortgage loan. However, it may be the perfect loan for your situation.

Fha Home Loans

If you have credit challenges, or a high-income debt profile, an FHA loan may be best for you. Of course, you need to make sure that you are comfortable with a lower FHA loan limit, and potentially paying a higher interest rate for an additional good lender.

Conversely, borrowers with strong credit scores and lower debt-to-income ratios can save money with a conventional mortgage. This loan is also a better option if you are looking to buy a home that costs more than the FHA loan term allows.

Some borrowers may qualify for both FHA and conventional mortgages. If you are in this situation, consider your luck. You have many options to choose from and you can compare the amount of each loan to save money when buying a home.

Remember, buying a home is a big financial decision. Saving money up front and being financially stable can help make this a great decision when it’s time to buy a home.

Federal Housing Administration (fha) Loan: Requirements, Limits, How To Qualify

Choosing the type of loan you want is one of the decisions you need to make when shopping for a new home loan.

You should also look for the lender that offers you the best deal on the type of mortgage you want. To do this, compare interest rates and fees from several lenders.

The CFPB [2] advises that trading between peer-to-peer businesses is losing money for consumers. A purchase price can save you tens of thousands of dollars in interest over the life of your mortgage.

:max_bytes(150000):strip_icc()/FHAnew-V1-b23f55ab8e61496d87eabfccaa25c254.png?strip=all)

In fact, studies show [3] that the average American can save nearly $50,000 on a 30-year mortgage by comparing offers from several mortgage lenders before buying a home.

New Fha Home Loan Requirements 2021

Credit scoring models like FICO and VantageScore use logic that doesn’t penalize you for rate shopping (within a specified time period and for certain types of credit).

Depending on the credit scoring model, some credit inquiries related to KPR will only count once in the 14-45 day window for credit scoring.

Buying a home can be an exciting adventure at any stage of life. But amidst all the excitement, make sure you take your time and review all your options when looking for the right loan and insurance policies.

It is also useful to check your credit for errors and improve your credit as much as possible before filling out the mortgage application.

Fha Loan Calculator

A higher credit score often results in lower interest rates and significant savings for you as a home buyer. It’s worth waiting a few extra months or even a year to start buying a home if you can improve your credit and save thousands of dollars on the deal.

For those with bad credit scores or no credit scores, it is highly recommended that you start building good credit so that you can qualify for these types of loans in the future. If you find yourself in this situation, consider getting a trust builder from Financial today.

Michelle L. Black is a leading credit expert with over 17 years of experience in the credit industry. He is an expert in reporting, credit scoring, identity theft, budgeting and debt eradication. See Michelle on Linkedin and Twitter.

Lauren Bringle is an Accredited Financial Advisor with Finance – a financial technology company with a mission to help people build credit and save. See Lauren on Linkedin and Twitter.

Fha Minimum Property Requirements And Standards

Disclaimer: does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial or regulatory purposes. The content provided does not reflect the views expressed by the Bank. Although this information may include references to third-party sources or content, it does not recommend or guarantee the accuracy of this third-party information. Credit Builder Account, Visa® Credit Card, and Level Credit/Rent Track link product boards. Please see the publication date for original content and affiliate context to identify the context.

By submitting my information, I agree to the Terms of Service, Consent to Use Electronic Documents and Signatures, Privacy Policy, Disclosure of Customer Reports and Customer Identification Program. You can use the menu, choose a different loan term, change the loan amount, or change your location.

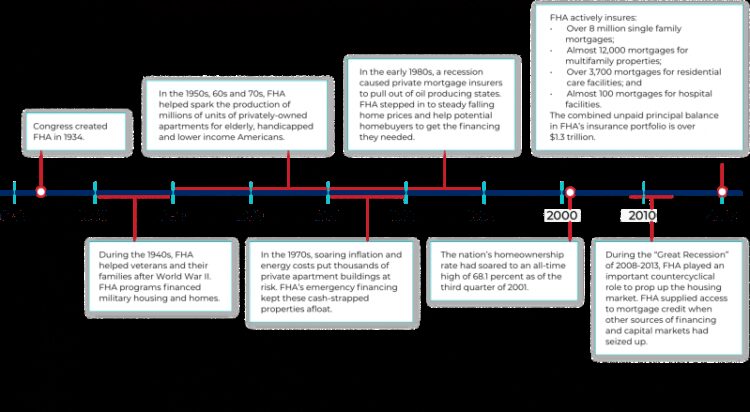

Because of the Great Depression, the Federal Housing Administration (FHA) was created under the National Housing Act of 1934. About 40 to 50% of our thousands of homeowners defaulted on their mortgages by 1933. To eliminate the housing crisis, the government created the FHA. to restore capital flow in the housing market. .

In the face of the Great Depression, borrowers received only 50% to 60% of home financing. Most home loans with short terms of 11 and 12 years and interest rates. This required large balloon payments until the end of the term. When homeowners can’t afford large payments, they continue to refinance and extend their mortgages. Eventually, many owners were unable to keep up with the payment, leading to many foreclosures.

Do Fha Home Loans Have Lower Interest Rates?| Omaha Ne Home Buyer’s Guide

Since the creation of the FHA, rules have been put in place to ensure better lending practices. Lenders are guaranteed at least 80% of the home price if they are prepared

Apply for an fha home loan, how to apply for fha mortgage loan, how to apply for fha 203k loan, how do i apply for an fha home loan, where to apply for an fha loan, fha loan how to apply, apply for an fha loan online, how to apply for fha home loan, how to apply for an fha loan online, how to apply for an fha loan, how to apply for the fha loan, apply for an fha home loan online