How To Apply For A Personal Loan Bank Of America – Get cash when you need it with an emergency loan from LendingPot. From medical bills to unexpected car repairs, our quick and easy loan process can help you get the money you need to handle life’s emergencies. Apply now and get approved fast.

The loan is issued by a bank or lender in cash and is repaid in fixed monthly installments. It is an unsecured loan. This means that you do not need to pledge any real estate as collateral. Lenders use your income level, repayment ability and history to check your eligibility and calculate your loan amount. The amount you can borrow is usually higher (up to 10 times your monthly income) and can be used for larger emergency expenses such as funeral expenses. Remember that defaulting on this loan will reflect on your credit report and negatively affect your credit score. A bad credit score can affect your eligibility for future loans. Since the loan requires you to repay the money within a certain period, make sure that you pay on time. This will help you build a good credit history.

How To Apply For A Personal Loan Bank Of America

A payday loan is a short-term unsecured loan equal to your monthly salary to help you finance urgent needs like buying a new laptop. Unlike loans, where the loan can be repaid up to 5 years, the repayment period is usually until the next payment. Refunds will also be made in full. To ensure that borrowers don’t borrow more than they can finance, lenders typically approve a loan amount within your ability to repay based on the borrower’s income and credit profile. Such loans are usually facilitated by lenders.

How Much Personal Loan Can I Take In Singapore?

A credit card loan is another type of emergency loan. These are short term loans that help you get instant cash with your available credit card balance Credit card interest rates and fees are usually higher than normal credit card usage. Interest rates start accruing as soon as you withdraw or spend money, so it’s always better to be careful about how you spend your funds.

Borrowers should consider their needs to decide which type of emergency loan to choose. Consider whether the requested amount is more or less than your monthly income and whether the desired loan period extends or expires on the payment date.

Consider a credit card cash advance only after you’ve exhausted all other ways to get cash This is because the interest and fees charged are relatively high and difficult to keep track of.

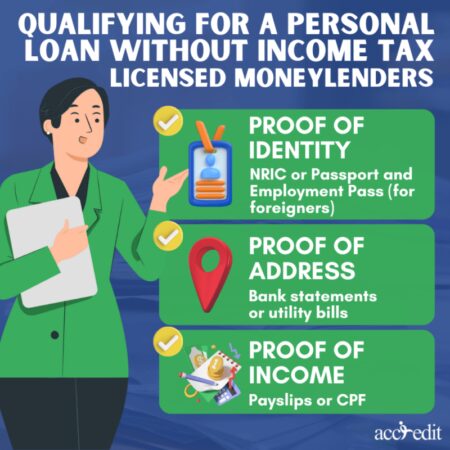

To get started, you can get emergency loans from two types of lenders. namely licensed banks and moneylenders. Everyone has to meet their own requirements to be eligible for an emergency loan.

Instant Personal Loan Application Process Implementation Of Omnichannel Banking Services

As a Singaporean, you must have an income of at least $20,000, but for foreigners it usually starts at $30,000 per year. In addition, not all banks lend to foreigners. Check the table below for the banks you are eligible for.

Extend loans to borrowers with annual incomes of less than $20,000 and limit loan amounts to $3,000. In addition, all foreigners are eligible to apply for a loan in Singapore if the lender has a sufficient foreign quota available.

Banks offer loans in as little as 15 minutes, depending on your credit report, income and more. Loans are available within days from licensed lenders.

Note that you may be paid immediately if you are eligible.

How To Apply For A Personal Loan Online

For quick loans, you will be able to view your offers before making a decision and making an appointment with a lender.

Depending on the available loan limit you qualify for, banks and lenders will offer you a loan based on their credit criteria.

4. I currently have some loans from banks and lenders, am I still eligible to apply?

As long as you pay off your current debt promptly, you can apply for a debt consolidation loan to consolidate your debt with certain lenders on our platform.

Apply For A Personal Loan From Dbs At Low Interest Rates

Instead of a cash advance that starts at 28% APR, you can use your existing credit card limit for the loan. This is the fastest option because the lender has already approved how much they are willing to lend you when your limit is extended. The final amount and outcome are still at the bank’s discretion.

To avoid delays and any information inconsistencies during check-in, it is better to use Singpass instead of manually entering it online. Since the information received from SingPass is already verified, it can reduce the loan processing time. For some banks, after submitting Myinfo, they provide an estimated loan amount and term.

Whenever you apply for a new loan from a bank, the bank obtains your credit report and the inquiry is recorded on your CBS. If more inquiries are made, the bank may take this as a sign that you want to take out more loans. Because of this, it can affect your chances of getting a loan.

It will be better if you apply for a loan, as the existing credit card issuing bank already has your documents. Select 1 or 2 banks to use from the list above.

Legal Personal Loan

One of the things lenders look at before extending a loan to you is your credit bureau score or the lender’s credit bureau score. These two reports show your repayment history, the amount of credit you are using, any outstanding loans, etc. Once you decide on a suitable emergency loan, make sure that the payment is made immediately to avoid future problems in obtaining a loan.

What is the difference between applying for a personal loan and applying to LendingPot?

Using Myinfo in just one app that takes less than 3 minutes, Lendingpot connects you with multiple lenders at once. You can compare the terms offered by lenders and choose the offer of your choice.

Can I restructure my loan with the lender due to changed circumstances (e.g. job loss, increased financial obligation)?

Apply For Dbs Personal Loan

Late payment charges apply. We recommend that you make your payments promptly to avoid late payments or bad records showing up on your credit reports with your credit bureaus and lenders. A personal loan is unsecured, you do not need to pledge funds. You can apply for a loan regardless of whether you are employed or self-employed. You can get up to Rs. 25 lakhs at an interest rate of 11.99%*. The tenure varies from 12 months to 60 months. At the conclusion of the loan agreement, you must pay a mandatory processing fee of up to 3% of the principal amount borrowed.

Now that you are familiar with the details of personal loans, you may want to apply for funds. After all, the next step to money is knowing how to apply for a loan with us. At SMFG India Credit, we offer you the option to cancel your loan application on our website. Alternatively, you can visit your nearest SMFG India Credit branch to submit your loan application.

Since many of our customers prefer to leave their loan request on our website, in this post we will talk about how to apply for a personal loan online:

The ‘Sign Up Now’ button is located on the home page and in the top right corner of every page of the site. Click on it and follow the steps below:

Ultimate Faq:personal Loan Bank, What, How, Why, When

You can download the SMFG India Credit InstaLoan app from the Google Play Store (for Android users) and apply for a personal loan by following these steps:

The following section shows the maximum loan amount limit you can get. It also shows the tenure and any applicable EMI offers.

Note: To understand the exact monthly installments that you have to pay, take help from the personal loan EMI calculator available on our website. This financial tool is free and gives accurate results.

Now proceed with the rest of the steps on how to apply for a personal loan mentioned on the page. You will be notified within a few minutes whether your loan application will be processed or not. If so, you will receive a reference number that you can use to track your personal loan application.

How To Get A Personal Loan With No Income Proof

You can easily apply for SMFG India Credit Personal Loan online anytime of the day. All you need to submit a loan application is the required device with an internet connection and we will respond as soon as possible.

Apply for a personal loan in just 2 minutes* and get a loan of up to 25 lakhs, download the app now! Prize winners

Best bank to apply for personal loan, bank of america personal loan, bank of america apply for a loan, how to apply for a personal loan, bank of america apply for a personal loan, bank of america personal loan rates, how to apply for a personal loan bank of america, apply for personal loan citizens bank, bank of america personal loan application, apply for personal loan, bank of america personal loan requirements, apply for personal loan bank of america