How Much Negative Equity Can I Roll Into A Lease – Negative equity in a car loan can hold you back financially. To avoid this you need to know this.

Has anyone ever told you that the value of a new car goes down when you win the lottery? If so, you may have been blocked since, well, that’s a bit silly. After all, cars are expensive and they can’t lose their value that quickly, right? Wrong.

How Much Negative Equity Can I Roll Into A Lease

According to CARFAX, cars lose more than 20% of their value in the first year after being scrapped. This, along with depreciation, bad credit or car terms, is called negative equity, even if you have made all of your loan payments on time.

Optimize Your Portfolio Using Normal Distribution

Negative Equity: When the amount owed on collateral (such as a car or home) exceeds its value, this is also known as a “reverse” loan.

Negative equity on a car loan, sometimes called “reverse equity,” occurs when you owe more on your vehicle than you own.

To find out how much negative equity you have, start by finding out how much your car is worth, commonly known as its retail value. You can easily find the retail price of a vehicle by visiting a reliable site like Kelley Blue Book (KBB) or Edmunds and using the car appraisal tool.

Once you know what your vehicle is worth, remove it from your current vehicle loan balance. This number is the amount of negative equity you have.

How To Trade In A Car With Negative Equity

For example, if your car is worth $5,000, but you still have a $10,000 loan, you have $5,000 in negative equity.

Another way to show your negative equity is your loan-to-value (LTV) ratio. This ratio is found by dividing the loan amount by the current retail price of the vehicle. If your LTV is over 100%, your debt is worth more than your car and your equity is in the red. Including lenders that offer refinancing, a high LTV may be a reason to decline your loan.

A loan-to-value ratio of more than 100% means you owe more than your vehicle is worth. An LTV above 125% can make refinancing more difficult, but not impossible.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QE2JPZGW2FJD7I42QYZ737AJTI.jpg?strip=all)

If your LTV is less than 100%, your car is worth more than you owe. The lower your LTV, the better.

How Much Negative Equity Can Be Financed In A Used Car?

It’s always best to avoid negative equity, but this is easier said than done. Here are some reasons why you may be tired.

An easy way to prepare yourself for negative equity is to make a small down payment on your car loan. The more money you pay upfront, the more equity you will have in your vehicle, which will help you stay ahead of your vehicle’s depreciation.

Additionally, paying more for your down payment can reduce the amount of interest you pay over the life of the loan. If you make too much upfront payment, the interest can add up quickly and extend the life of the loan. The longer you’re stuck making payments, the more negative equity you can build up as your car’s value continues to decline.

If you finance a car that is more expensive than you can afford (or borrow from a previous car loan), you will be able to withdraw money from your loan.

Negative Equity In Car Finance Explained

If you have difficulty making monthly payments and fall behind on your loan, you may find yourself in a more negative situation. To pay off the monthly payments, you may consider extending the loan tenure – thereby increasing the loan.

According to Edmunds, the most common car loan term is 72 months or 6 years. Since your car is only worth 40% of what you bought it for after five years, a long-term loan could push your payments more than your car is worth.

People drive for a variety of reasons, some simply to get to and from work, while others drive for fun. There’s no penalty here if you’re one of the last ones in! However, if so, you should be aware that the value of your car will depreciate faster than the same model used as a commuter, especially if you are in a hurry to calculate it. This will reduce the value of the vehicle and expose you to negative equity.

Regular vehicle maintenance may seem expensive, but not following it can cost your car dearly. Like people, vehicles also need to remain healthy to extend their lifespan.

What Does Negative Equity Mean For Me?

If your car is no longer drivable, it’s worthless as a trade-in or even a private party sale, but you’ll still have to repay the loan in full.

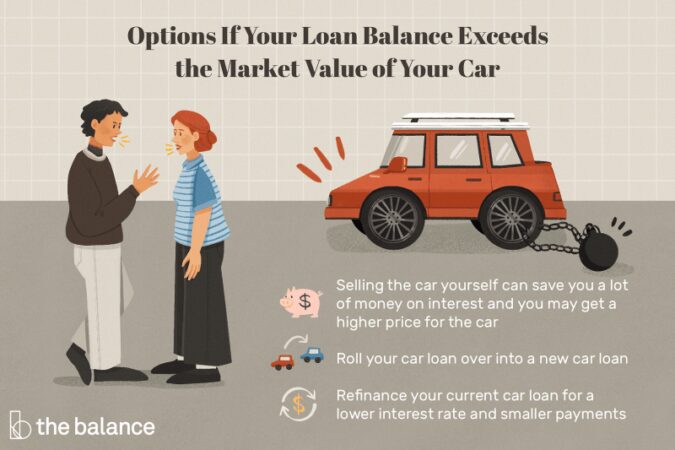

Sometimes a negative equity new car loan is an option when trading in your vehicle. The lender pays off your original loan and consolidates your negative equity by adding it to your new car loan.

This is a source of pride for those whose prices are low and would not cover the cost of a new vehicle.

However, if you exceed negative equity, you will exceed the life and cost of the new loan. This can cause you to pay more in interest and, unfortunately, leave you with more negative equity if you don’t keep up with the depreciation on your new vehicle.

Car Loan Upside Down? 5 Options When You’ve Got Negative Equity

How much negative equity you can put into the new loan will depend on the new lender.

Your new lender will need to review your income, credit report, credit score and other factors to determine whether you will be approved. If you have bad credit, you may not be allowed to transfer your negative equity.

When you accumulate negative equity, you’ll want to get rid of it as quickly as possible. Here are some strategies for getting back in the black:

If your monthly payment increases by $0, you’ll save $0 in interest and pay off your loan 0 months earlier!

Are You In Negative Equity?

If you have a reverse car loan, you want to recover the value of your car and selling it can be a good way to do so. Luckily, you don’t need positive equity to get started, although it’s a good idea.

With a private sale, you can set the price of the vehicle and keep all the profits. This can help you pay off your negative equity more quickly, if not completely, depending on the success of your sale.

Make sure you’re not undervaluing your car for a quick sale. You still have to pay off your loan in full, so you need to get as much money as possible for your vehicle.

Trading in your vehicle can be messy when you have negative equity in your current car loan.

When Do Stocks And Bonds Move Together, And Why Does It Matter?

Not only does the seller pay less than if you sell in a private sale, leaving you with even more negative equity, but they also control when you’ll be able to roll the negative equity into a new car loan. Or not. If they set or allow a lower amount than required to cover your negative equity, you’ll be stuck paying the difference before you can buy the new car.

If you want to clear your vehicle quickly to prevent your negative equity from increasing, you have the option of selling it to the dealer. While trading in your vehicle is like a loan for a new vehicle, selling it outright means getting your money back. In fact, some dealers will even pay you cash!

Like trade-ins, dealers will often pay you less for the vehicle than in a private sale. This allows the dealer to exchange your vehicle for a profit.

To avoid negative equity in the future, make sure you consider the following before purchasing your next car:

How To Trade In A Car That’s Not Paid Off

It’s always best to avoid negative equity, but if you find yourself, that’s OK. Take a deep breath, make a plan and stick to it!

If you go back in the dark, learn from your experience and make sure you have a plan to get your next loan on the right track.

Micah Murray is a personal finance writer who has written for Money Under 30, ChoiceFi, Leverage RX, and others. She lives in Maine with her husband, three cats, and a dog. In his free time, you can find him around the fire listening to true crime podcasts.

If you’ve been reviewing your budget lately, and thinking about ways to save money, your monthly car payment may be an expense you want to cut back on. Fortunately, there are options available for drivers who want to limit the costs of car ownership without compromising on travel. Loan modification is one approach

Social Media Marketing In A Down Economy

Roll negative equity into new car loan, trading in a car with negative equity for a lease, how much negative equity can i roll over, how much negative equity can i roll into a lease, rolling negative equity into new car loan, can you roll negative equity into a new mortgage, negative equity lease calculator, lease negative equity, negative equity car lease, rolling negative equity into a lease, negative equity car lease calculator, roll over negative equity car loan