How Long To Pay Off Loan Calculator – Due Date – Enter the date you expect the borrower to repay and deposit the loan.

Total Account Balance – This is the loan account amount on the date you select – The date shown next to Balance is the date of the last transaction in the ledger account that occurred on or before the payment date.

How Long To Pay Off Loan Calculator

Payments that do not count towards the balance – this is the amount that will be added to the loan after the selected date. Normally, this number should be zero. If the payment is scheduled for a future date, it will be the amount due on the selected date.

Loan Calculator Shows How Quickly You Can Get Out Of Debt

Daily Interest – The daily interest accrued since the last interest was added to the loan.

Escrow Deficiency – If there is an incorrect amount in the escrow account, this amount is added to the payment to ensure that the amount is zero when the loan is paid off.

Prepayment / Prepayment Penalty – Any penalty that may apply if the loan is paid off early will be added to the loan. (Note: As of 06/22/2017, Fees have not been used in MoneyLender 3. No one has shown much interest yet…)

Additional Closing Fee – If you add a closing fee after the loan closes, you can enter the fee amount here. At this point, the money is not added to the loan, but to the down payment to ensure you receive the required payment at closing.

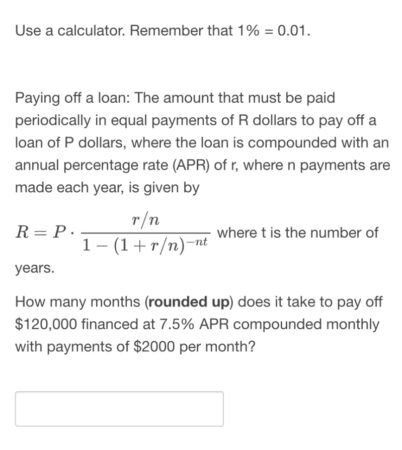

How To Calculate Loan Payments And Costs

Send Payoff Quote – Opens the Print Template window, and all the payoff quotes in the Print Template are listed below the top.

Enter Payment and Close Loan – It opens a window to enter new payment, pre-set amount of payment, date and type of payment made on payment. After saving the payment, the loan closing wizard will open. This calculator will help you compare the costs between a bi-weekly payday loan and a monthly payday loan. You can use this for any type of loan including home loan. We also provide home reading calculators every two weeks.

Are you paying more interest on your loans? If so, you can take advantage of low interest loan payments, consolidate your loan using home equity, or refinance your New York home loan at today’s low rates. The rates for various rental items are shown in the table below.

Our chart lists mortgages available in your area, which you can use to find a local lender or compare other loan options. In the [Loan Type] selection box, you can choose between a HELOC and a home equity loan with terms of 5, 10, 15, 20 or 30 years.

How To Pay Off Your Car Loan Faster: Tips And Strategy (december 2023)

The table below shows New York’s 30-year interest rate. You can use the drop-down menu to choose a different loan term, change the loan amount, change payments, or change your location. More details are available in Advanced Downloads

Once you start paying off your debt, most of your monthly payments will be interest on long-term loans (such as mortgages). The more you extend your loan, the more interest you will pay. As your principal is paid off, your interest payments will also decrease and your payment ratio will shift toward a larger payment each month.

A common method that landlords and other lenders use to make payments faster is bi-weekly payments. Instead of paying once a month, they pay half the amount twice a month.

The idea of paying twice a month is a bit misleading. Bi-weekly is not the same as twice a month. There are 52 weeks in a year, which means 26 paychecks per year on a two-week pay schedule. However, there are only 12 months in a year, and if you pay twice each month, you only pay 24 in a year.

Ways To Pay Off Your Mortgage Early

When you pay each week, you create another loan each year. So, if your monthly income is $1,500 per month, you would pay $18,000 per year in monthly payments. If you pay weekly, you could pay $19,500 a year.

The main benefit of regular payments is that you pay off more money faster, lower your interest payments, and shave years off your debt. For example, if you have a $250,000, 30-year loan with an interest rate of 5 percent, you would pay $1,342.05 per month, excluding taxes and property insurance. You’ll pay $233, $139.46 over the life of the loan, and pay monthly. If you switch to the two-week plan, you’ll pay just $189, $734.44 in interest and shave four years and nine months off your credit life. Depending on how you borrow, a regular payment swap can shorten your loan by up to eight years.

You don’t have to spend every week to save money. You can simply divide your loan by 12 and add 1/12 of that amount to your monthly payment. So, if your regular salary is $1,500 per month, you pay $1,625 per month instead. Some people also use tax refunds, performance bonuses and other similar streams to help pay for the 13th year.

The same benefits that apply to home loans also apply to other types of loans. Some loans often have low interest rates, but often come with high interest rates. Cars depreciate quickly and unsecured loans have high interest rates to cover the risk of default.

Calculator: How Long Will It Take To Pay Off My Loan?

Unfortunately, change may not be as simple as writing a check every two weeks. If you are already on a pay-as-you-go plan, you should ask your lender if you can cancel or change it. Next you need to find out if the lender will accept bi-weekly payments or if there is a penalty for paying off your loan early.

Some services offer you bi-weekly payments. However, these companies may charge you for this service (such as a few hundred dollars), and may charge you once a month (refused to save money).

Instead, you’ll have to pay the lender directly, and you want to make sure it’s used right away and that extra money is applied to your principal.

As long as you have the ability to pay, it is better to pay directly instead of signing up for an automatic payment plan because it gives you relief during lean times.

How Is Interest Calculated On A Home Loan?

Use the calculator above to find out how much you could save by switching to bi-weekly mortgage payments. You will also find out how to pay off your loan faster. Play around with different amounts to see how much you can save on your monthly payments.

Check out conventional mortgages, FHA loans, USDA loans and VA loans to find out which option is right for you. Real estate calculators are tools that help users determine the financial impact of one or more changes to a home’s finances. Mortgage calculators are used by consumers to determine monthly payments and by lenders to determine the eligibility of loan applicants.

Mortgage calculators are usually available on for-profit websites, although the Consumer Financial Protection Bureau has developed its own mortgage calculator.

The main variables in the mortgage calculation are the loan principal, balance, periodic interest rate, annual payment amount, payment amount and regular payment amount. Most advanced calculators can also take into account other costs associated with a mortgage, such as local and state taxes and insurance.

Pay Off All Your Debt: Debt Repayment Calculator Canada

Real estate accounting capabilities can be found in mobile financial calculators such as the HP-12C or the Texas Instruments TI BA II Plus. There are also free online home appraisers and software programs that provide financial and loan calculations.

When purchasing a new home, many buyers choose to pay a portion of the purchase price using a home equity loan. Before interest rate calculators became popular, those who wanted to understand how money affects changes in the five main factors of a mortgage had to use compound interest tables. Using these tables correctly often requires an understanding of the mathematics of compound interest. In contrast, mortgage calculators provide answers to questions about changes in mortgage rates that are readily available.

If a person borrows $250,000 at 7% annual interest and pays off the loan over thirty years, how much will it cost him with $3,000 a year in taxes, $1,500 a year in home insurance premiums, and 0.5% a year in commercial home insurance? ? . Pay monthly? The answer is $2, $142.42.

Borrowers can apply for the loan online

Considering Paying Off Sba Loans Early? Read This First

How long to pay off a car loan calculator, pay off car loan early calculator, how long to pay off a loan calculator, how to pay off loan faster calculator, pay off student loan calculator, how long to pay off debt calculator, how long to pay off student loan, calculator to pay off loan, pay off calculator loan, how long to pay off student loan calculator, how long to pay off home loan calculator, loan calculator how long to pay off