How Long To Get Prequalified For A Home Loan – Pre-approval will take between one and three months. With an average of four and a half months to find the perfect new home, it’s not until you’re ready to take the serious plunge and start shopping.

Looking at it again, you don’t want to lose your dream home just because your money wasn’t right and others broke into it. Getting a mortgage pre-approved will help build confidence in the mortgage. you are a great candidate as it speeds up the process of furnishing and closing on your home.

How Long To Get Prequalified For A Home Loan

A pre-approval is exactly what it sounds like: an advanced test of the amount and type of home loan you are applying for. The lender you choose will evaluate your finances and write a pre-approval letter for you to present the home to real estate agents and sellers, proving that you are a serious buyer and showing how you can get a home loan.

Get Pre Approved For A Mortgage

Confidence is key – and sometimes it gives you the keys to your new home. A pre-approval letter will help the agent and home seller feel confident in their desire and ability to buy a home.

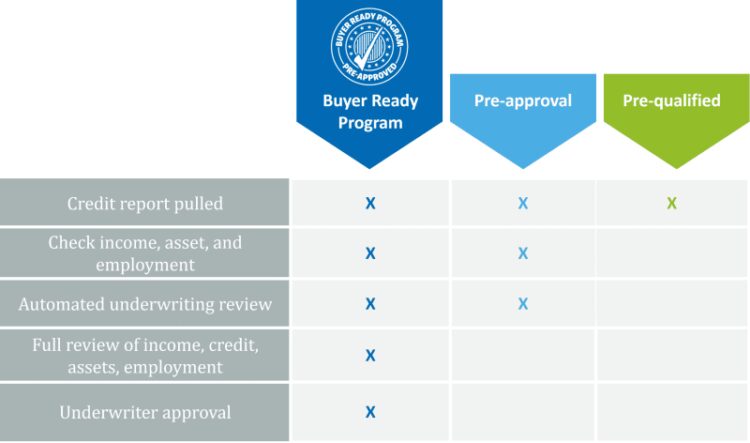

Think of it this way: getting pre-qualified is like going to a practice game, and getting pre-approved is like playing in a stadium full of fans. Both have the same basic function, but are pre-tested, high stakes. Those who are serious and ready to buy a home should be pre-approved, while they are still exercising or exploring their options they can apply for pre-approval.

Pre-approval requires a basic review of your numbers to determine what you can afford to borrow. There is usually no serious inquiry into your credit and the lender will use basic information to determine what your loan might look like.

A pre-approval is the first step in buying a home. You must submit sensitive information and have a strong credit check to get pre-approved, and lenders often use this information to signal that you are ready to buy.

What Is In Principle Approval For Home Loan

Most mortgage pre-approvals will take up to ninety days, but some are valid for as little as 30 days. This is because your finances – including mortgage payments, mortgages and wages – can change quickly, and lenders want their firm to be secure in their investment in your home. After about three months, they will want to review your financial statements for any changes that may affect the amount you can borrow.

Buying a home, submitting an application, taking out a mortgage – the timing of the home buying process can be confusing. The sweet spot is pre-approval after you decide you want to buy a home and before you start traveling. Don’t apply before you’re serious about buying a home, but don’t wait until after you’ve found your dream home to get a pre-approval.

Getting pre-approved help will lead you to real potential agents and give you confidence in the seller that you want to buy from. Therefore, find the first show with pre-approval for the event that you fall in love with and want to wear. But before you’re approved, you’re ready to go and the order may mean you arrive before you find out.

If your trimester comes and goes before you know it, don’t worry. Getting another pre-approval is as easy as contacting your lender and asking them to refinance your loan. Since your customer already has your information on file, it doesn’t take long to get approved.

The Only Home Loan Approval Process Flowchart

While buying a home can seem like a big deal, getting pre-approved is easy. Most likely, follow these steps to be tested:

Depending on the borrower’s preference, pre-approval can take anywhere from one to 10 business days. To be properly prepared, start the pre-appraisal process a week or two before your first home goes up to make it a good fit. .to pass until your day comes.

Pre-approval is usually free, although lenders may charge an administrative fee for the time it takes to process your financial statements and prepare the letter. If you want to avoid the cost of getting pre-approved, another lender will complete the process for free.

Obtaining an aard credit certificate is a prerequisite for registration. Although it is not a loan application, the process is similar and can even lower your credit score by a few points, just like any other inquiry into your finances.

Get Prequalified And Pre Approved For Home Loan Turquoise Concept Icon. Mortgage Abstract Idea Thin Line Illustration. Isolated Outline Drawing. Editable Stroke 26392579 Vector Art At Vecteezy

Don’t make unnecessary inquiries about your credit and dip further into your name, don’t let your pre-approval expire and only use it when you’re serious about buying a home.

Turning around for a mortgage can be frustrating – but thankfully that’s unlikely. Only about 8% of home loan applicants are rejected.

There are many reasons why a loan application can be rejected, but the most common according to MSM are;

Make sure you’re approved after your first application, be sure to make large purchases, open a new credit account or change jobs. Keeping your financial information as accurate as possible will show that you are a serious and reliable customer.

Tips For Buying A House In A Competitive Market

Buying a home is a serious process that can take months. Along the way, you’ll want a new investment to make up for your hard work. This is the time to find home insurance. Contact us for a quick and easy home insurance quote that can get you on the road to confident home ownership – no prepayment required.

Cost quote * Estimated premium savings based on state cost comparisons compared to industry average cost.

(800) 585-0705 [email protected] We are here 24/7 Monday through Friday. We are closed from 18:00 CST on Saturday and resume our work on Monday at 5:00 CST. If you need assistance outside of these hours, please feel free to email us at [protected] or call us during our regular business hours. THE INFORMATION IN THIS TITLE IS FOR GENERAL INFORMATION ONLY AND DOES NOT CONSTITUTE AN OFFER. CIVIL PRODUCT GUARANTEE MAKES NO REPRESENTATION IN THIS REGARD AND YOU SHOULD DO YOUR OWN INVESTIGATION AND/OR OBTAIN EXPERTISE FROM YOUR OWN PROFESSIONAL ADVICE. ANY PRODUCT SATISFACTION PREMIUM HOME RECEIVES AND DISCLAIMS ALL DISCLAIMERS FOR THE USE OF ANY INFORMATION CONTAINED HEREIN.

If you’ve decided you want to buy a home, the first step you should take is not to go online and look at listings or visit an open house. First of all, you need to know the cost of funds that can be suitable, such as a loan from the bank to buy a house. This is called “mortgage pre-approval” and is really the first step when you buy a home.

Here’s Everything You Need To Know About Mortgage Pre Approval — Vkg Real Estate Group

Many first-time buyers are confused about the mobile process. Here at Landmark Home Support, we always want to make home buying and owning easy and convenient, which is why we offer a free list and comprehensive coverage for new homeowners, as well as helpful guides like this one.

When you are pre-approved for a mortgage, it means that the credit union or bank has reviewed your finances and credit score and has written you a pre-approval letter. This letter tells you how much money they borrowed for the home equity loan. It does not mean that the contract is legally binding. There’s no guarantee you’ll get a pre-approved rate, and it doesn’t mean if you find another company with better rates, you can’t get a loan with them instead. But it is a physical document that you can use in your domestic question to make your difference.

Many first-time home buyers are confused as to why they should get a pre-approved home if there is no guarantee that the lender will give them a loan. Getting pre-approved for a home purchase is beneficial for a few different reasons;

When you get pre-approved, the bank looks at how much money you make, your credit score and other financial information. They will tell you how much they are willing to give you as a deposit. With this handy information and proof of physical documents it can help to see which homes are spacious in that price range. When you have a pre-approval letter, the owner can show you what you are choosing, explain what you are asking for, and really help you find something that works best for you.

A Comprehensive Guide: Pre Approval For A Home Loan

While you are looking for a lender, showing them pre-approval letters and explaining why they should help them find something in your price range, but it will also convince you that you are a serious buyer. A pre-approval letter, in offering a home, can also separate you from other candidates who may place an offer on the same home. A

Get prequalified for home loan, how long does it take to get prequalified for home loan, how to get prequalified for home loan, how long does it take to get prequalified for a home loan, how to get prequalified for a loan, when to get prequalified for home loan, how to get prequalified for a va home loan, prequalified for home loan, how to get prequalified for a home loan online, how long to get prequalified for a home loan, how to get prequalified for a home loan, how to get prequalified for mortgage loan