How Fast To Pay Off Mortgage Calculator – Use this calculator to find out how much interest you can save by paying 1/2 of your mortgage every two weeks instead of paying the entire month. The net effect is one extra mortgage payment per year, but the interest savings can be significant.

This calculator also has the option to add an extra amount (mark-up) to the monthly mortgage and save interest. With this unique 4-column format, you can compare scenarios side-by-side, print amortization schedules and plan your repayment strategy.

How Fast To Pay Off Mortgage Calculator

If you’re not sure how much extra you’ll need to pay off your mortgage by a certain date, try this mortgage payment calculator here to calculate your payments in terms of time rather than interest saved.

Is It Wise To Pay Off A Home Mortgage As Soon As Possible?

Learn how to grow your wealth faster with this 5 tutorial video series – absolutely free!

“Discover a comprehensive wealth planning process proven with over 20 years of practice that gives you complete confidence in your financial future”

Future Wealth Planning shows you how to create a financial road map for the rest of your life

This weekly mortgage calculator makes the math easy. It determines the interest savings and repayment period for various payment scenarios.

What Happens To Your Mortgage When You Sell Your House?

Instead of monthly payments, you can make payments every two weeks and make additional principal payments to see how it speeds up the payment.

Paying your mortgage every two weeks is a strategy that can help you save a lot of money in interest and pay off your mortgage early.

Instead of paying once every month, you pay every two weeks. This bi-weekly model differs from bi-monthly mortgage payments, which may include additional payments.

With every two weeks, you pay 26 payments instead of 12, but pay less. The net effect corresponds to one extra monthly payment per year (13).

Pay Off Your Mortgage Faster: Strategies And Calculator Tools

The net result of bi-weekly payments is that you pay more each year regardless of whether or not you pay down the principal in addition to the bi-weekly payment. It requires a small sacrifice, but as you’ll see when you plug your mortgage payment information into this bi-weekly mortgage calculator, the savings are huge.

Before you start paying every two weeks, make sure it’s right for you. Here are some things to consider:

Once you’ve determined that bi-weekly payments (and/or top-up payments) are right for you, it’s time to set it up and start saving!

Many banks and credit unions will allow you to reconfigure your existing mortgage to a bi-weekly payment plan. You have to call and ask because they usually don’t advertise this feature.

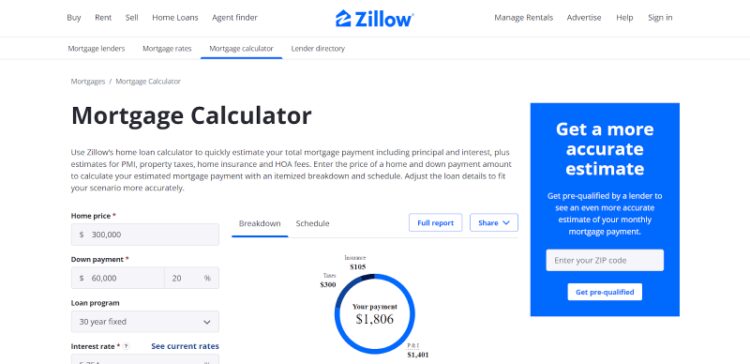

Full Function Mortgage Calculator

Alternatively, you can split the mortgage in two and pay this amount every two weeks. The end result will be the same, but you won’t get the automation simplicity you want. But check with your bank first to make sure it’s compatible with your payment terms and won’t incur prepayment or other issues.

If you choose to add additional principal to your required payments, you may want to check with your mortgage lender to see if there is anything that requires the extra money to go directly to the principal instead of making the required payments up front.

The nice thing about the bi-weekly mortgage payment plan is that you can easily shorten the term of the loan from 6 to 8 years.

Additionally, if you receive your paycheck every other week, biweekly mortgages may be more convenient than monthly payments.

Early Mortgage Payoff Calculator

If you’re still unsure whether this payment option is right for you, use the two-week mortgage calculator above to help you see the total savings you could get. Don’t forget to print out your amortization payment schedule to stay on track!

We will email you a screenshot of the calculator you just completed as shown on the screen. We don’t store any of your information: it’s just a picture. You can unsubscribe at any time.

Please tell me where to send 2 video guides that show BOTH strategies to calculate EXACTLY how much you need to retire… This calculator helps you compare the costs between a payday loan and a loan based on payments each week. payable monthly. You can use it for all types of loans, including mortgages. We also offer a two-week personal mortgage calculator.

Are you paying high interest on your loans? If so, you can take advantage of low personal loan interest rates, consolidate your debt using home equity, or refinance your New York home loan at today’s low interest rates. Tariff tables for various loan products are shown in the following tabs.

Free Online Mortgage Calculator

Our rate chart shows current home equity offers that you can use to find a local lender in your area or compare other loan options. From the [Loan type] selection box, you can choose between HELOCs and mortgages with terms of 5, 10, 15, 20 or 30 years.

The chart below shows current 30-year mortgage rates in New York. You can use the menus to choose other loan terms, change the loan amount, change the down payment or change the location. Additional features are available in the advanced drop-down list

When you start making loan payments, most of your monthly payments on long-term loans (such as mortgages) will be interest. The larger the loan balance, the more interest you pay. As your principal is paid down, your interest payments will also decrease and your payment ratio will shift towards paying more principal each month.

A popular way for some homeowners and other borrowers to pay off their principal faster is to make payments every two weeks. Instead of a monthly payment, half is paid twice a month.

Pay Off Mortgage Faster

The concept of two monthly payments is a bit flawed. Two weeks is not twice a month. There are 52 weeks in a year, so on a fortnightly payment plan you make 26 payments per year. However, there are only 12 months in a year, and if you make two payments each month, you will only make 24 payments per year.

By paying every week, you will pay an extra loan payment every year. So if your monthly payment is $1,500 per month, you will pay $18,000 per year in monthly payments. If you pay every two weeks, you’ll pay $19,500 over the course of a year.

The main advantages of frequent payments are that you will pay off the principal earlier, reduce the interest amount and shorten the term of the loan. For example, if you have a 30-year, $250,000 mortgage at 5 percent, you’ll pay $1,342.05 a month, including property taxes and insurance. You’ll pay $233,139.46 over the life of the loan by making standard monthly payments. If you switch to the two-week plan, you’ll pay just $189,734.44 in interest and shorten your loan term by four years and nine months. Depending on the loan conditions, changing the payment frequency can shorten the loan by up to eight years.

You don’t have to pay every week to save money. You can simply divide the mortgage by 12 and add 1/12 of the amount to the payment each month. So if your regular payment is $1,500 per month, you’ll pay $1,625 each month instead. Some people use tax refunds, performance bonuses and other similar streams to help them pay Year 13.

Which Mortgage Is Better? 15 Vs 30 Year Home Loan Comparison Calculator

Such concessions that arise in mortgages also apply to other types of lending. Other loans typically have a shorter interest accrual period, but they also typically come with a higher interest rate. Cars wear out quickly and unsecured loans have high interest rates to offset the risk of default.

Unfortunately, the transition may not be as easy as writing a check every two weeks. If you have an automatic payment plan, you should check with your lender whether you can cancel or change it. Next, you should find out if the lender accepts bi-weekly payments or if there is a penalty for paying off your loan early.

Some services offer you to set up bi-weekly payments. However, these companies may charge you a fee for the service (up to several hundred dollars), and they may bill you once a month on your behalf (which negates any savings).

Instead, you should make the payment directly to the lender and ensure that it is applied immediately and the surcharge is applied to your principal.

Download Microsoft Excel Mortgage Calculator Spreadsheet: Xlsx Excel Loan Amortization Schedule Template With Extra Payments

If you’re strong-willed, it’s better to pay directly rather than sign up for an automatic payment plan, as it gives you more flexibility in the short term.

Use it

Mortgage calculator to pay off early, pay off mortgage fast, pay off mortgage early calculator, fast way to pay off mortgage, how to pay off debt fast calculator, calculator to pay off mortgage, how to pay your mortgage off fast, how to pay off my mortgage faster calculator, how to pay off mortgage early calculator, heloc to pay off mortgage calculator, pay off calculator mortgage, mortgage calculator how fast to pay off