How Early Can You Get Pre Approved For A Mortgage – One of the most important steps in the home buying process, and usually the first, is obtaining financing. There are several types of mortgages available. Each mortgage product varies from the amount of money needed to the acceptable debt-to-income ratio and everything in between. When buying a home, it’s important for buyers to know for sure what type of mortgage product is best for their needs. There’s even a loan program for cash-strapped buyers!

How do you know which type of loan is best for your situation? The answer is simple, get pre-approved for a mortgage! There are many buyers who do not understand why it is important to get pre-approved. In fact, many of them believe they don’t need a mortgage pre-approval before looking at a home. This is wrong and frankly, one of the main things buyers hate about real estate agents.

How Early Can You Get Pre Approved For A Mortgage

Below are detailed instructions on when to get pre-approved for a mortgage, as well as many reasons why it’s so important to have one before buying a home.

Ultimate Faq:loans Banks Credit, What, How, Why, When

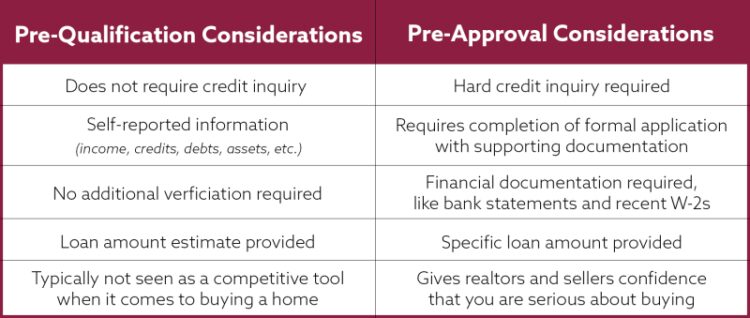

Some people think pre-approval and pre-qualification are the same thing, and some lenders who use the two interchangeably don’t. They are actually very different and it is important to understand the difference when buying a home.

A mortgage pre-approval is when a lender gives a written commitment to a potential borrower. The mortgage pre-approval process is a process where the lender will review your bank statements, last year’s tax returns, verify employment and issue a triple-checked credit report. This process shouldn’t take a lot of time, however, it does take a little more time than pre-qualification, however, the extra time is time well spent.

It is important to understand that once a mortgage pre-approval is approved, there are still some conditions that must be met before the lender will release the funds. The most common situation in a mortgage pre-approval is for the buyer to find a home and do a proper home appraisal. This means that the property in question must be worth whatever the buyer and seller agree on, and there is also no bank settlement. Other mortgage pre-approval requirements may include an acceptable homeowner’s insurance policy, ongoing creditworthiness and, in some cases, depending on financing, proof of an acceptable home inspection.

A mortgage pre-qualification can be described as an estimate of how much a buyer can borrow. In most cases, pre-qualification is comparable to written work only. Many lenders will ask borrowers about their income, debts and other assets and use what they say to qualify them. Some lenders will pull credit reports, but others will not. This can often lead to surprises in the future when the buyer goes to formally apply for a mortgage.

How To Get Pre Approved For A Mortgage

The answer to whether you need a mortgage pre-approval is simple, before you start looking for houses. As mentioned above, many customers do not understand why this is important. Below are a few reasons why you should be glad you got pre-approved for a mortgage before you start your home search!

It’s not unusual for potential buyers to not know their credit score, especially first-time buyers. It is also possible and common for buyers to be unaware of their credit problems. The most common credit problem of potential buyers is the score. Each lender has a minimum credit score requirement for each of their loan products.

Another common credit problem is a buyer’s credit error. Most people don’t monitor their credit reports. It’s very possible that a buyer has a blemish on their credit that isn’t actually their credit problem. The process of removing errors from your credit report may include sending letters to creditors and credit bureaus. Sometimes it can take several months to correct the report and fix the result.

Eliminate Frustration No one likes to be disappointed or let down. The same applies to buying a house. Another reason it’s so important to get pre-approved before viewing a home is that it can eliminate disappointment. Unfortunately, there are many real estate agents who show houses to buyers even though they, or the buyer, cannot afford the house. This is worse customer service than anyone else.

Mortgages Made Easy With Canadian Mortgages Inc

Why does this hurt the customer? The problem is that buyers can fall in love with a home, submit an offer to purchase, and when they talk to a lender, find out they can’t afford the home due to credit issues or other reasons. This can understandably leave customers frustrated, heartbroken and disappointed! All of this can be avoided if you get pre-approved for a mortgage before you look at the house.

There are many costs associated with buying a home. It’s not as easy as a 3% down payment on a house. By getting pre-approved, you’ll have a very good idea of what to expect when buying a home, so there are no surprises. The first thing you’ll learn when buying a home is that everyone has to get a “piece of the pie.” Usually when you buy a house, you have to pay a year’s worth of property taxes, annual home insurance, and various other expenses.

As a result, you get pre-approved to fully understand how much money you need to close on your dream home, who will pay those costs, and why you’re paying those costs.

If you are self-employed or considering an independent contractor, it is very important that you get pre-approved before looking at homes. There are many rules for self-employed workers and those employed by a company. A few years ago, there were lenders that allowed personal buyers to get “no-document” or no-document loans, which allowed the buyer to purchase a home without providing all the documentation the lender required. – gone are the days of “no doc” loans. If you are a self-employed buyer, you must file tax returns for at least 2 years.

How To Prepare For A Bidding War

Does your income depend a lot on commissions? Well, just like self-employed buyers, there are different requirements that lenders will have. Lenders often need to verify 2-3 years of history showing that the amount of commission earned is relatively consistent. Typically, lenders will need 2-3 years of history and an average. For example, if a customer has a sales position and has a three-year history of commissions of $100,000, $200,000, and $150,000, they will likely use an average commission income of $150,000 or less. Lenders want to be sure that the commission income is achievable, year after year, before they approve the loan.

Depending on the real estate market in which you want to buy a house and the time of year, there is a good chance that the house will have multiple offers. Another reason to get pre-approved for a mortgage is the advantage it can give buyers when they are in a multiple offer situation! A pre-approved buyer is more likely to win in a multiple-offer situation than a buyer with only a pre-qualification letter, assuming most other terms in the sales contract are relatively similar.

Any real estate agent who tells you that a pre-qualification letter is just as good as a mortgage pre-approval is either not telling the truth or doesn’t understand the difference! Real estate agents of large sellers will advise their clients that pre-qualified buyers are stronger candidates than pre-qualified buyers.

Recently one of our sellers in Irondequoit, NY had multiple offers on his home. The pre-qualified buyer’s offer is $1,000 less than the pre-qualified buyer’s offer, but sellers choose the pre-qualified buyer’s offer even if they have less money because they believe they are more serious about buying. Homes from pre-qualified buyers! This is a unique situation where this happens, but it happens more often than most buyers realize, which is why pre-approval can be the difference between a win or a loss in a multiple offer situation.

Mortgage 101: What Is Preapproval?

Faster Closing Real estate transactions typically take 60 days to close. The key word is “general”. It’s important to understand when buying a house that contract dates don’t always hit the mark 100% of the time! Pre-qualified buyers will be able to close faster than pre-qualified buyers.

The main reason a faster closing can happen is because most background checks are completed

Get pre approved for a mortgage online, how to get pre approved for mortgage, get pre approved for fha mortgage, how can i get pre approved for a mortgage, get pre-approved for mortgage, pre approved for mortgage, cost to get pre approved for mortgage, how early can you get pre approved for a mortgage, how early to get pre approved for mortgage, how early should i get pre approved for a mortgage, get pre-approved for mortgage online, to get pre approved for mortgage