How Do You Calculate Net Cash Flow – A statement of cash flows (CFS) is a financial statement that summarizes the flow of cash and cash equivalents (CCE) into and out of a company. CFS refers to how well a company manages its cash position, generating cash flow to pay the company’s debts and cover operating expenses. As one of the three main financial statements, the CFS complements the balance sheet and the income statement. In this article, we will explain the structure of CFS and how it can be used to evaluate a company.

A statement of cash flows shows how a company’s business is doing, where its money is coming from, and how that money is being spent. CFS, also known as a statement of cash flows, helps creditors determine how much cash (called liquidity) a company has available to cover operating expenses and pay debts. CFS is equally important to investors as it tells whether a company is financially sound. Therefore, they can use the statement to make better and more informed investment decisions.

How Do You Calculate Net Cash Flow

Business at CFS includes all business-related income and expenses. In other words, it shows how much profit the company’s products or services generate.

Solved Below Are Summary Cash Flow Statements For Three

In the case of a portfolio or investment company, proceeds from the sale of debt, securities or equity instruments are also treated as such.

Changes in cash, liabilities, depreciation, inventory, and liabilities are generally reported as cash from operations.

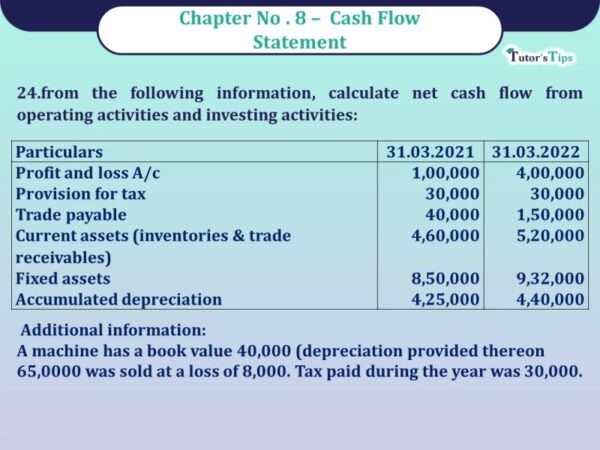

Investment activities include the use of any resources and funds from the company’s investments. Payments related to the purchase or sale of assets, loans to suppliers or customers, or mergers and acquisitions (M&A) fall into this category. In short, changes in assets, real estate or investments are related to investment returns.

Investing in cash flows is often considered a cash flow because the cash is used to purchase short-term assets such as new equipment, buildings, or investments in the market. But when a company disposes of an asset, the sale is considered cash for purposes of calculating investment income.

How To Calculate Cash Flow? Formulas, Calculations, And Example

Income from financing includes sources of income from investors and banks, as well as the way money is paid out to shareholders. This includes all loans, share buybacks, and debt repayments by the company.

Changes in cash flows from funds are the outflows when funds are raised and dividends are paid. So when a company issues a bond to the public, the company receives capital. However, when interest is paid to bondholders, the company will reduce its equity. Note that interest is reported as an operating activity, not a financing activity, even though it is an expense.

Directly summarizes all cash payments and receipts, including cash payments to suppliers, cash payments from customers, and cash payments to employees. This CFS method is suitable for very small businesses that use the cash basis of accounting.

These numbers can also be calculated by checking the opening and closing of various asset and liability accounts and the decrease or increase in the accounts. It is shown in a straight line.

How To Calculate Net Cash Flow For Your Business

Most companies use the billing method. In these cases, revenue is recognized when it is earned, not when it is earned. This creates a difference between net income and net income because not all net income transactions on the income statement relate to actual income. Therefore, some factors need to be reassessed when calculating cash flows from operations.

Indirectly, cash flow is calculated by adjusting net income by adding or subtracting differences arising from non-cash transactions. Non-monetary items arise from changes in a company’s assets and liabilities on the balance sheet from one period to the next. Therefore, the accountant identifies any increases and decreases in asset and liability accounts that must be added or subtracted from the income statement to determine whether income is inflows or outflows.

Changes in accounts receivable (AR) on the balance sheet from one accounting period to another should be reflected in the cash flow statement:

This includes taxes paid, wages paid, and insurance paid in advance. If something is paid, the difference in the amount of tax from year to year must be deducted from income. If money is still owed, any differences will need to be added to all income.

How To Calculate Cash Flow For Your Business

Bad cash flow should not cause alarm without further investigation. Negative cash flow is sometimes caused by a company’s decision to expand its operations over a period of time, which can be a good thing for the future.

Analyzing changes in cash flow from one period to another gives the investor a good idea of how the company is doing and whether the company is in danger of failing or succeeding. CFS should be considered in conjunction with the other two financial statements (see below).

The indirect cash flow method allows you to reconcile two other financial statements: the income statement and the balance sheet.

A statement of cash flows measures a company’s performance over a period of time. But it is not easy to use it for non-cash transactions. As mentioned above, CFS can be derived from the income statement and the balance sheet. In the income statement, net income is a derived representation of CFS data. But they are the only ones that are important in determining the role of CFS. Therefore, net income has nothing to do with the investment or financial aspects of CFS.

How To Analyze A Cash Flow Statement

The income statement includes depreciation expense. It is simply the cost of the asset divided by its useful life. A company may choose a depreciation method that alters the cost shown in the income statement. CFS, on the other hand, is a real measure of input and output that cannot be easily manipulated.

For the balance sheet, the net cash flow reported in the CFS must equal the net change in the various line items reported in the balance sheet. It excludes cash and cash equivalents and non-cash accounts such as depreciation and amortization. For example, if you are calculating income for 2019, make sure you use the 2018 and 2019 pages.

CCIs differ from income statements and vouchers because they do not include future revenues and expenses that are recorded as revenues and expenses.

Thus, revenue does not equal revenue that includes cash sales and credit sales on cash accounts.

Cash Flow From Investing Activities

We can see that the 2017 cash flow from this CFS was $1,522,000. Most of the good cash flow comes from operating cash flows, which is a good sign for investors. A basic job means having enough money to start a business and buy new equipment.

Buying new equipment shows that the company has money to invest. Finally, the company’s cash flow should make it easier for investors to think about the details of payments because there is more money available to cover future expenses.

When using the direct method, actual cash flows and cash flows are known. A statement of cash flows is presented on a straight-line basis using cash payments and revenues.

When using the indirect method, actual cash receipts and expenses may not be known. The indirect method starts with a profit or loss on the income statement and then adjusts the account balance increases and decreases to calculate income and expenses.

Free Cash Flow (fcf) Formula

It’s actually for better or worse. However, the indirect method provides a way to reconcile items on the balance sheet with income on the income statement. When the accountant prepares the CFS using the indirect method, he can determine the increase and decrease in income due to non-cash transactions.

It is useful to see the balance sheet accounts and income statements and their results and relationships and can provide a better understanding of financial statements as a whole.

Cash and cash equivalents are combined into one item on the company’s balance sheet. It represents the value of business assets that are cash now or can be converted to cash in the near future, usually within 90 days. Cash and cash equivalents include cash, petty cash, accounts receivable and other short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with maturities of three months or less.

The statement of cash flows is an important measure of a company’s strength, profitability, and long-term outlook. CFS can help determine whether a company is good enough

How To Calculate Net Cash Flow

How do you calculate operating cash flow, how to calculate net cash flow from financing activities, calculate annual net cash flow, calculate net cash flow, how to calculate cash flow, how do you calculate cash flow from operating activities, how do you calculate discounted cash flow, how do you calculate free cash flow, how to calculate net cash flow, how do you calculate cash flow, calculate net cash flow from operating activities, calculate net operating cash flow