How Can I Pay Off All My Debts – A question often asked by my community is “Should I pay off my debt if I have money in my bank account?”

People like Dave Ramsey say, “Save $1,000 and use the rest to pay down debt. Then move on to baby step 2: Use the debt snowball to pay off all non-mortgage debt.”

How Can I Pay Off All My Debts

:max_bytes(150000):strip_icc()/debt-ratio-74ee2ef7a9a14c50ad59646fe2f3b27a.jpg?strip=all)

My answer is always “It depends because you first need to understand more about money”.

How I’m Paying Off My Law School Debt Year 2

I personally don’t believe there is a one-size-fits-all approach to debt because we are all individuals and our money stories and histories are all different. So before I answer what to do about debt, I want to know the root cause of debt. I first want to know why you are in debt.

Many times, if you find yourself in debt, you’re in trouble. You’ve been using a credit card or loan to pay for expenses you couldn’t and still can’t afford, and now you’re making the minimum payment and still using cash. You don’t have to buy these things, but I hope you owe me some one day.

This prompts me to learn more about your spending habits, budget, and emergency cash. That’s why you should start your relationship with money to find answers.

Tracking your money is important for debt management because it builds self-awareness. When tracking your spending habits, consider your payment methods. Do you use cash, debit or credit card? (If you want to keep track of where your money is going on a daily basis, you can easily use one of my favorite client tools, which you can find here .) If you find yourself using your credit card all the time. Paying off your expenses instead of your debt may only be a temporary solution because you’re not seeing the root of the problem – your spending habits! I recommend that you continue to monitor your spending while focusing on only using cash for purchases. This awareness will benefit you in the long run if you don’t add to your debt and help you save more and spend less.

How We Paid Off $80,000 Of Debt In 6 Years

Do you have a budget? To clarify, I’m not talking about a budget you create in January or the beginning of the month, but a budget you create and never see! What I mean is a budget that you regularly check and review before making or rejecting a purchase. A budget that lets you know how much money you have left to spend on groceries, gas, and branches—more than the balance in your bank account. A budget is a great tool to help you manage your spending habits to help you stay in or get out of debt. So unless you have a budget to stick to, I wouldn’t recommend using your savings to pay down debt. If you pay off your debt but don’t have a budget to actually monitor your spending, you may find yourself in the same situation again.

In 2019, 4 in 10 Americans couldn’t afford a $400 emergency expense without going into debt or borrowing the money from a close friend or family member. As you consider dipping into your savings account to pay off debt, I also encourage you to ask yourself: (1) Will this money serve as my buffer in an emergency? ? (2) If I use savings to pay off debt, how soon can I replenish my savings? By thinking about your emergency preparedness, you are creating a safety net for yourself so that you don’t fall back into debt if an emergency strikes.

My guess is that you may be struggling with your decision. I invite you to choose at least one of the following steps this week to decide how to manage your debt.

If you feel like you’ve tried it all before and still feel like I’m here to help. I want to help you create a plan that will help you maximize your savings and reduce your spending so you can pay off debt and reduce money stress.

How To Organize Your Bills To Get Out Of Debt Quick

This community is designed to encourage and help you have open and honest conversations about money so you can stop wasting your time and finally gain clarity and confidence about your finances. Do you have credit card debt? you are not alone. More than half of U.S. consumers have credit card debt. In the third quarter of 2021, Americans accumulated $17 billion in credit card debt. Some attribute the sharp rise in credit card debt to stimulus payments and extended unemployment benefits. Overreliance on credit cards and credit card debt can place a monthly burden on you and your family. Looking for the best way to pay off credit card debt? Check out these tips:

You may have heard this tip before, but it can make a huge difference in how you pay off your credit card debt. When you only make the minimum payment, your balance will keep growing due to interest. If you have extra cash at the end of the month, applying it to your credit card bill can make a big difference. If you don’t have extra cash, you should consider creating a budget and prioritizing paying off your credit card debt.

If you have debt from more than one credit card, check the interest rates on each card. Any account with the highest interest rate should be your “pay” card. Just like making a payment over the minimum, using this card to make your first payment will help prevent your balance from growing too fast due to interest.

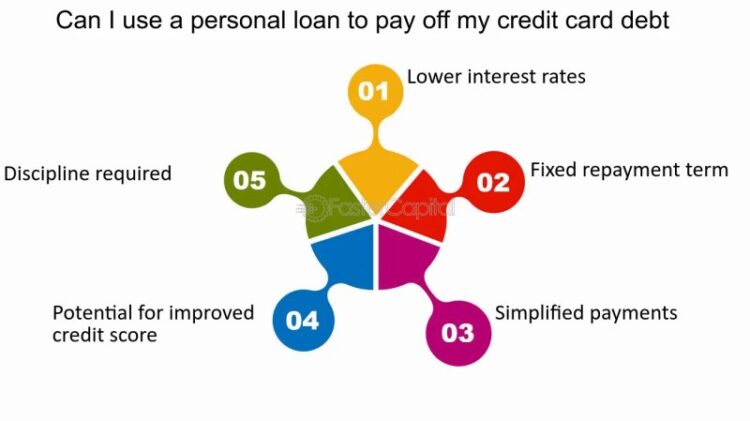

One way to get out of credit card debt quickly is to apply for a personal loan for debt consolidation. When you take out a personal loan to strengthen your credit, you can use the loan proceeds to pay off your credit card balance, leaving you with a debt. Debt consolidation loans are a good option when loan interest rates are lower than credit card rates. Learn more about ways to consolidate debt and compare debt consolidation to debt relief.

How I Paid Off $22,000 Of Credit Card Debt

Getting a new credit card may seem counterintuitive, but it can be one of the best ways to pay off credit card debt. When you get a new card that offers a 0% APR* balance transfer offer, like the PCU Platinum Rewards MasterCard, you can transfer your existing credit card balance and pay no interest during the offer period. This means that any fees you pay will go toward paying down the principal. This goes a long way toward paying off debt faster! If you’re looking for a rewards credit card in Nanuet, New Town, or Orangeburg, the Palisades CU Rewards Mastercard could be a great choice for you! Learn more about the benefits of shopping with the Palisades CU Credit Card.

If you have questions about paying off your credit card debt or would like to learn more about our 0% APR* balance transfer offer, contact us today! Palisades serves community members in Rockland County, NY, and Bergen County, NJ. View current credit card rates in Nanuet, Orangeburg, and Newtown.

Share: Share on Facebook: How to pay off credit card debt faster? Share on Twitter: How to pay off credit card debt faster? I’m going to tell you when I paid off a large credit card I’d had for a long time and how I did it. But fair warning: this is not financial advice. This is just one account of how I paid off my massive credit card debt.

.png?strip=all)

It took me 11 years to pay it off. 11 years. So you can imagine my relief when I recently realized I could pay off the remaining balance and not worry about it anymore.

My Friends And I Are All In The Same Financial Boat—making “grown Up” Money, But Struggling To Pay Off Debt

But it’s more than just a feeling of relief. It’s also a deep sense of accomplishment. Month after month I went from “I’m definitely going to pay this off” to “I can’t believe it’s over.”

Without getting into specifics about the amount, suffice it to say that this is far more than the current average American credit card debt of $9,000. Start with a relatively small loan, maybe just a few thousand dollars. The result of financial hardship. We all sat there. I thought I could still pay off the loan. But one day I found that the loan interest increased

How can i pay all my debts at once, how can i pay my debts off quickly, how to pay off my debts, how to pay off debts, how can i pay my debts, pay my debts off, pay off all my debts, how can i pay all my debts, how can i pay off all my debts, how can i pay off my debts faster, how can i pay my debts off, pay all debts off