- Home Equity Loan To Pay Off Student Loan

- Nobody At Work Wants To Hear About Your Student Loan Payments

- The Process Of Making Your Final Student Loan Payment

- When It Makes Sense To Use A Heloc For Your Student Loans

- Should You Use A Home Equity Loan To Pay Off Debt?

- Should I Pay Off Student Loans With A Home Equity Loan?

- What Is A Home Equity Loan And How Does It Work?

- Should You Pay Off Your Student Loans Or Start Investing?

Home Equity Loan To Pay Off Student Loan – Millions of Americans constantly struggle to pay off their student loans. What if your most valuable financial asset – home equity – is aggressively used to pay off your student loans?

Turns out, you can do anything. Let’s take a look at how to use home equity to pay off student loans.

Home Equity Loan To Pay Off Student Loan

The more principal you pay on your mortgage, the more you own your property. You build equity in your property by paying this principal amount. In other words, your equity is the difference between the value of your home and the amount you owe on your mortgage (plus any other liens). This capital can be used as a financial instrument like security for various loans.

Nobody At Work Wants To Hear About Your Student Loan Payments

However, you can use your home equity by “paying off” your student loans and then putting the money directly into your student loans.

Your current mortgage. In other words, it is worth more than the remaining principal of the mortgage. You pay off your current mortgage with a higher balance refinance, then use the difference to pay off your student loans.

Imagine you own a home worth $300,000. The remaining principal on the mortgage is $200,000. Meanwhile, you have $40,000 in student loans.

If you refinance your $250,000 student loan, you can pay off the remaining mortgage balance, pay off your student loan and still have $10,000 left over.

The Process Of Making Your Final Student Loan Payment

In many cases this may be the case. You may want to consider using your home equity to pay off your student loans if the following apply to you:

Remember that if you agree to any type of refinancing, the loan period begins. Depending on the loan term you choose, you can go back up to 30 years.

You don’t have to use cash out refinancing for student loans. You can access your home equity and pay off your student loans by:

Home ownership with a balance can be a great way to use your home equity to pay off your student loans.

Should You Use A Home Equity Loan To Pay Off Vehicle Debt?

When you contact Balance, we will review your home equity and, depending on the state and market, we may decide to invest the equity in the property. This means we become co-owners of your property.

After replacing a mortgage loan with an equity investment, homeowners take home an average of $50,000, which could be the amount they need to pay off their student loans. Moreover, you do not violate the ownership status of the house. You remain the owner of the house and do not have to move.

Instead of a mortgage, you pay a monthly fee on the balance, which covers your occupation and a portion of your insurance and taxes.

We always invest in your property for the long term. Balance has helped many people struggling with student and other debt burdens – all without taking the same risks as other ways to access home equity.

Home Equity Loan Vs. Mortgage: What’s The Difference?

Overall, using home equity to pay off student loans can be a smart idea, especially if you work with the balance. Unlike other options for accessing capital, a balance allows you to stay in your home, prevents foreclosure risk, and maximizes your disposable income to pay off as many student loans as possible. At Credible Operations, Inc., NMLS 1681276, below “Credible,” our goal is to give you the tools and confidence you need to improve your finances. Although we promote the products of our partner lenders who compensate us for our services, all opinions are our own.

A home equity loan allows you to borrow a lump sum of cash relative to the value of your home and repay it in fixed monthly installments. (Sutterstock)

A home equity loan allows you to take out a lump sum loan when the value of your home is greater than your mortgage loan. Like a first mortgage, you repay your home loan at a fixed interest rate over 10 to 30 years.

Here’s an overview of how home equity loans work, the typical costs associated with them, and the requirements you must meet to qualify for them.

When It Makes Sense To Use A Heloc For Your Student Loans

Credible doesn’t offer home loans, but you can compare pre-qualified mortgage refinance rates from multiple lenders in minutes.

A home equity loan allows you to borrow for a percentage of your equity, which is the difference between the market value of your home and the balance on any home equity loan you already have. You can take a home loan when you need a one-time amount to cover a large expense.

A home equity loan is a type of second mortgage, and involves the risk of taking out a second mortgage. First, your home will act as security for your home equity loan. If you are unable to repay the loan, you may lose your home. Your home also insures the first mortgage loan you used to purchase the home. If you take out a home loan in addition to your first mortgage, you will have two loans secured by your home, which increases your risk.

Increasing your monthly home loan payments will also tighten your budget. If your income drops, it may be more difficult to make your monthly housing payments than if you had a first mortgage or no mortgage at all.

Home Equity Loan, Heloc Or Cash Out Refinance. What’s Best?

A home equity loan, like a cash-out refinance, allows you to borrow against available equity. After your loan closes, you have three days to cancel your loan if you change your mind. After these three business days, your lender will deposit the lump sum amount you chose to borrow into your bank account.

What you do next is entirely up to you. You can build a heated swimming pool, replace a damaged roof, decorate your garden or pay off all your credit cards. You can finance your wedding, make a down payment on an investment property, or send your child to college.

How much you can borrow with a home loan depends on the amount of equity in your home, credit history, income and existing debt. The more home equity you have, the better your credit history, the higher your income, and the lower your debt, the more you’ll be able to borrow and the better your interest rate.

For example, if your home is worth $400,000 and your first mortgage is $150,000, your equity is $250,000.

Should You Use A Home Equity Loan To Pay Off Debt?

Lenders often allow you to borrow up to 80% of the home’s value, or $320,000 for a $400,000 home. Your combined loan-to-value (CLTV) ratio is the sum of your first mortgage and the home loan you want to continue with. After subtracting the $150,000 first mortgage from $320,000, you have $170,000 of available equity to borrow.

The cost of taking out a home loan varies depending on the lender, but here are the costs you can expect:

Some lenders will waive all or part of your home loan closing costs in order to make money from your business. However, if you refinance or pay off the loan within three years of closing, you may have to pay some of these costs back to the lender.

You won’t find a home loan on Credible, but if you’re looking for a good mortgage refinance rate, you can compare rates from multiple lenders.

Should I Pay Off Student Loans With A Home Equity Loan?

Every financial product has its advantages and disadvantages. Here’s what you need to know about the pros and cons of home loans:

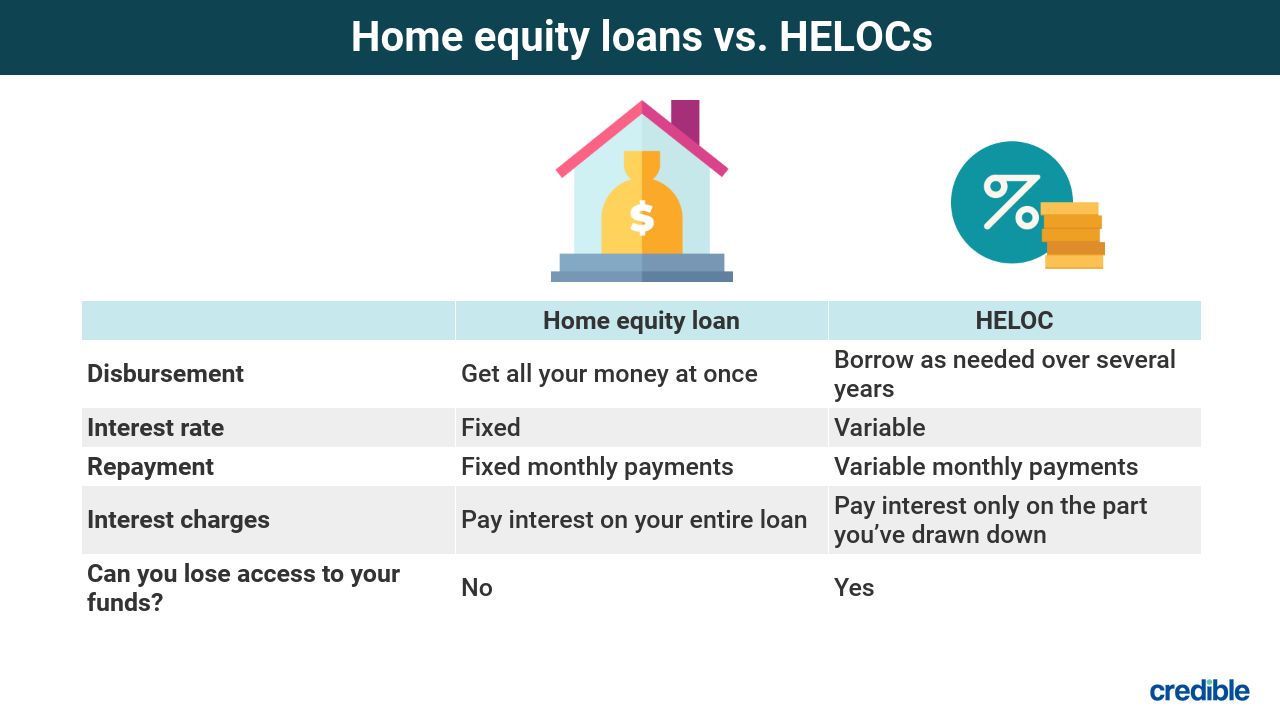

Home equity loans and home equity lines are types of second mortgages, but they work differently and meet different requirements.

A home equity line of credit, or HELOC, gives you access to a set amount of money that you can borrow as needed until you reach your credit limit. The term of the loan starts with a draw period, which usually lasts for 10 years, followed by a repayment period, which usually lasts for another 10 to 20 years. You can gradually renovate your home over time using your HELOC.

During the HELOC draw period, you can borrow against your line and make repayments at your discretion. Once the drawing period ends, you can no longer borrow under the line of credit.

What Is A Home Equity Loan And How Does It Work?

The interest rate varies throughout the collection and repayment period. However, some lenders will allow you to lock in the interest rate on some or all of the money you borrow from a home loan, such as a HELOC.

Depending on your needs, one loan may be more suitable for you than another. Here is a comparison of both models:

You will need to submit a statement of your income, assets and liabilities and support this with information from your account statements and tax returns.

If you decide that refinancing better suits your financial goals, you can compare mortgage refinance rates from multiple lenders in minutes using Credible’s tool. A cash-out refinance pays off your old mortgage in exchange for a new mortgage, preferably with a lower interest rate. A home equity loan

Should You Pay Off Your Student Loans Or Start Investing?

Personal loan to pay off student loans, best way to pay off home equity loan, loan to pay off student loan, home equity to pay off student loans, student loan to pay off credit card, private loan to pay off student loan, home equity loan to pay off student loans, home equity loan to pay off debt, home equity loan to pay off student loan, pay off home equity loan, home equity line of credit to pay off student loan, home equity loan to pay off mortgage