Home Equity Loan For Credit Card Debt – The Covid-19 pandemic has changed everyone’s life. Whether you’ve lost your job and need help getting your job done or need to renovate your home to add office space, borrowing money from your home can be an affordable and flexible way to get financing. In addition, home prices are historically low and rising demand has driven home prices higher. In this article, we’ll explain the difference between a mortgage and a line of credit and help you choose the best option to meet your needs and goals.

Also known as a second home loan, a home equity loan is secured by the equity in your home. Your value is the difference between your mortgage and the market value of your home. In most cases, you can borrow up to 80% of the value of your home, so you need to have enough cash to qualify. At Palisades Credit Union, members can borrow up to 100% of their home equity.

Home Equity Loan For Credit Card Debt

Mortgages usually come with a fixed interest rate and are long-term loans, meaning you get more money as you close and repay the loan, plus interest on your monthly payments over a period of time. Default.

When Does It Make Sense To Use Your Home’s Equity In Charlotte Nc

Applying for a home loan is similar to the process you went through to get your first mortgage. Here are the steps:

Often called a HELOC home equity line of credit, this is a flexible line of credit that is guaranteed by the equity in your home. HELOCs come with adjustable interest rates and operate like a credit card: you get a certain credit limit and can withdraw and repay as needed. You can link your HELOC to your checking account.

HELOCs usually come with a drawdown period of about 10 years, after which the entire balance is converted to a long-term loan. First account closure may result in penalty.

At Palisades Credit Union, we offer special offers on our HELOCs. Enjoy 1.99% APR* for the first 6 months!

Home Equity Loan Or Heloc Requirements 2023

Applying for a HELOC is a slightly different process than a home loan. Here’s what you need to know:

The main difference between a mortgage and a HELOC is how you finance your home and how your monthly payments are calculated.

Earn full interest on your mortgage by making payments at a fixed interest rate. Make monthly payments for a certain number of years until the loan is repaid.

Access your equity through a line of credit on a revolving line of credit. Pay what you want, when you want, and make monthly payments that can vary depending on how much you borrow and how the interest rate changes.

Home Equity Loan & Cashout Refinancing In Singapore (2023)

When choosing between a mortgage and a mortgage, the main question is whether you are going to use your own mortgage or your own mortgage. Take a look at some examples that will help you decide.

On the other hand, fixed interest payments and mortgages provide stability that can be beneficial…

As you can see, there is a difference between the two. Overall, a HELOC is good if you don’t know how much you’ll borrow or if you want to make larger payments over time. Best home equity loan if you already know how much you need and you have a large source of income right now. Here are some things you can do with a HELOC:

As mentioned earlier, Palisades CU members can borrow up to 100% of their home equity (the difference between what your home is worth and what your home can sell for). For example, let’s say your home is worth $200,000 and you currently own $125,000 in stock. This means you have $75,000 in stock and will be eligible to borrow up to $75,000 with a home equity loan. Or a HELOC from Palisades. You don’t have to borrow all the money if you don’t want to or need more money.

What Is A Home Equity Loan?

Are you ready to use your savings to renovate your home and help pay for your child’s tuition? In college and more? Contact our experienced real estate lenders in Nanuet, Orangeburg or New City with questions about home equity and loan options or apply online today! We are here to help you understand all the ways to earn money from home. View home loan rates in Rockland and Bergen County.

Share: Share on Facebook: Difference Between Home Equity Loan and Home Equity Line of Credit On Twitter: Difference Between Home Equity Loan and Home Equity Line of Credit Owning a home is a process. Many homebuyers don’t have a down payment on their home, so they have to take out a mortgage and make payments for years before they can claim ownership. All these payments help create a bond that is a fraction of the total cost of the home the buyer owns. This relationship is an asset.

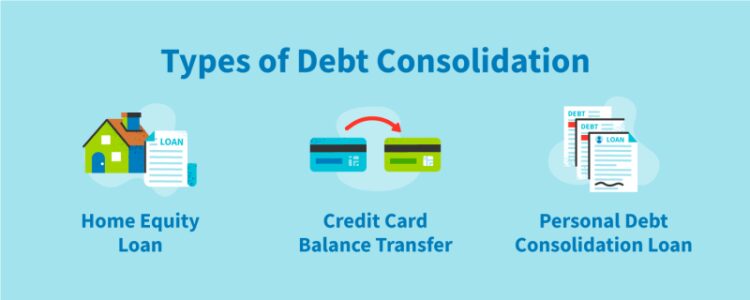

A home equity loan is a secured loan in which the collateral is money made by the home buyer over time. Mortgages are often taken out for home improvements or to solve financial problems. They can also be used for debt consolidation. In this article we’ll explain how it works and whether it’s a good idea or not.

Include loans and low interest rates. Credit card interest rates are high. Mortgage rates are generally lower because they are more secure than other types of loans and are tax deductible. This makes this type of loan a great option for combining high-interest credit card debt and expense management.

How To Get Approved For A Home Equity Loan Or Heloc

There are benefits, but it’s also important to understand the risks. Renting your home puts you at risk of foreclosure if you don’t pay. Good financial planning should be done before any attempt to get a home loan. An unsecured loan can be a good option despite the high interest rates.

Another benefit of a home equity loan is that property prices can depreciate throughout the term of the loan. This causes the homeowner to “get on their knees” and owe more than the home is worth. Installments can span ten years or more, allowing property prices to fluctuate. Check market indicators before you act to see if they should go up.

Interest rates on mortgages are lower than other types of debt, such as credit cards. This is because a home loan is a secured loan, which means you are giving collateral to the borrower.

Mortgages have longer repayment periods than other types of loans, so your monthly payments can be reduced.

Loan Color Icons Set. Student Loan. Borrowing From Retirement. Personal Creditworthiness. Heavy Credit Card Debt. Home Equity Loan. Retail, Consumeris Stock Vector Image & Art

Instead of worrying about deadlines and paying off multiple loans, you should worry about making monthly payments.

Your interest may be tax-deductible if your loan is used to improve the value of your home, for example, building an addition or renovating a kitchen. Whatever credit is used will not be deducted.

Because you are mortgaging your home, you have less risk of defaulting on your mortgage and you don’t need a high credit score to qualify. However, higher interest rates often allow for better interest rates.

Your home will be used as collateral for the loan. If you miss payments, your home can be foreclosed on.

Tips To Aggressively Pay Down Your Debt — Intrepid Eagle Finance

If the value of your home drops and you suddenly have a lot of debt on your home, you may have to sell your property to the bank.

It can take 30 days or more to get your mortgage, so if you’re in a rush to consolidate this may not be the best option for you.

The biggest disadvantage of a home equity loan is that you only add to your credit. If you find yourself overburdened and unable to pay your mortgage, you could end up losing money.

Get compensation from lenders and other providers of the various products available on this site. Compensation does not affect a buyer’s ‘match points’, but it can affect how ads are placed. The ‘Match Points’ calculation shown by the listing is based on the buyer’s income and the lender’s and/or product’s match with the offer. To maintain transparency, any product ranking based on payment is called “promotion” or “support”. Read all our posts to learn more about what we recommend and evaluate and how we make money.

Home Equity Loan For Debt Consolidation?

You can get a home equity loan if you have credit on your mortgage, although in some cases you can get a home equity loan as soon as you buy your home. It depends on how you can borrow

Credit for home equity loan, home equity loan debt to income, loan for credit card debt, home equity loan credit, home equity loan to pay off debt with bad credit, home equity loan for debt consolidation, home equity loan credit card, home equity loan debt, home equity loan to pay off debt, home equity loan to pay off credit card debt, debt consolidation loan home equity, home equity loan to pay credit card debt