Home Equity Line Of Credit To Pay Off Mortgage Calculator – Thinking of taking a home loan? Here are five things you should know before proceeding.

It is important to consider your financial needs, and when and how you will use the money, to decide which option is best for you.

Home Equity Line Of Credit To Pay Off Mortgage Calculator

Both of these options have closing costs, but they are lower than what you would find with a first mortgage loan product.

Home Equity Line Of Credit (heloc) For Home Renovations

Equity is the portion of the home you own versus what you owe the lender. In other words, if your home is worth $150,000 and you owe $100,000, you have $50,000 in equity (or 33%). This means you still owe 67% of the home’s value

Home equity loans are designed to meet major expenses. Generally, the minimum loan amount for home equity loans is $10,000. So, if you don’t need that much money, you can choose another option like a personal term loan. Another consideration is getting a $10,000 HELOC and borrowing only what you need.

However, if you plan to use only a portion of the line, it’s important to remember that you must have 20% equity in your home that exceeds the total credit limit.

Do not forget that these options are considered a type of mortgage. A loan is classified and treated by the lender as a loan with interest on the property securing the loan. As with all mortgages, there are pros and cons for the borrower.

Home Equity Loan, Heloc Or Cash Out Refinance. What’s Best?

Before entering into an agreement for any loan, especially if your home is collateral, it is important to determine your overall financial picture, including your spending habits!

Let’s look at the total amount of debt you pay per month for the amount of income you earn. This will give you a good indication of whether you can comfortably afford the extra payment.

Budgeting to pay off a foreclosed home equity loan is simple. You will receive the payment amount you paid in due time. For a HELOC, you must pay 1.5% of the outstanding balance each month. As discussed earlier this may vary depending on the amount actually borrowed.

Home equity loans are one of the many options that can help you meet your financial needs and goals. Our best advice is to thoroughly research and understand all of your options to determine the best course of action for you. Our mortgage team are always happy to review and discuss your options so you can be sure you’re making the best decision with your money now and in the long term! The COVID-19 pandemic has been a life-changing experience for everyone. Whether you’ve lost your job and need help making ends meet or you want to renovate your home to include a home office, borrowing against your home equity is a flexible and affordable financing option. Additionally, rates are historically low and home values have risen in response to increased demand. In this article, we’ll explain the differences between home equity loans and lines of credit and help you choose the best option that fits your needs and goals.

Heloc Do’s And Don’ts: A Step By Step Guide To Home Equity Lines Of Credit

Also known as a second mortgage, a home equity loan is secured by the equity in your home. Your equity is the difference between your current mortgage balance and the market value of your home. Generally, you can borrow up to 80% of the value of your home, so you need to have a fair amount of equity to qualify. At Palisades Credit Union, members can qualify to borrow up to 100% of their home equity.

Home equity loans usually come with a fixed mortgage interest rate and are term loans, which means you receive a lump sum after closing the loan and repay it in predictable monthly payments over a predetermined period of time.

Applying for a home equity loan is similar to the process you followed to get your first mortgage. Here are the steps:

Often referred to by the acronym HELOC, a home equity loan is a flexible, revolving loan secured by the equity in your home. HELOCs come with a variable interest rate and work like a credit card: You get a set credit limit from which you can withdraw, make payments, and withdraw as needed. You can link your HELOC to your checking account, making transfers easier.

Pay Off Your Tax Debt With A Home Equity Line Of Credit (heloc)

Typically, a HELOC comes with a fixed draw period of 10 years, after which any remaining balance is converted into a term loan. Penalties may apply for early account closure.

At Palisades Credit Union, we offer a special introductory rate on our HELOCs. Enjoy 1.99% APR* for the first 6 months!

Applying for a HELOC is a slightly different process than a home equity loan. Here’s what you need to know:

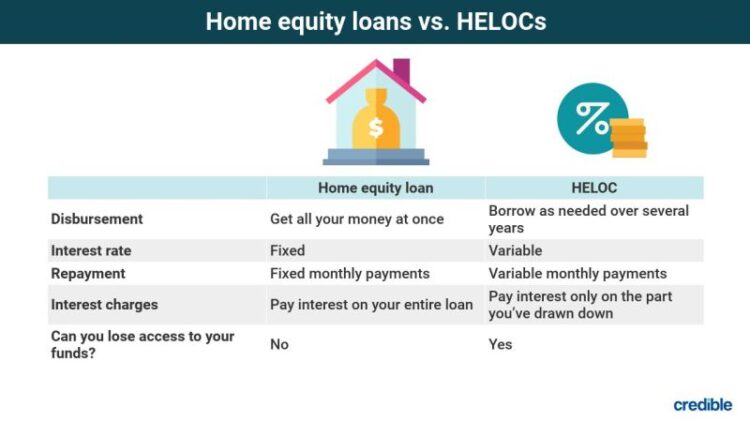

The biggest difference between a home equity loan and a HELOC is how you approach your home equity and calculate monthly payments.

Paying Off A Home Equity Loan Or Line Of Credit

Get the full equity you borrow in one down payment with a fixed interest rate. Make monthly payments for a specified number of years until the loan is paid off.

You can access your equity through a revolving credit loan. Borrow what you want, when you want, and make monthly payments that fluctuate based on how much you borrow and how the interest rate fluctuates.

When choosing between a home equity loan and a home equity loan, the big question is what you will use your loan or line of credit for. Let’s look at some example scenarios to help you decide

On the other hand, the lump sum payment and fixed interest rate with a home equity loan offers some stability which can be advantageous.

What Is A Home Equity Loan And How Does It Work?

As you can see, there is some overlap between the two. Generally, a HELOC is best when you don’t know how much you need to borrow or when you need to finance multiple expenses over a period of time. A home equity loan is ideal when you already know the amount of money you need and now have significant expenses to finance. Here are some other things you can do with a HELOC.

As mentioned earlier, Palisades CU members are eligible to borrow up to 100% of their home equity (the difference between what you owe on your mortgage and what your home can sell for). For example, let’s say your home is worth $200,000 and you currently have a mortgage balance of $125,000. This means you have $75,000 in equity and are eligible to borrow up to $75,000 with a home equity loan or HELOC from Palisades. You don’t need to borrow the entire amount if you don’t need or want the amount.

Are you ready to use your equity to renovate your home, help pay for your child’s college, and more? Contact our experienced home equity lenders in Nanute, Orangeburg or New City with questions about home equity loans and lines of credit or apply online today! We are here to help you understand all your home financing options. See current loan rates in Rockland and Bergen County.

Share: Share on Facebook: Difference Between Home Equity Loans and Home Equity Loans Share on Twitter: Difference Between Home Equity Loans and Home Equity Loans Home equity loans and home equity loans (HELOCs) are loans secured against the borrower. at home A borrower can get a title loan or an equity loan if they have equity in their home. Equity is the difference between what is owed on the mortgage loan and the home’s current market value. In other words, if a borrower pays off their mortgage loan and the home’s value exceeds the unpaid loan balance, the homeowner can borrow a percentage of the difference, or equity, usually up to 85% of the borrower’s equity.

Home Equity Loan Vs. Line Of Credit Vs. Home Improvement Loan

Because home equity loans and HELOC loans use your home as collateral, they often have better interest rates than personal loans, credit cards and other unsecured loans. This makes both options very attractive. However, consumers should be careful when using both. Accumulating credit card debt can cost you thousands in interest if you can’t pay it off, and defaulting on a HELOC or home equity loan can cost you your home.

A home equity loan (HELOC) is a type of second mortgage similar to a home equity loan. However, a HELOC is not a lump sum. It works like a credit card, it can be used over and over again and can be repaid in monthly payments. It is a secured loan where the account holder’s house acts as collateral.

Home equity loans provide a lump sum to the borrower, and in exchange, they must make fixed payments throughout the loan period. Home equity loans also have fixed interest rates. In contrast, HELOCs

Equity to pay off mortgage, using home equity to pay off mortgage, rocket mortgage home equity line of credit, home equity line of credit to pay mortgage, home equity loan to pay off mortgage, home equity line of credit pay off mortgage, can i use a home equity line of credit to pay off my mortgage, using home equity line of credit to pay off mortgage, home equity line of credit to pay off mortgage, mortgage calculator home equity line of credit, home equity pay off calculator, pay off home equity line of credit