- Grants For Home Buyers With Low Income

- Homeownership Programs And Housing Counseling: A Positive Partnership

- Clark County Program Helps Homebuyers Get Down Payments

- Budget 2023: How An Additional 30k Grant Can Impact The First Home Buying Journey Of An Average Couple

- What You Need To Know Before Getting A Home Loan

Grants For Home Buyers With Low Income – Which HDB flats can you buy individually in Singapore? Here’s a comprehensive list of housing and grant programs available to you!

The Housing and Development Board (HDB), a statutory body under the Ministry of National Development (MND), is Singapore’s housing authority and is responsible for planning and developing affordable public housing for Singaporeans. HDB was established on 1 February 1960 and has since built more than 1 million houses, covering 80% of the country’s population.

Grants For Home Buyers With Low Income

HDB currently offers 99 residential rental options in Singapore including Build to Order (BTO), Design, Build and Sell Scheme (DBSS) and Executive Apartments (EC) to suit different housing needs and budgets.

How The Grant Process Works

HDB announced a series of new measures in September to help first-time home buyers buy and resell new homes. The following measures have been implemented with effect from 11 September 2019:

The maximum household income for eligible first-time HDB flat buyers aged 35 and above will increase from $6,000 to $7,000. Eligible singles can buy or resell new flexible two-bedroom flats. up to 5 beds) and living allowance for singles in the free market.

If you are currently single, your next step is to get your own HDB flat. Finally, you can avoid your parents’ questions. Or you can step up another ladder on the #adultladder.

HDB will also increase the monthly income of households buying or reselling a new HDB flat for the first time from $12,000 to $14,000.

First Time Home Buyer? California Gives 0% Down Payment Loan

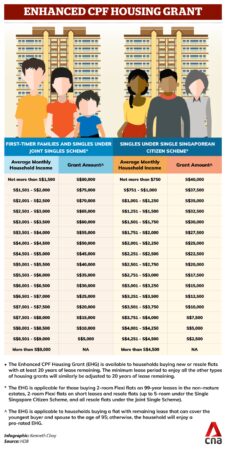

EHG replaces two previous schemes, Additional Housing Benefit and Private Housing Benefit. The EHG grant depends on your income. The less you earn, the higher the subsidy. Under the Singapore Citizen Individual Scheme, the EHG amount for first-time home buyers through new or resale is US$40,000 (the maximum eligible household income has been increased to US$4,500) and US$80,000 for Tier 1 households. People who buy new or resell homes together (eligible household income up to $9,000);

To qualify for EHG, applicants or their spouses must have worked continuously for at least 12 months, similar to other HDB schemes that include the private housing allowance.

They must also buy houses that they can call home until they are 95 years old (as per HDB’s maximum 99-year lease). Those whose homes do not meet this requirement will receive support to cover them for the remainder of the rental period of the home.

First of all, you must be a Singapore citizen and apply as a single or divorced person who is at least 35 years old. The only exception is if you are an orphan without a sibling, you can apply for your own residence at 21 under the orphan scheme.

Homeownership Programs And Housing Counseling: A Positive Partnership

Unrelated single citizens aged 35 and above can also apply for HDB flats together so that 4 people can share a flat in the joint singles scheme.

Other eligibility requirements include the National Integration Policy (EIP) and the Singapore Permanent Resident (SPR) Standard (used to promote and maintain social cohesion). However, this may affect where you live rather than preventing your eligibility to apply.

As an individual buyer, you have 2 options when it comes to HDB flats: a flexible 2-room HDB BTO flat in an immature house or an HDB resale flat. The table below shows the pros and cons of both options.

The biggest advantage of buying a BTO flat is the financial one – BTO prices are significantly cheaper than in the resale market. However, even with a small number of applicants, singles are limited to flexible 2-bedroom units* on undeveloped properties.

Clark County Program Helps Homebuyers Get Down Payments

There is 1 bedroom and 1 living room and the total floor area of such units varies between 35 square meters and 49 square meters.

Obviously, a 2 bedroom flat is small, but if you apply under the BTO scheme, you will get a brand new flat which you can renovate to suit your needs. For example, the current 36 square meter model has a sliding partition instead of a solid wall, allowing you to realize an open-plan room.

In the November 2020 HDB BTO exercise, there were 2,564 applications for 2-bedroom Flexi units (2.6 applicants per unit) and 23,691 applications for 3-bedroom units and above (4.9 applicants per unit).

But be careful with the waiting time. Even if you are lucky enough to get the HDB BTO ballot, you will have to wait 3 to 4 years for your flat to be built before you can move in.

Budget 2023: How An Additional 30k Grant Can Impact The First Home Buying Journey Of An Average Couple

Tip: When talking about HDB flats, always subtract 1 from the name to determine how many bedrooms you will have. So a 3 bedroom house has 2 bedrooms + 1 living room, a 4 bedroom house has 3 bedrooms + 1 living room, etc. Means.

If you are not interested in voting (reserving) a flexible HDB BTO 2 bedroom unit, you can try looking for a suitable flat in the resale market. Singles can buy any HDB sale they can afford, either alone or jointly.

The main downside to buying a resale home is the cost. Now, the smallest resale HDB you can buy for the next 30 years will probably be a 3 bedroom house. .

Thanks to the government’s cooling measures, fixed HDB prices have been steadily declining. This makes resale homes affordable for most buyers. However, you should expect to pay around $238,000 to $407,000 for a 3-bedroom HDB retail unit.

What You Need To Know Before Getting A Home Loan

If the lease on your resale home is less than 60 years, the amount you can repay your loan is limited. The latest update from May 2019 shows an estimate of how much you should pay for your home based on whether the youngest home owner could afford the rent until age 95.

This means you’ll have to pay more cash out of pocket as your mortgage matures. Keep this in mind when planning your finances.

The latest update from May 2019 states that you can only finance your property if its rent can be afforded by the youngest buyer aged 95. If these criteria are not met, the utilization rate will be assessed.

This means that the lease should preferably cover the youngest buyer up to the age of 95. The buyer can pay for the property up to the appraisal limit if they meet the criteria. Otherwise, the usage rate is evaluated. It cannot be used if the remaining lease term is less than 20 years

Op Ed: Instead Of Rent Vouchers, Give People A Shot At Owning A Home

Once you find and buy your HDB resale flat, you may need to carry out some major renovations. Anecdotal evidence suggests you can expect to pay $30,000 for a 3-bedroom, $40,000 for a 4-bedroom and $50,000 for a 5-bedroom.

As a single homeowner, you will undoubtedly find a used home more valuable. However, a resale property gives you a financial advantage that a 2 bedroom BTO cannot.

If you don’t need the extra room, you can rent it out and earn extra income. Of course, there are pros and cons to sharing your home with a renter, but don’t underestimate the financial potential of renting.

Owning your own property in Singapore is a big decision because of the big investment. Whether you’re getting a 35-year flat through an individual scheme or a shared singles scheme, it’s important to check the eligibility criteria for each scheme.

Tsahc Dpa Mortgage Program For Texas Homebuyers

By knowing about these grants and loans you can apply for, you can find ways to lower the cost of buying your own home and enjoy the freedom that home ownership offers. If you thought COVID would cause a recession. Houses are cheaper, think again. After a brief dip in the second quarter of 2020, median home sales prices in the US rose to their highest level on record.

St. The third-quarter figure was $387,000, according to the Federal Reserve Bank of St. this was the highest average since the same period in 2018.

It keeps renters away in an economy that has been stabilized by stimulus checks and eviction moratoriums, which is encouraging news for landlords, but not so much for others. This is still a seller’s market.

It raises the question of how you can afford a house if you belong to the low income group. “Low income” shouldn’t have a stigma, and it’s not the same as bad credit – which is good news, because credit can be an important part of getting a mortgage.

Down Payment And Mortgage Assistance Programs For Illinois Homebuyers

As we’ve seen, different types of loans require different loan limits, and there are a variety of opportunities for potential homebuyers with low future gross income but good credit to purchase a home. There are even ways to buy a foreclosed home.

There

Grants for low income first time home buyers, grants for home buyers, dental grants for low income, grants for new home buyers, government grants for low income home repair, home grants for low income families, free grants for home buyers, low income home buyers, car grants for low income, government grants for low income first time home buyers, grants for low income home buyers, home grants for low income