Government Loan For First Time Home Buyers – Wondering which HDB flats to buy in Singapore? Here is a list of the types of housing and grants you can get!

The Housing and Development Board (HDB) is a statutory body under the Ministry of National Development (MND). It is Singapore’s housing authority responsible for planning and developing affordable public housing for Singaporeans. HDB was established on February 1, 1960 and since then has built more than 1 million homes, representing 80% of the country’s population.

Government Loan For First Time Home Buyers

HDB currently offers Singaporeans three 99-year residential rental options: Build to Order (BTO), Design, Build and Sell (DBSS) and Executive Condominiums (EC) to suit their needs, housing needs and budgets. different

New Housing Rebate

HDB announced several new measures in September. To help first time homeowners buy new homes and resell. From 11 September 2019 onwards, the following measures are in place:

The monthly household income ceiling for first-time single HDB flat buyers and those aged 35 years and over will increase from $6,000 to $7,000. Eligible singles can choose to buy a new two-bedroom home or a home for sale (up to 5 houses) – rooms) with housing benefits only in the open market.

That’s good news if you’re single. And your next success is having your own HDB flat. You can finally avoid pointed questions from your parents. Or you could be kicked down another rung on the #adulthood ladder.

HDB will also increase the monthly household income ceiling for families buying a new or resale HDB home for the first time from $12,000 to $14,000.

Types Of Home Loans For All Home Buyers

EHG replaces two previous schemes: Additional Housing Benefit. and special housing allowance The amount of your EHG subsidy is linked to your income level. The less income you have The higher the subsidy, the EHG amount for unmarried first-time homebuyers or resellers under the Singapore Citizens Innovation Scheme will be up to $40,000 (eligible household income limit increased to $40,000). $4,500) and up to $80,000 for first-time families or single people buying new or/jointly House for resale (The income limit for eligible families increases to $9,000.)

To qualify for EHG, the applicant or spouse must have worked continuously for at least 12 months, as with other HDB schemes including Private Housing Grants.

They should purchase a home that they can call home until they reach the age of 95 (on HDB leases, capped at 99). Those whose homes do not meet these requirements will receive a proportional subsidy depending on the extent. that the residential lease agreement can cover up to that age

First, you must be a Singaporean citizen. who are at least 35 years old to be able to apply to be single or divorced The only exception is if you are an orphan with no siblings. You can apply for your own home at age 21 as per your parents’ policy.

Ultimate Faq:find Loan Lenders, What, How, Why, When

Single, unrelated citizens aged 35 and over can apply for a joint HDB flat, and up to four such people can own a flat under the Singles Joint Scheme.

Other eligibility criteria include the ethnic integration quota (EIP) and Singapore permanent residence (SPR) (used to promote and maintain social cohesion). However, this is likely to have an impact on home location. yours Instead it impedes your right to apply.

As a private buyer, you have two options when it comes to HDB flats: a flexible 2-room HDB BTO flat in a prime estate or a resale HDB flat. The table below quickly summarizes the pros and cons of both options.

The biggest benefit of buying a BTO home is financial – BTO is much cheaper than the resale market, however single people will be limited to a 2 bedroom flat* in a detached home, even if there are multiple applicants.

Buying A House With Cash Vs. Getting A Mortgage

With 1 bedroom and 1 living room, the total area of these units varies from 35 sq m to 49 sq m.

Obviously, the 2 bedroom house is small. But if you apply through the BTO system, you will get a new house that can be renovated to meet your needs. For example, the current 36 sq m model has sliding sections instead of solid walls. So you can see the open plan view of the house.

The November 2020 HDB BTO exercise saw 2,564 applicants for 2-room Flexi (2.6 applicants per unit) and 23,691 applicants for 3-room or more units (4.9 applicants per unit).

But be careful of the waiting time. Even if you are lucky enough to win the HDB BTO, you will still have to wait 3 to 4 years for your home to be built before you can move in.

Verify: Will The Government Give You $25k For A New Home?

Pro Tip: When talking about HDB accommodation, always subtract 1 from the name to see how many rooms you’ll get. So a 3-room apartment means 2 rooms + 1 room, a 4-room apartment means 3 bedrooms + 1 living room, etc.

If bidding (and waiting) for a 2 bedroom flexi HDB BTO unit doesn’t appeal to you? Instead, look for suitable properties on the resale market. Communities – individually or jointly – can buy back any type of HDB they want. that they can afford

The biggest downside to buying a resale home is the cost. Currently, and possibly in the next 30 years, the smallest HDB unit you are likely to buy is a 3-bedroom unit (HDB flats are at least 5 years old and, as current supply has not kept up with demand, So you’re unlikely to find a two-bedroom unit on the resale market any time soon).

HDB property selling prices gradually decreased following the administration’s easing measures. This keeps the homes for sale within the reach of most private buyers, however you should expect to pay $238,000 to $407,000 for a three-bedroom HDB unit for sale.

Low Rates, Not Government Policies, Biggest Help To First Home Buyers

If your resale home has fewer than 60 years left on your lease, you will be limited in the amount of money you can use to pay off your mortgage. Updated in May 2019, the amount you can pay to buy a home is assessed based on whether the remaining lease term can cover homeowners as young as age 95.

This means that when the debt is due, You will have to pay extra out of pocket. Please keep this in mind when planning your finances.

The latest May 2019 update also states that it can be used to finance your property if the remaining contract can cover the youngest buyer up to age 95, if these conditions are not met. Usage is the same.

This means that the lease covers the youngest buyer until age 95. The buyer can then use it to pay for the property up to a certain maximum value if conditions are met. If not then Indicates that it is no longer used. This cannot be used if the remaining lease term is less than 20 years.

First Time Home Buyer Tips

After you’ve found and bought your own HDB resale flat. You may need/need a major renovation. The following evidence suggests that you should spend $30,000 on a 3-bedroom home, $40,000 on a 4-bedroom home, and $50,000 on a 5-bedroom home to renovate.

As a homeowner You will undoubtedly find homes for sale that are more expensive than the property, however, a for sale unit gives you one financial advantage that a 2 bedroom BTO does not.

If you don’t need additional room You can rent it out to create extra income. Admittedly, there are pros and cons to sharing your home with tenants. But don’t underestimate the financial opportunities that leasing opens up.

Owning your own space in Singapore is a big decision as it requires a large investment. If you are under 35 years old through the Singles Program or the Singles Share Program, It is important to check the eligibility requirements for each project.

First Time Homebuyer Qualifications

When informed about the grants and loans you can apply for You will be able to find ways to reduce the cost of purchasing your own home. So you can fully enjoy the freedom that comes with home ownership. In the process of protecting your first home? Find out the differences between HDB loans and bank loans to make an informed decision!

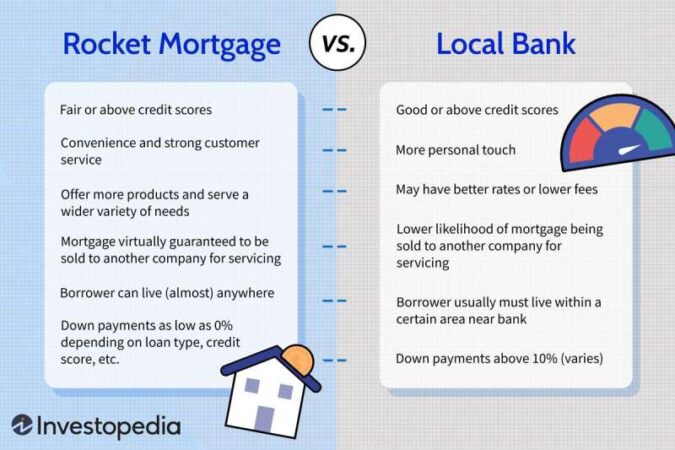

When preparing to buy your first home Start by looking at your financing options. Should you choose HDB loan or bank loan? This is the difference between the two. So you can choose the one that best suits your needs!

HDB loans require you to make a down payment of at least 10% of the purchase price, which you can pay in full from a cash savings account (OA) or a combination of cash and OA savings. You must use existing savings from your OA. you to buy a house Before taking out an HDB loan for the remainder, however, you have the flexibility to park up to $20,000 of your OA for future needs. Not only will these savings continue to benefit your OA, but they will also act as an emergency backup to cover monthly installments when needed!

If you choose a bank loan, you will

Things You Need To Be Pre Approved For A Mortgage

Government loan first time buyers, government loans for first time home buyers with bad credit, government loan programs for first time home buyers, government loan for home buyers, 20 government loan for first time buyers, loan for first time home buyers, government home loan programs first time buyers, first home buyers loan government, government loan for first home buyers, home loan grants for first time buyers, first time home buyers loan, home loan options for first time buyers