First Time Home Buyer Interest Rate Calculator – FHA home loans require just 3.5% down and lower credit scores and employment history than other types of mortgage loans.

The first step to finding out if the FHA can make you a homeowner is to crunch the numbers with this FHA mortgage calculator.

First Time Home Buyer Interest Rate Calculator

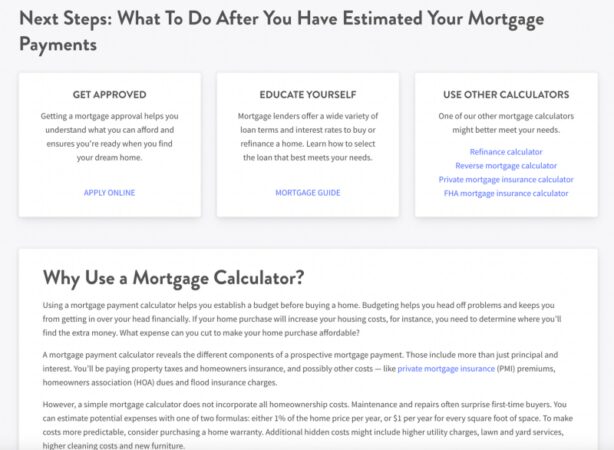

When you pay off your mortgage, you’re not just paying back the loan principal and interest to the lender. You’ll also have to pay for homeowners insurance, property taxes, and other related costs.

Calculate Credit Card Payments And Costs: Examples

The FHA mortgage calculator above will help you estimate your “real” payment when all these fees are added. This will help you get a more accurate number and figure out how much housing you can afford with an FHA loan.

Here’s a breakdown to help you understand each of the terms and conditions included in our FHA Loan Affordability Calculator:

This is the dollar amount you put down to buy your home. FHA has a down payment of 3.5% of the purchase price. This can come from a down payment gift or qualified down payment assistance program.

This is the standard period in which you must repay the mortgage loan. Most home buyers choose a 30-year fixed rate mortgage that has equal payments over the life of the loan. 15-year fixed rate loans are also available through the FHA program.

Debt To Income (dti) Ratio: What’s Good And How To Calculate It

The FHA also offers adjustable rate mortgages, although these are less popular because the mortgage rate and payment rise over the life of the loan.

This is the annual interest rate that your mortgage lender charges as a cost of borrowing. Mortgage interest rates are expressed as a percentage of the loan amount. For example, if your loan amount is $150,000 and your interest rate is 3.0%, you will pay $4,500 in interest in the first year (0.03 x 150,000 = 4,500).

This is the amount you pay your mortgage lender each month to pay off the loan balance and interest. This will be constant for the life of the fixed rate loan. Your monthly mortgage payment will not change, but you will pay more principal and less interest each month until you pay off the loan. This progression of payments is called arrears.

FHA requires a monthly payment similar to private mortgage insurance (PMI). This fee, known as the Mortgage Insurance Premium (MIP), is a type of insurance that protects borrowers from losses during foreclosure.

Daily Mortgage Rates Live

The FHA charges upfront mortgage insurance (UFMIP) equal to 1.75% of the loan amount. This can translate into your loan balance. It also charges annual mortgage insurance, which is typically 0.85% of your loan amount. The annual MIP is paid in monthly installments along with the mortgage payment.

The county or city where the house is located collects a certain amount of tax each year. This cost is divided into 12 installments and collected monthly along with the mortgage payment. Your lender charges this fee because the home can be foreclosed upon if property taxes are not paid. The calculator estimates average property taxes from Tax-rates.org.

Lenders require you to insure your home against fire and other damage. Your monthly home insurance premium will be collected along with your mortgage payment, and the lender will send the money to your insurance company each year.

If you are buying a condo or home in a planned unit development (PUD), you may be required to pay a Home Owners Association (HOA) membership fee. Loan officers will take these costs into account when determining your DTI rates. You can enter other home-related expenses like flood insurance in this box, but don’t include things like utility bills.

How To Calculate Loan Interest

Property taxes and homeowner’s insurance are usually paid to your lender each month along with your mortgage payment. Fees and insurance are held in an escrow account until they are due, at which time your lender pays them to the appropriate company or agency.

FHA mortgages offer great deals for first-time home buyers. However, to use this loan program, you must meet the requirements set by the Federal Housing Administration and your FHA-approved lender.

These are general eligibility guidelines. However, lenders often have enough flexibility to approve loan applications that are weak in one area but strong in others. For example, if your credit score is good, you can avoid a high debt-to-income ratio.

If you’re not sure if you qualify for financing, check your eligibility with a few different mortgage lenders.

First Time Homebuyer Loans And Programs

The agency—a division of the Department of Housing and Urban Development (HUD)—uses the FHA mortgage program to make homeownership more affordable for disadvantaged homebuyers.

Lower down payments and lower credit requirements make homeownership more affordable for buyers who might not otherwise qualify for a mortgage.

Although FHA loans are backed by the federal government, they are originated (‘originated’) by private lenders. Most major mortgage lenders have FHA credit, so it’s relatively easy to shop around and find the best deal on an FHA mortgage.

If you have a bad credit score, low savings, or a high level of debt, an FHA mortgage can help you move into a new home faster.

Mortgage Pre Approval Calculator: How Much Will I Qualify For?

The FHA defines a low cost zone as one where you can multiply the median price of the home by 115%, meaning less than $.

On the other hand, the most expensive parts are above $. In these cases, $ is . About 65 counties in the US have home purchase prices high enough to qualify as the most expensive area.

Alaska, Hawaii, Guam and the US Virgin Islands have special exemptions and limitations on loans over $1 million.

Although the FHA allows the purchase of multi-family homes, you must live in the unit as your primary residence.

What Is Simple Interest?

Interest rates today for a 30-year fixed rate FHA loan start at % (% APR), according to The Mortgage Reports daily interest rate survey.

Interest rates on FHA loans are typically competitive and can be lower than conventional loans, making them an attractive option for qualified borrowers.

It’s important to remember that FHA loan interest rates vary based on factors such as credit score, loan amount and market conditions, so it’s a good idea to shop around and compare offers from different lenders. loan

Using an FHA loan calculator can help you in many ways, especially if you are new to the real estate market or need a complete picture of your future mortgage payments.

Year Mortgage Calculator: Calculate Local 15 Yr Home Loan Refi Payments Nationwide

The FHA Loan Calculator is a useful tool to help you understand how much you can expect to pay for your mortgage each month. The calculator gives a clear picture of your monthly obligations by including details like loan amount, interest rate, loan term and other important details.

This allows homeowners to plan their budget effectively and ensure that they can comfortably manage their monthly mortgage payments along with other expenses.

Mortgage insurance premiums (MIPs) are usually required on FHA loans and are an additional cost that borrowers must factor into their monthly mortgage payments. This is usually included in the FHA loan calculation, which provides a more accurate estimate of monthly costs and helps borrowers understand the overall financial impact of their loan.

When using an FHA loan calculator, it’s important to be aware of some common mistakes that can lead to incorrect calculations.

Pro Rata: What It Means And The Formula To Calculate It

A common mistake is entering incorrect or outdated data into the calculator. This includes information such as the purchase price of the home, the length of the loan, the interest rate and the cost of insurance. To get an accurate estimate of your potential mortgage payments, you must enter accurate and up-to-date information.

When using the FHA loan calculator, homebuyers often forget to include other costs. Some of these costs include Home Owners Association (HOA), property taxes, insurance premiums, and fees for repairs or renovations. If you don’t include these costs, your estimate of your total monthly mortgage costs will be incorrect.

You will need information about the loan amount, interest rate, loan term, and additional costs such as PMI, HOA fees, and property taxes. To get an accurate estimate of your total monthly mortgage payment, make sure all the information you enter is correct.

The FHA sets loan limits for each county that dictate the maximum amount borrowers can qualify for under the FHA program. Loan limits tend to be higher in areas with more expensive real estate, and borrowers who purchase 2-4 unit properties can often receive higher loan amounts than those who purchase single family homes. Not all borrowers qualify for the highest loan rate. The amount you qualify for with FHA will depend on your down payment, income, debt and credit.

How The Cpf Accrued Interest Can Affect Your Property Sale Proceeds

Homebuyers must put down at least 3.5 percent on an FHA loan. That’s because the maximum FHA loan-to-value ratio is 96.5 percent—meaning your loan amount can’t exceed 96.5 percent of the home’s value. By paying a 3.5% down payment, you push the loan amount below the FHA’s LTV limit.

Unlike conventional mortgages, FHA loans don’t waive mortgage insurance if you put 20 percent down. All FHA home owners are required to pay mortgage insurance.

Average first time home buyer interest rate, lowest interest rate for first time home buyer, first time home buyer loan interest rate, average interest rate for first time home buyer, first home buyer loan interest rate, 1st time home buyer interest rate, first time home buyer interest rate, interest rate for first time home buyer with good credit, first time buyer interest rate, first time home buyer low interest rate, first time home buyer program interest rate, best interest rate for first time home buyer