First Time Home Buyer Down Payment Programs – When you need down payment assistance in Maryland, First Home Mortgage is here to provide you with all the tools and resources to make your journey through the loan process a smooth one. There are many different plans you can apply for and our experienced team will help you choose the right one for you!

Buying a home for the first time can be stressful and confusing. That’s where my Mortgage Home team comes in! There are down payment assistance programs available to Maryland residents that can bring you one step closer to paying off and owning a home. Contact us today to make a reservation and start your journey to your dream home!

First Time Home Buyer Down Payment Programs

When it comes to buying a home for the first time, there are many steps and processes involved. Fortunately, there are many payment assistance and cost-containment programs that Maryland residents can take advantage of. From government subsidies to special home programs to help first-time home buyers, My Home Mortgage Group can help you search and find the best programs for your needs. Call us today for more information.

First Time Homebuyer Programs In Missouri

While first-time home buyer programs are specific to the county or city in which you plan to buy, there are several state programs that prospective home buyers in Maryland can take advantage of. Read more or contact us today!

When you think of a good place to live, Maryland is probably the place that comes to mind. Here, beach life and city life come together in perfect harmony, making it a solid choice for those looking for their forever home. Check out the great things Maryland has to offer and contact First Home Mortgage for help buying your dream home!

There are several options for first-time and repeat buyers in Maryland. These programs can hook you up with a lower market rate, lower your mortgage insurance, and provide down payment assistance and closing costs. Downpayments are based on the type of program, such as FHA, conventional, rural housing and VA assistance programs. Our team will walk you through all your options to help you find the best one for you. Remember, these programs define first-time buyers as someone who has been homeless for three years. Check out some of the programs available below and contact us to find out what’s right for you!

This program is for first-time buyers and market interest is low. You must have at least 640. Mortgage insurance may be reduced.

Florida Down Payment Assistance Programs You Should Know About

This program provides financial assistance in Maryland. You can borrow up to 3% of the loan base to cover down payment and closing costs. This amount is free and is refundable every time the house is sold.

If the purchase price is under $170,000, this program is for you. You can get up to $5,000 to help with down payment and closing costs.

Are you fed up with your college loans and want a way to get rid of them? You’ll have up to $40,000 in college loan payments that you can pay off when you buy a home with this program. Call us for an energy transfer.

Another government down payment assistance program not limited to first-time home buyers is the MMP Flex 3% Grant. If you have a credit score of 640 or higher, you can apply for a 3% down or closing cost loan. As Flex gives 4%, there is no need to redeem the gift money.

Farm: First Time Homebuyer Programs

If you have a credit score of 640 or higher, you can get a 30-year deferred interest loan. Plus, you can get a 3% loan for a home payment or closing costs.

Whether you’re looking to buy your first home or have already bought a home, you can qualify for the MMP flex 5000 program if you have a minimum credit score of 640. If you meet the conditions, you can get it. $5,000 credit for down payment and/or closing costs.

MMP Flex Direct offers competitive interest rates to homebuyers with a credit score below 640. As with other public assistance programs, you do not have to be a first-time homeowner to qualify.

If any of these programs catch your eye, let us know! We can help you through the process and get you home!

Programs For Homeowners & First Time Home Buyers

Note that these programs are subject to change. Call us to find out if there are any programs or changes that could benefit you. Check out the company-specific programs below for additional support.

If you buy a home outside the city limits, you can get a 100% down payment below the market interest rate. A country house is a freehold and tax-exempt property, but you may be wondering what a “village” means.

Did you know that if you’re looking to buy a home as a first-time buyer in a certain state or region, you may be able to access even more important financial aid and assistance programs? We at Home Mortgage Group know that buying your first home can be difficult and expensive. Therefore, we provide all the resources to ensure a smooth and easy process that fits your budget. Here are a few states and counties that offer the best home buyer loans;

Contact the My Home Mortgage Team for more information on the special programs available. We’ve been helping people buy their first home for over twenty years, and we know how to get your dream home at an affordable price.

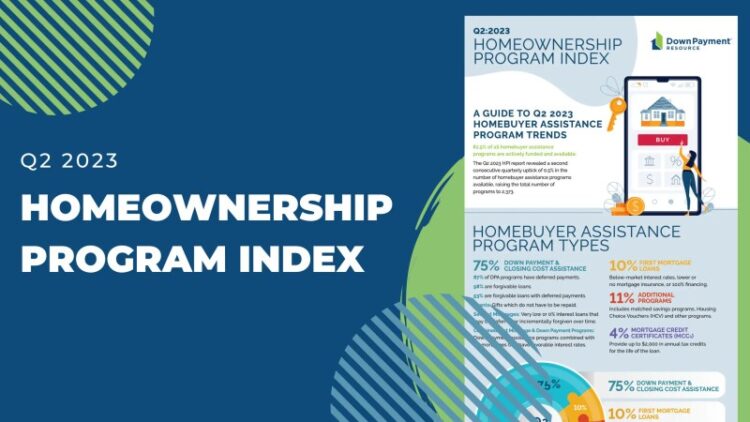

The Down Payment Report

There are a lot of steps and considerations to take when looking for a home loan, and if you want to get the best results for yourself, this is not the place for guessing games. Here’s a team of Maryland First Home Mortgage experts to help you. With our vast experience in the loan and mortgage industry, we can assure you that you will get the help you need when you need it. Contact us today. We are happy to help you and answer any questions you may have!

Tammy was very patient and helpful during the application process. As a home buyer, I didn’t know much about it, which made me nervous, but I approved, now thanks Tammy!

Tammy Lewis made my home buying experience so easy. I felt no force or pressure. Tammy was with me every step of the way and made sure I understood everything through detailed discussions. My credit score was low and Tammy told me how to raise it. So that the loan process is approved without any hassle. We recommend Tammy Lewis and Front House for anyone looking to buy their first home.

Lifesaver first time home buyer made sure my experience was smooth and painless. Very professional and got things done in a timely manner. You can’t ask for more!

How To Buy A House With No Down Payment In Nc

R° was always willing to go through many pages with me. I am a newbie and this is my first time swimming at home. He explained everything to me in a way that I could understand and provided all my documents in a timely and efficient manner. I thoroughly enjoyed working with him and would recommend him to anyone looking for him. Down payment assistance is a key feature of Nationwide Loans. We offer traditional home loans through FHA, Conventional and Jumbo, but over the years we have become one of the top lenders in North Texas helping Texas home buyers.

Most often, installment plans are used under FHA loans, but they can be used with many loan products. The most popular payment programs we use are SETH 5 STAR and TSAHC (as well as Home’s for Hero’s and Home Sweet Texas). There is a significant family approach to both of these programs…see also SETH 5 STAR Income Limits. In Dallas County, including Collin, Dallas, Denton, Ellis, Hunt, Kaufman and Rockwall counties, the SETH program cap is $67,735, and TSAHC allows programs for heroes (including “heroes and educators”). 115% AMFI, that’s $78,085, Texas Sweet Home is 80% AMFI.

Depending on your specific needs, there are many pricing and support options available through the program. Both programs have 3 options: 5% down payment, 4% dp support and 3% dp support. The more you help, the more credits you get.

Be the first to know

Down Payment Assistance For First Time Home Buyers

First time buyer down payment assistance programs, first time home buyer programs to help with down payment, no down payment first time home buyer, first time home buyer programs arizona down payment assistance, first time home buyer 0 down payment, first time home buyer programs los angeles down payment, first time home buyer programs california down payment, first time home buyer programs down payment assistance new mexico, first time home buyer programs down payment, first time home buyer programs no down payment, first time home buyer programs in virginia no down payment, first time home buyer low down payment