First Time Home Buyer Down Payment Assistance – Dan Green has been a mortgage broker and business owner since 2003. His dedication to first home buyers and home buying knowledge has established him as a trusted voice among his colleagues, friends and the media. Dan is designed to bring the American dream of ownership to anyone who wants it. Read more about Dan Green.

Helps you achieve your real estate dreams. We follow editorial guidelines, including fairness and transparency, and may receive offers from other companies. Read how to make money.

First Time Home Buyer Down Payment Assistance

Your trusted guide to home ownership. Since 2003, our team has provided experience and advice to tens of millions of US home buyers. Our information depends on its truth: it is truth, neutral and free from external influences. Read more about our editorial guidelines.

Can You Use A Personal Loan For Your Home Down Payment?

Issuer associated with a mortgage company. Earn a discount when you click on specific website links or apply for a mortgage with a partner listed in our comparison tables. Our partners have different prices than we do, so we prepare our lists to avoid misleading our readers. We also receive payment for the most frequently displayed advertisements on the Site. Although we publish restrictions in your area, restrictions on our software and credit issues may affect the offers and comparison tables you’ll find elsewhere on this site. We do not include offers on all mortgage products available. We hope to one day.

Your trust in us is very important. This article was checked for accuracy on 7 November 2023. We ensure that the information shared reflects the latest mortgage standards. Learn more about our commitment to our readers in our editorial guide.

Homebuyers have many options for buying their first home with an affordable mortgage.

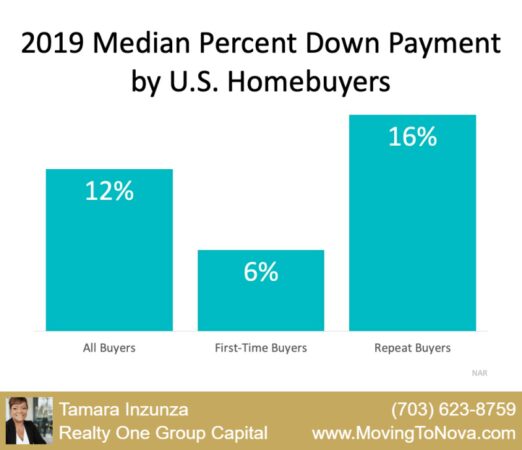

Consumers can get 3 percent down on their mortgages, and low-cost mortgages are available from $0 down. First-time home buyers save 7 percent on a down payment, but that’s not required either.

News Flash • First Time Homebuyers Program

You don’t need tens of thousands of dollars in savings or a 401(k) to buy a home. Below are mortgage assistance and payment programs to help you make your dream of home ownership a reality.

Conventional loans are the most common type of loan with an interest rate of less than 3 percent. They have stricter FICO score requirements than government loans.

Buyers have no restrictions on the type of house they can buy or the location of the property. Customers can manage their own taxes and insurance and choose an account to split these payments and monthly mortgage payments as they wish.

Mortgage insurance is required for buyers financing more than 80 percent of their home purchase. Mortgage insurance can be canceled when borrowers reach 20 percent of their income. Average mortgage payments are $30 to $70 per month for every $100,000.

Down Payment And Mortgage Assistance Programs For Illinois Homebuyers

FHA loans are cheaper than conventional loans with low limits for buyers with low scores.

Lenders prefer a credit score of 580 or higher. Customers paying 10 percent or more can earn less than 500 points.

Mortgage insurance is required regardless of payment. Mortgage insurance is paid for through an upfront fee and an annual recurring payment that is paid monthly.

Customers can choose from two low-interest loans, 3.5 percent or 5 percent down payment assistance. Both programs require customers to have a credit score of 640 or higher.

First Time Homebuyer Grant

People with low or low incomes can get a second loan with no monthly payments or interest. The second loan covers 3.5 percent of your payment and is forgiven after 36 months of equal payments.

The down payment assistance package includes 5 percent of down payment and 5 percent of closing costs. 5% loan 10 years after repayment, no later than 60 days.

People who earn a lot of money can get this help. There is a monthly fee and there are two options to choose from.

3.5 and 5 percent loans offer a 10-year loan at 0 percent or a 30-year loan at 5 percent.

Down Payment Assistance Programs For Home Buyers In 2023

Income and credit history often help. First-time buyers can also enroll in home buyer education.

USDA loans have no down payment requirements, so you can buy a home for $0 down. Credit score requirements are the same as standard credit programs with a minimum score of 580.

Although buyers must purchase a home in a convenient location, USDA loans are not limited to agriculture. It is available for housing in small towns, cities and non-urban areas. Consumers can check their locations with the USDA certification chart.

Mortgage insurance is not required, but there is a USDA bond fee that applies. This is paid through a fixed fee, an upfront fee, and an annual fee that is paid monthly.

Virtual Home Buyers Club Workshop

Yes, you can use cash donations from someone who is not involved in the home buying process for a down payment.

VA loans are available to members of the US military, their spouses, and eligible veterans. This is another payday loan option with higher credit score requirements than USDA loans.

VA loans have no term or credit score requirements, and most lenders require a score of 580 or higher for approval.

VA loans do not require traditional mortgage insurance, the borrower is responsible for a one-time payment for a “guaranteed payment” that works the same way. Your mortgage can be financed or paid off in full at closing.

Featured Loan Program

Yes, you can use financial contributions from a non-party to the contract to offset the fee. The lender may require a prepaid gift certificate to verify the gift.

Buying a home with a low down payment is possible with the right credit. Conventional, FHA, VA and USDA loans are low interest options. In addition, FHA can help lower the down payment on your loan.

Be a better customer. Subscribe now and never miss exclusive insights, new market trends and first-time sales events.

© 2021-2023 All Rights Reserved. Growella Inc d/b/a. Administered by Novus Home Mortgage, a division of Ixonia Bank, NMLS 423065. www.nmlsconsumeraccess.org Suite 400, Brookfield, WI 53045. US Department of Housing and Urban Development, US Department of Veterans Affairs, US Department of Agriculture or Nor is it affiliated with any other government agency. US government agencies have not reviewed this information and this site is not affiliated with any government agency. Equal Housing Provider. The loan must be approved and signed by the applicant. Not all applicants are accepted for funding. Acceptance of application does not guarantee financing or interest rate. Restrictions may apply.

Cdcu Down Payment Assistance

The mortgage rates shown on this page are based on considerations for your home and the state in which you want to buy. The rate shown is correct as of 2018, but keep in mind that mortgage rates are subject to change without notice depending on the performance of the mortgage market.

The mortgage rates shown on this page are based on considerations for your home and the state in which you want to buy. The rate shown is correct, but please note that mortgage rates may change without notice depending on mortgage market activity.

Our mortgage rate estimates may differ from those used by other mortgage lenders in the comparison table. The mortgage rate, APR, points, and monthly payments don’t match the chart above unless you:

You are a first-time homebuyer purchasing a single-family home as your primary home in any state except New York, Hawaii, and Alaska. Your credit score is 660 or higher. You pay twenty percent and take advantage of a standard 30-year mortgage. Household income is low compared to your area.

D.c. First Time Home Owner Loans

The information provided is for informational purposes only and should not be confused with mortgage rates or mortgage approvals.

}. The mortgage interest rate (APR) shown above is based on information published on the issuer’s website and received by the issuer. According to the website, the published rate is what homebuyers would pay at score and closing on an example 30-year conventional mortgage. Mortgage rates indicate whether a homebuyer will pay less or more when purchasing a single-family home. The mortgage rate assumes that the homebuyer has } or higher credit. Monthly mortgage payments on the above terms are 360 months plus taxes and insurance payments.

Alabama first time home buyer down payment assistance, florida first time home buyer down payment assistance, down payment assistance first time home buyer, first time home buyer down payment assistance texas, home buyer down payment assistance, first time buyer down payment assistance, first time buyer down payment assistance program, first time home buyer down payment assistance nc, first time home buyer down payment assistance illinois, colorado first time home buyer down payment assistance, first time home buyer down payment assistance nj, first time home buyer ohio down payment assistance