First Time Home Buyer Down Payment Assistance California – Written by Kacie Goff Written by Kacie GoffArrow Opportunity Personal Financial Contributor Kacie Goff is a financial and personal insurance writer with seven years of experience in personal and business financial options. He has written for , Easy Dollars, Future Advisor, Varo Money, Help, Best Credit Cards and more. It covers a wide range of policies – with little mention of services such as policy and E&O – and specializes in auto, home and life insurance. Connect with Kacie Goff on LinkedIn Linkedin Connect with Kacie Goff via Kacie Goff Email

Laurie Dupnock Edited by Laurie DupnockArrow Editor, The Loan Laurie Dupnock is a loan writer in the mortgage group. Connect with Laurie Dupnock on LinkedIn Linkedin Laurie Dupnock

First Time Home Buyer Down Payment Assistance California

Founded in 1976, it has a long history of helping people make smart financial choices. We have maintained this reputation for more than four years by simplifying the financial decision-making process and giving people confidence in their future careers.

California Dream For All

Adhere to strict regulatory requirements, so you can be confident that we put your interests first. All our content is written by experts and experienced editors, who ensure that everything we publish is true, accurate and reliable.

Our mortgage brokers and adjusters focus on what our customers care about – the latest rates, the best lenders, tracking the home buying process, getting your money reverse mortgage and more – so you can be confident when making a decision to buy a house or home. the master.

Adhere to strict regulatory requirements, so you can be confident that we put your interests first. Our award-winning editors and award-winning publishers create valuable and useful information to help you make smart financial decisions.

We appreciate your trust. Our goal is to provide readers with accurate, unbiased information, and we have an editorial process to ensure this. Our editors and publishers check the content of the editorial to ensure the accuracy of the information you read. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct payment from our advertisers.

First Time Homebuyer Loan Assistance Program To Resume In Santa Barbara County

The editorial team writes on behalf of you – the reader. Our goal is to provide you with the best advice to help you make smart financial decisions. We follow strict guidelines to ensure that advertisers do not interfere with our editorial content. Our editorial team is not paid directly by advertisers, and our content is carefully reviewed to ensure accuracy. So, whether you are reading an article or review, you can be sure that you are getting reliable and trustworthy information.

Do you have a financial question? he has an answer. Our experts have been helping you manage your finances for over four years. We continue to provide our clients with the advice and tools they need to succeed in their financial lives.

Adhere to strict regulatory requirements, so you can be confident that our information is true and accurate. Our award-winning editors and award-winning publishers create valuable and useful information to help you make smart financial decisions. The content created by our editorial staff is objective, objective, and not influenced by our advertisers.

We understand that we can bring you the best experience, competitive price, and quality equipment by explaining the money.

The $25,000 Downpayment Toward Equity Act: Explained

An independent service, advertising and sales service. We are paid for sponsored products and services, or for clicking on certain links posted on our website. Therefore, this price will affect how, where and how the products are listed, unless prohibited by law for mortgages, real estate and loan products for other buildings. Other factors, such as our own website policies and whether products are available at your location or at the rating you choose, may affect the visibility of products on this website. While we try to provide as many results as possible, this does not include information about financial products or financial services.

Saving money for a down payment can be difficult, especially if you are a first time home buyer. The minimum interest rate for various types of loans cannot be higher. Here’s what you need to know about the average home payment for a first-time buyer.

Many first-time home buyers mistakenly believe they need to put 20 percent down to qualify for a loan. Fortunately, that is not the case.

The average down payment for a first-time home buyer is 6 percent in 2022, according to the National Association of Realtors (NAR). For a $400,000 home, a 6 percent down payment is $24,000.

Moving Tips & More

Comparing this to new home buyers, the average down payment in 2022 is 17 percent, or $68,000 on a $400,000 home. Twenty-six percent of first-time buyers told NAR that down payments are the hardest part of buying a home.

The amount you should set aside for your down payment depends on your financial situation, comfort level and other factors.

If you can put down 20 percent, you will avoid mortgage insurance and can get a lower rate, which means saving money. You should not do this if it means throwing away all your money. It is important to take care of the youth. In addition, you’ll need money for closing costs – more on that below – and expenses like furniture, moving and home repairs after you move.

Even if a first-time home buyer can’t afford the 20 percent down payment, it can be worth buying. Since your savings aren’t equal to the increase in home prices, come up with a 3 percent down payment — the minimum paid for a home with some pre-sale value. – may be necessary for the owner of the house, although he intends to pay. long term insurance. When you have the balance (usually, 20 percent), you can ask your lender to take out your mortgage insurance.

First Time Home Buyer Programs By State

The less you pay, the easier it is to save. Here are some ways to reduce your costs:

Many loan programs require a down payment on a home for a first-time buyer. Here’s a quick look at some of your options:

Although a low down payment can make it easier to get a home, remember that if you put down less than 20 percent of the loan, you will pay private mortgage insurance. (PMI), which protects the lender if you. stop paying. A low down payment means you won’t qualify for a low interest rate loan.

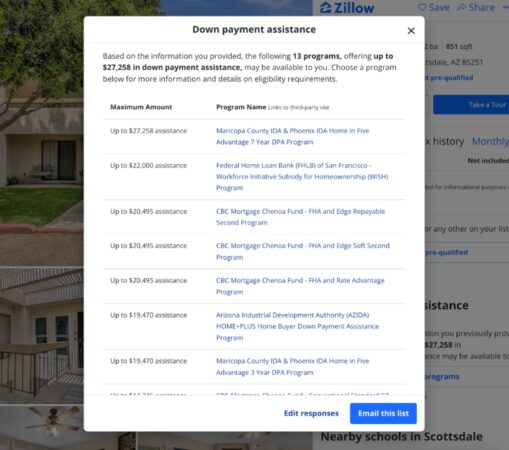

To find out if you can get down payment assistance, ask your lender what loans they accept and if you qualify.

How To Get A First Time Home Buyer Grant In The Philly Region

Choosing to use a down payment option for home buyers will keep more money in your pocket, but it has its downsides. If you’re trying to decide how much to put down on a home as a first-time buyer, consider the pros and cons:

The difficulty of saving isn’t the only reason why the average down payment for a first-time home buyer is less than 20 percent. People do less to earn more money for:

Kacie Goff is a financial and personal insurance writer with seven years of experience in the personal insurance industry and business. He has written for , Easy Dollars, Future Advisor, Varo Money, Help, Best Credit Cards and more. It covers a wide range of policies – with little mention of services such as policy and E&O – and specializes in auto, home and life insurance.

Laurie Dupnock Edited by Laurie DupnockArrow Editor, The Loan Laurie Dupnock is a loan writer in the mortgage group. Join Laurie Dupnock on LinkedIn Linkedin Laurie Dupnock Editor, Jurupa Valley Home Loans is committed to providing affordable housing to people of all income levels. To achieve this goal, the city works with local partners to provide different services to its citizens with the goal of having a home for everyone in our community. The city partners with developers, non-profit organizations, and/or city, state, and federal agencies to improve housing in the Jurupa Valley.

Down Payment Assistance Programs In California. Calhfa Gsfa First Time Home Buyers Cheat Sheet!

The Housing Choice Voucher Rental Assistance Program is a program that helps low-income, seniors, and people with disabilities find affordable, safe, and clean housing in the private market. guy. Because housing assistance is provided to families or individuals, participants can own their own homes, including single-family homes, townhouses, and condos. Participants can choose housing that meets the needs of the program and is not limited to housing programs.

The Jurupa Valley Affordable Housing Program is administered by the Riverside Housing Authority. For more information on this and other programs, visit their website.

The Riverside County FTHB Program is designed to help low-income and low-income families purchase their first home. Down payment assistance can be provided when purchasing a home. The amount of the subsidy depends on the customer’s eligibility as well

First time home buyer down payment assistance, alabama first time home buyer down payment assistance, home buyer down payment assistance, first time buyer down payment assistance, first time home buyer down payment assistance texas, colorado first time home buyer down payment assistance, first time home buyer down payment assistance nj, florida first time home buyer down payment assistance, first time home buyer ohio down payment assistance, first time home buyer down payment assistance illinois, first time home buyer down payment assistance nc, first time buyer down payment assistance program