Fha Loans For First Time Home Buyers – If you’re on the Galaxy Fold, flip your phone or view in full screen to enhance your experience.

Seller Disclosure Most resources displayed on this site receive compensation for The Motley Fool. These returns may affect how and where products appear on this site (including, for example, the order in which they appear), but our reviews and ratings are not affected by the returns. We do not include all companies or all offers available in the market.

Fha Loans For First Time Home Buyers

:max_bytes(150000):strip_icc()/terms_l_loantovalue_FINAL-9676cca1d30f478a9a875a8f60f94ba8.jpg?strip=all)

Most or all of the products here are from our review partners. This is how we make money. But our editorial integrity ensures that our experts’ opinions are not influenced by compensation. Terms may apply to advertisements listed on this page.

What To Expect When You’re Buying A House

An FHA loan is a type of home loan designed to increase access to home ownership in the United States, especially among consumers with low credit scores or those who do not have the money to make a large down payment.

While an FHA loan isn’t right for everyone, it can be a great loan product for many consumers. Below are some important things first-time buyers should know about FHA home loans.

First, the basics. FHA loans are guaranteed or insured by the Federal Housing Administration (FHA). This is why lenders are willing to lend to borrowers who otherwise wouldn’t be able to get a conventional mortgage loan—if the borrower defaults, the borrower’s FHA insurance will prevent any loss to the lender.

To be perfectly clear, the FHA does not make loans directly to borrowers. FHA loans come from banks, credit unions, online lenders, and other outside companies.

Fha Vs. Conventional Loan: What’s The Difference

FHA loans are designed for the purchase of a home to live in, so they are generally not available for the purchase of a vacation home or investment property. However, an FHA loan may be issued on a property with four residential units. As long as the client resides in one of them, there is no law against hiring others.

FHA loans are fixed rate loans. This type of loan requires a down payment of only 3.5% of the purchase price. Also, borrowers can add their closing costs to the loan, i.e. 3.5% of the down payment. FHA loans are available with 15- or 30-year loan terms.

Borrowers with a credit score below 500 can get FHA loans with a down payment of 10% or more.

Can’t afford the 10% down payment? Don’t stress – work to improve your credit score. Borrowers with a FICO® credit score of 580 or higher can get an FHA mortgage with a 3.5% down payment. Reference lenders must be in continuous employment for at least two years at the same location to qualify for an advance.

Demystifying Fha Loans: A Comprehensive Guide For First Time

Your debt-to-income (DTI) ratio should be less than 43%, although lenders may extend it to 50% in some cases. Conversely, conventional loans require a minimum credit score of 620.

Please note that FHA loan guidelines may change over time. When I got an FHA loan to buy my first home in 2012, the required credit score was 620 with a 3.5% down payment.

Despite the high costs, FHA loans are the best choice for many borrowers. They may be a better choice:

This does not mean that all FHA-accredited lenders are the same. There are many factors to consider when shopping for an FHA loan. These include:

Contour Mortgage News

Finding an FHA-approved lender with excellent customer service is important for homebuyers, especially first-time buyers. Some lenders, like Rocket Mortgage, have an amazing reputation for customer service.

It is convenient to have all your financial accounts in one place. For example, if you bank with Wells Fargo, it might be a good idea to get a loan quote from Wells Fargo Mortgage. Additionally, some lenders offer discounts on origination fees and other lender fees to existing customers.

The FHA sets minimum standards, but some lenders have more lenient guarantee requirements than others. For example, some mortgage lenders will not consider applicants with DTI ratios above 40%, while others may accept borrowers with higher credit scores.

![]()

One thing homebuyers can do is evaluate potential lenders. Check for the lowest annual percentage rate (APR). A loan’s APR includes any loan origination fees and interest. Comparing APRs can help you understand the true value of different loans.

How Much Housing Loan Can I Take?

Worried about your credit score? Don’t: No matter how many loan applications you fill out during the two-week shopping period, it will count as one inquiry on your credit score.

In addition, there are a number of fees you may have to pay to third parties, such as appraisal fees, attorney fees, and credit reporting fees. Although they are not offered directly to the lender, mortgage lenders often use their preferred agents and other vendors.

If you’re a first-time home buyer, our experts have vetted the best lenders to find the best deals for first-time home buyers. We have used some of these lenders ourselves!

Matt is a Certified Financial Planner and Investment Advisor in Columbia, South Carolina. He writes personal finance and investment advice for Ascent and parent company The Motley Fool, including 4 published articles, 500 and a 2017 SABEW Best in Business Award. Matt writes a weekly investment column (“Ask The”) that is syndicated in USA Today, and his work has been featured on CNBC, Fox Business, MSN Money and many other major outlets. He graduated from the University of South Carolina and Nova Southeastern University and holds a certificate in financial planning from Florida State University.

Usda Vs. Fha: Which Loan Is Better For First Time Home Buyers?

Share This Page Facebook Icon This icon shares the page you are on with the Facebook Blue Twitter icon. Share this website with the Twitter LinkedIn icon. This icon integrates page sharing through LinkedIn. Email icon Share this website via email

We are firm believers in Big Frame, which is why editorial opinions are our own and have not been previously reviewed, endorsed or approved by specialized advertisers. Not all facilities are available in the upstream market. Ascent’s editorial content is different from Motley Fool’s editorial content and has a different analytical team.

Wells Fargo is the marketing partner of motley company Ascent. Matthew Frankel, CFP® holds a position at Wells Fargo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Ascent is a Motley Fool service that rates and reviews products important to your everyday financial affairs FHA loans are a great option for first-time homeowners These loans are designed to improve those who don’t have the financial resources or credit scores to qualify for conventional loans. FHA loans are unique because they are backed by the Federal Housing Administration (FHA), which provides borrowers with a level of protection in case they default on their loan. This support from the government allows lenders to offer favorable terms to borrowers, making the dream of home ownership accessible to a wide range of people.

Down Payment And Mortgage Assistance Programs For Illinois Homebuyers

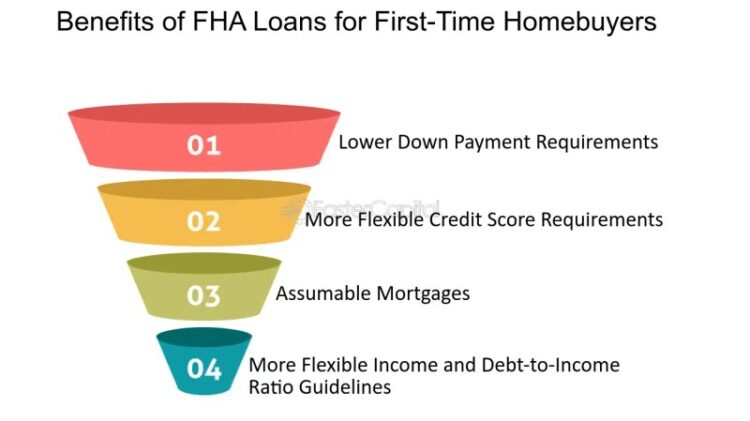

FHA loans have many advantages, including low down payment requirements, strict credit score requirements and a manageable loan-to-income ratio. Here are some more details on what FHA loans cover:

1. Down Payment Requirement – One of the most important benefits of an FHA loan is the down payment requirement. Borrowers can put down 3.5% of the purchase price, much less than the 20% down payment required on a typical mortgage. This low down payment requirement makes home ownership more affordable for those who don’t have enough money saved up for a down payment.

2. Very lenient credit score requirements – FHA loans are very forgiving when it comes to credit scores. While conventional loans require a credit score of at least 620, FHA loans are available to borrowers with credit scores below 500. However, borrowers with poor credit scores may have to pay larger down payments.

3. Manageable debt-to-income ratio – Lenders also look at the borrower’s debt-to-income ratio while approving a loan. With an FHA loan, borrowers can have a higher debt-to-income ratio than a conventional loan. Borrowers can have a debt-to-income ratio of up to 50%, while the debt-to-income ratio for standard loans does not exceed 43%.

The Key To Getting Your First Home

In general, FHA loans are a great option for first-time buyers who don’t have financing or credit scores. With lower down payment requirements, stricter credit score requirements, and higher loan-to-income restrictions, FHA loans offer a way out for those who previously thought homeownership was out of reach.

First-time buyers face many challenges when buying a home. One

Loans for first time home buyers, are fha loans only for first time home buyers, best home loans for first time buyers, best fha loans for first time buyers, federal loans for first time home buyers, fha loans for first-time home buyers, special loans for first time home buyers, fha loans first time home buyers only, fha loans first time home buyers, mortgage loans for first time home buyers, bank loans for first time home buyers, fha loans for first time buyers