Federal Mortgage Programs For First Time Home Buyers – Since 2003, Dan Green has been a mortgage broker with an established corporate identity. His commitment to first home buyers and home buying education has established him as a trusted voice among his colleagues, friends and the media. Don was created to extend the American dream of home ownership to everyone who wants it. Read more about Dan Green.

To help you achieve your home ownership dreams. We follow editorial guidelines, including honesty and transparency, and may receive offers from other companies. Read how to earn money.

Federal Mortgage Programs For First Time Home Buyers

Your trusted guide to home ownership. Since 2003, our team has provided world-class experience and advice to billions of US consumers. Our content is based on integrity: honest, unbiased, and free of external authority. Read more about our editorial guidelines.

Texas First Time Homebuyer Programs & Grants

A publishing house attached to a mortgage company. A reward is given when you click on certain links on the website or apply for a mortgage listed in our comparison tables or with a partner. Our partners have different prices than us, so we disguise our plans to protect our readers from confusion. We also receive payments for advertising on the Site, which is clearly stated. Please note that the limitations of our software, even if we are based on mortgages in your area, and credit issues may affect the offers and comparison plans that you can find in different sections of this site. We do not offer for all mortgage products. We hope to do so one day.

Your trust in us is very important. This article has been carefully reviewed as of November 6, 2023. We ensure that all information shared reflects the latest mortgage laws. Learn more about our commitment to our readers in our publishing guidelines.

A first-time home buyer is a home buyer who has not owned the home they have lived in for the past three years.

First-time buyers make up 43 percent of the new home market. The government gives first-time buyers access to tax credits and incentives to buy a home that other buyers can’t take advantage of.

Down Payment And Mortgage Assistance Programs For Illinois Homebuyers

Whether you’re buying your first home or your first home purchase in more than three years, it’s good to know your options and how to increase your home’s value.

The government defines a first-time buyer as someone who has not owned a primary home for the past 3 years.

The three-year period for first-time home buyers is refunded based on the closing date of the future purchase. The date of mortgage application does not affect eligibility.

You and your spouse are first home buyers if you have not owned a first home within the past three years and your spouse has owned a first home within the past three years.

First Time Home Buyer Loans And Programs

I am a divorced parent. When we got married, I had a house with my ex-wife. This is the only home I have ever owned.

You are the first home buyer for this sale because you are buying the home as a single parent, since you were married to your ex.

When we got married, I had a house with my ex-wife. This is the only home I have ever owned. I will go back to work.

You are the first home buyer in this sale because you have been designated as a government relocated home owner.

Down Payment Assistance Programs & Grants By State 2023

I owned the house I lived in more than three years ago. Now it’s an investment property for me. I have rented elsewhere for over three years.

For an FHA mortgage, you are the first buyer of this purchase because you have not owned your first property within the last 36 months.

For a conventional mortgage backed by Fannie Mae or Freddie Mac, you are not a first-time buyer because you have owned your home within the last 3 years.

You’re a first-time home buyer because your mobile home isn’t attached to a permanent foundation forever.

The Best Mortgage Lenders For First Time Buyers Of 2023

The DASH Act is a tax bill that gives first-time buyers a $15,000 tax credit. However, the DASH Act defines the “first time home buyer” differently than other first aid and programs.

In the DASH Act, a first-time home buyer is someone who doesn’t already own a home. There is no requirement for buyers who owned the home more than 36 months ago, or for buyers who owned the home jointly with their spouses.

If you haven’t owned a home in the last three years, you’re still considered a first-time buyer. So you can buy first.

First time repeat customers are like first time customers. A person who has lived in their home for three years or more and then moves in is eligible to become a first-time buyer, who may be eligible for first-time buyer loans, tax credits and rental assistance.

Tips For Purchasing A Home, From First Time Homebuyers

A first-generation home buyer is a first-time home buyer whose parents are not currently living in the home, and whose parents have never owned a home.

First-generation homebuyers have special access to the Toward Equity Act, a $25,000 first-time homebuyer program.

Only first-time buyers can apply for the LIFT Act, which lowers interest rates for qualified home buyers.

When Congress passed the Affordable Care Act and Amendments, first-time homebuyers:

Best Lenders For First Time Homebuyers Of December 2023

Additionally, several bills have been introduced by the US House and Senate starting in 2021 to make it easier for renters to own a home and afford the American dream.

At the end of 2022, the FHFA announced a mortgage payment program for the first time. First time buyers get up to 1.75% discount on mortgage rate extensions. Check your score.

First home buyers get favorable tax treatment. The IRS allows tax-free withdrawals from an IRA or 401(k) to purchase a first home. And tax incentives, such as first-time home buyer tax credits, are deducted from your federal income tax credit.

In 2009, the state gave an $8,000 tax credit to first-time buyers. Congress is pushing for a $15,000 tax credit that goes back to December 31, 2020.

First Time Homebuyer Programs In Delaware

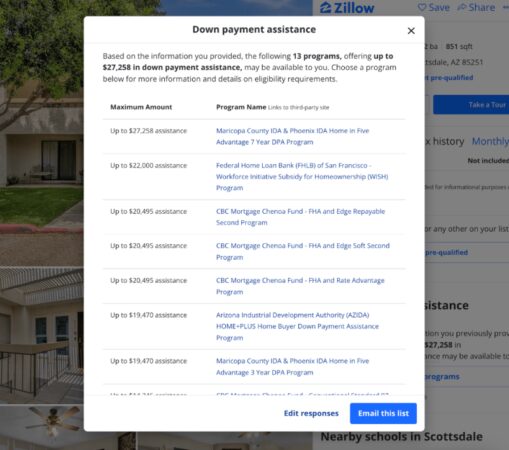

First-time home buyers can apply for a down payment from local governments or apply for a mortgage loan in lieu of down payment. Grants are up to $25,000. Loans can be forgiven up to five percent of the purchase price.

First-time home buyers have special access to mortgage programs designed for first-time buyers, such as the 97 Conventional Mortgage, which offers a three percent mortgage. First-time buyers receive the lowest interest rates on HomeReady and Home Possible from Fannie Mae and Freddie Mac.

First-time home buyers don’t need a 20 percent down payment, and most first-time buyers pay less.

Most first-time buyers use conventional mortgages that are backed by government agencies Fannie Mae and Freddie Mac. There are three 3% Regular Home Loan programs: 97 Regular, HomeReady and HomePossible.

State May Scale Down New Home Loan Equity Program

A typical 97 is a three percent mortgage backed by Fannie Mae or Freddie Mac. The borrower gets his name for the remaining 97% of the loan balance after repayment.

Only 97 are available to qualify for Fannie Mae and Freddie Mac’s five percent down payment for first-time home buyers.

HomeReady is a mortgage loan for first-time buyers with low to moderate incomes. Compared to other mortgages, they have lower mortgage rates and less insurance.

The Home Possible mortgage program is similar to HomeReady. Among its features are premium rates, reduced fees and flexible admission standards.

Down Payment Assistance Focused On First Generation Buyers Could Help Millions Access The Benefits Of Homeownership

FHA mortgages are affordable mortgages. Since 1934, the Federal Housing Administration has insured millions of renters to buy their first home. FHA mortgages offer credit scores of 500 or more, with an interest rate as low as 3.5 percent.

Backed by the Department of Veterans Affairs, VA home loans are non-mortgage loans for veterans, active duty veterans and surviving spouses.

USDA Home Loans are 100% mortgage loans available to home buyers in many small, urban and rural areas of the country. Qualified home buyers have access to below-market mortgage rates, mortgage insurance and flexible approval standards.

Payday loans are the most common type of mortgage for first-time buyers. Mortgages are rated according to Fannie Mae and Freddie Mac mortgage guidelines.

First Time Home Buyer Louisiana

Consolidation loans are best for home buyers with at least five percent down and average or better credit scores.

Better buy Subscribe now and don’t miss out on specials, new market features and early bird deals.

© 2021-2023 All rights reserved. Growella Inc d/b/a. Novus Home Mortgage, a division of Ixonia Bank, NMLS 423065. www.nmlsconsumeraccess.org Located at 230 Findlay Street, Cincinnati, Ohio 45202. . Suite 400, Brookfield, WI 53045. We are not affiliated with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture, or any other government agency. This information has not been reviewed by any US government agency and this site is not affiliated with any government agency. That Home Delivery. The applicant is subject to a credit agreement and a guarantee. Not all applicants are eligible for funding. particle for the correct object

Mortgage loan programs for first time buyers, first home buyers mortgage, federal housing programs for first time buyers, best mortgage programs for first time buyers, federal mortgage programs for first time buyers, mortgage assistance programs for first time buyers, mortgage programs for first time home buyers, federal programs for first time home buyers, government mortgage programs first time buyers, mortgage programs for first time buyers, federal home mortgage programs, federal assistance programs for first time home buyers