Example Of Small Business Profit And Loss Statement – We’ve compiled a comprehensive list of profit and loss templates for small businesses. Each template is free, printable, downloadable and editable.

On this page you will find a basic profit and loss template, a sample annual income statement, a profit and loss dashboard, and a profit and loss template organized by small business type.

Example Of Small Business Profit And Loss Statement

This simple income statement template is available in multiple formats and includes sections for calculating business income and expenses over a customizable time period. Examples of costs include employee salaries, office rent, utilities, insurance costs, supplies and taxes. Use this template to create a list of business expenses and view your total net income.

What Is A Profit And Loss (p&l): Examples For 2023

Create a 12-month income statement that tracks monthly and annual expenses and income. After entering your data into the spreadsheet, the template will calculate the totals and create a graph showing gross profit, total costs, and profit or loss over time. This template includes example line items with typical small business expenses and sources of income. For added convenience, the spreadsheet breaks down costs into categories such as employee salaries, banking, overhead, vehicle expenses, and taxes.

Use this template to create a pro forma income statement for annual financial projections or to perform an annual profit and loss analysis. For added efficiency, this template includes sample data for small businesses, including gross sales, cost of sales, operating expenses, and net income before and after taxes.

This blank income statement allows you to record quarterly financial information for the year. The template’s layout is simple and intuitive, with sections for tracking income, expenses, and tax information. Include your company name, source of income, discounts or other benefits, business expenses, and tax information. The template will automatically calculate the running total and total net income.

Track your small business’s monthly profit and loss information with this dashboard template. The charts included in the template show total revenue, cost of goods sold, gross profit, total expenses, earnings before interest and tax (EBIT), and net income before and after taxes. Use this template to compare financial statements from the previous month and the current month and provide stakeholders with a snapshot of your monthly revenue performance.

How To Analyze Corporate Profit Margins

Designed for independent contractors and other self-employed individuals, this income statement includes areas to record income from various clients, tax expenses, and business expenses. After each client’s income is entered, the template subtracts expenses and taxes to calculate net profit. Use a sample list of expenses to prepare your small business’s income statement.

This template uses a basic income statement format to help you track your hotel’s income and expenses. Give each item a reference number and record all sources of income and expenses in the appropriate field. By doing this, you will be able to closely monitor all the profits and losses of your hotel or other hospitality business.

Use this template to track your daycare’s finances. Record income information such as class fees, monthly payments, and grants. Also, write down expenses such as food, art supplies, toys, rent, utilities and wages. The template automatically calculates net profit or loss for the period you select.

Compile financial information for multiple rental properties into a single income statement. This comprehensive template includes sections for recording property details, deposits received and rental income. List operating expenses, such as landscaping and property management fees, for each month of the year. Track your one-time expenses separately by listing date, total amount paid and other details. Real estate agents can customize this template to create an income statement template for their small business.

Financial Reports And Ratios For Profitable Landscaping Companies

The example income statement for this restaurant lists merchandise sold, labor costs, and other sources of total restaurant income and expenses. General sources of revenue include purchases of food and beverages and merchandise, while general expenses include marketing expenses, utilities, equipment repairs, depreciation, and administrative and labor costs. For simplicity, the template separates labor costs into wages, hourly wages, and employee benefits. The template also calculates gross sales, gross profit, gross expenses and net profit.

View monthly and yearly financial information with this construction profit and loss spreadsheet. Enter your monthly income for each client or project and list job costs, such as labor, materials, equipment rental and removal fees. Add in overhead costs, vehicle costs associated with advertising and professional memberships, and the purchase of small equipment. This template automatically calculates your monthly total and clearly displays your profit and loss information for ease of use.

This profit and loss template includes the hair salon’s total sales and expenses. Determine gross profit by subtracting gross income from salon services, retail sales, rental income and general expenses. For transparency and accuracy, list all salon expenses, including marketing fees, utilities, subscriptions, business licenses, insurance fees, and all other operating expenses. Download an Excel spreadsheet to automatically calculate the amount, or select PDF format to calculate manually.

Using a simple 12-month spreadsheet format, this template allows you to track the gross profit and net income of your landscaping business. Include all income from landscaping clients such as labor, fuel, equipment rentals, equipment, vehicle fees, as well as business expenses such as advertising costs. This template calculates the running total and net profit or loss for each month and year.

Profit And Loss Statement (p&l)

, the profit and loss template calculates the profit or loss of a business by subtracting costs and expenses from revenue.

Small business owners can use an income statement to measure business performance on a monthly, quarterly, or annual basis. Along with other financial documents such as balance sheets and cash flow statements, income statement templates help facilitate accurate financial tracking and forecasting of future business performance.

To learn how to create an income statement in Excel with step-by-step instructions, check out our guide.

Empower your people to do their best with a flexible platform that fits your team’s needs and adapts as their needs change. The platform makes it easy to plan, capture, manage and report work from anywhere, helping your team work more efficiently and achieve more. Report on key metrics and gain real-time visibility with summary reports, dashboards, and automated workflows designed to keep your team connected and informed. When a team has clarity on what they are going to do, it is impossible to predict how much more they can do at the same time. Try it for free now. Income: 1 Income from your business. 2 Gross income. $ Business Expenses: 3 Advertising/Marketing. There is a $4.00 credit/debit card fee. Equipment rental/hire $5…

Financial Statements And Valuation For Planning Sample Pentagram Business Plan In Excel Bp Xl

Subtract all operating expenses, such as rent, utilities and wages, from gross profit to calculate operating profit.

Take into account any additional income or expenses, such as interest income or loan interest, to arrive at your net profit or loss.

Investors and shareholders rely on the income statement to evaluate profitability and potential return on investment.

Email, fax or share your income statement form via URL. You can download, print, or export the form to the cloud storage service of your choice.

Income Statements For Interior Designers

Upload the document. Select “Add new” in your personal account and transfer files to the system in the following ways: by downloading from a device or importing from the cloud, the Internet or internal mail. Then click “Start Editing.”

Edit the income statement form. Rearrange and rotate pages, add new and changed text, add new objects, and use other tools. When you’re done, click Done. You can use the Documents tab to attach, share, lock, or unlock your files.

Save the file. Select from a list of entries. Then move your pointer to the right toolbar and choose from several export options: save in various formats, download as PDF, email, or save to the cloud.

Working with documents using pdfFiller is easier than you think. You can try it yourself by registering an account.

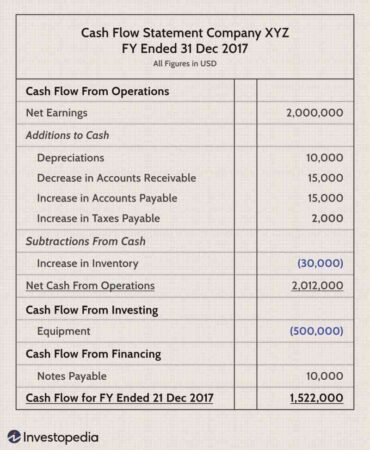

Small Business Accounting: Using A Cash Flow Statement

To create a basic income statement manually, follow these steps: Gather the necessary information about income and expenses (mentioned above). Your sales list. List your COGS. Subtract cost of sales (step 3) from gross income (step 2). List your expenses. Subtract expenses (step 5) from gross profit (step 4).

A profit and loss (P&L) statement refers to a financial statement that summarizes income, expenses, and expenses for a specific period of time, usually a quarter or a fiscal year.

The statement of financial position has several key elements. This includes assets, liabilities, working capital (net current assets), and working capital. Broadly speaking, assets are things that a business owns, and liabilities are things or money that a business owes.

The profit and loss (or income) statement lists your sales and expenses. It shows how much you earn or how much you lose. Typically, you prepare an income statement every month, quarter, or year.

Small Business P&l Statement

Profit and loss consists of two main parts: income received during the reporting period and expenses for the same period. Not all profits and losses will have the same line. revenue Cost of goods sold (COGS).

Example of business profit and loss statement, example of profit & loss statement, profit and loss statement example, example of restaurant profit and loss statement, example of profit and loss statement for small business, small business profit and loss statement example, example profit and loss statement for small business, example of profit and loss statement template, example of profit loss statement for small business, example of profit and loss statement for service business, business profit and loss statement example, example of simple profit and loss statement