Example Of Restaurant Profit And Loss Statement – It’s a fact: you want your bar or restaurant to grow. To make it grow, you need to make decisions that encourage growth and boost profit margins to improve the bottom line on how much bars you make with manageable expenses, even with your Valentine’s Day promotional ideas for restaurants. You’ll spend a lot in the beginning learning how to get a liquor license, so from now on, you’ll have to focus on profits and knowing your upfront costs and cost of goods sold (COGS).

Strategic decisions based on restaurant accounting, restaurant SEO and restaurant SWOT analysis. The reality of your restaurant’s financial situation. That’s what runs a successful bar and restaurant.

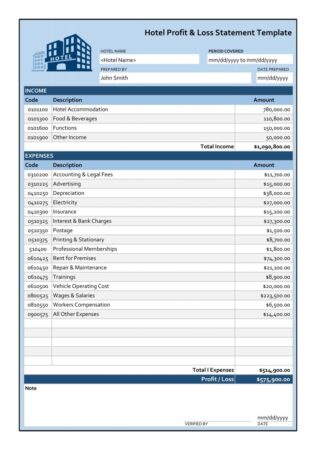

Example Of Restaurant Profit And Loss Statement

Enter the restaurant’s profit and loss statement. This is probably the most concise measure of your restaurant’s financial health, and it’s a big part of knowing how to manage a restaurant’s accounts.

Bsbfim601 Appendix E Budget Template

All successful food service and hospitality operators are proficient in calculating, creating, and reading profit and loss statements. Just read some books about restaurant management.

Learn how to give them all the information they need to slowly become profitable. This means a lot in businesses with tight margins like food and beverage. So, let’s learn what a restaurant profit and loss statement is and how to create it.

A restaurant profit and loss statement, also called a profit and loss statement or income statement, is a financial document that details a business’s total income and expenses over a specific period of time. A P&L provides a snapshot of the key metric a company has: how much profit is being made and from where.

At its simplest, it’s just the cost deducted from the sale. Knowledge that gives bar and restaurant managers the ability to use profitable items or strategies and vice versa.

Buffet Restaurant Financial Model Excel Template

By calculating three costs (labor, operating, and goods sold), and deducting these from total sales, the company is left with its net profit or net loss. This is what the profit and loss statement conveys.

Every four weeks. If you use tape management software like BinWise Pro, it’s instantly available for review whenever you want.

This is the most important document that your accountant or restaurant’s accounting software creates. The more you look and give the opportunity to course correct based on their numbers, the better.

Another way to understand a restaurant’s profit and loss statement is to know what it isn’t. Your restaurant P&L does not include your total cash on hand, or any information about your stock, equity, debts or liabilities.

Sensitivity Analysis Model

Your restaurant budget does that. While the Profit and Loss provides a quick snapshot of profitability, the Balance Sheet provides a comprehensive look at short- and long-term financial health.

The restaurant’s profit and loss information is included in the balance sheet. However, as you can see, the balance sheet is a more detailed picture of finances.

How to calculate a restaurant’s profit and loss is a matter of pulling numbers from a point of sale, accounting software, or inventory management system. Then subtract it from the total sale.

Net Profit/Loss = Total Sales – Cost of Goods Sold – Labor Costs – Operating Costs Net Profit/Loss = $8,000 – $2,500 – $2,000 – $1,235 Net Profit/Loss = $2,265 Total Sales

Restaurant Expense Report Template

You need to calculate the sales of each item that contributes to your total revenue, and each stream. Fortunately, you can pull this from your point of sale or inventory management software like BinWise.

In fact, BinWise Pro’s SmartView report shows you exactly what you sold, when and for how much. You can then use this information to determine price percentages and conduct price experiments (psychological pricing, anyone?) to maximize profits.

COGs, or cost of goods sold, is the total amount your business pays to purchase and prepare each item sold. You should also be able to pull your COGs from your point of sale or restaurant accounting software. List of COGS every week.

If you find that your gears are very different, look for standardized recipes. Most restaurant failure is due to lack of supervision and lack of consistency. This is another thing BinWise Pro helps bars and restaurants across the country with: consistent data collection, analysis, and reporting. All in just a few clicks.

Projected Profit And Loss Statement Strategical Planning For Opening A Cafeteria

Take all wages, hourly wages, and contract wages for time to calculate the restaurant’s total labor costs.

This is the final result of the week’s profit and loss equation. You can also calculate by month using the same formula with monthly numbers.

To make your life a little easier, we have a free Restaurant Profit and Loss Statement for Excel. You can download the program below.

Our suggestion is to import the restaurant profit and loss model into Excel or Google Sheets. You should also download our Restaurant Financial Checklist for additional accounting help.

Free 6+ Restaurant Business Paperwork In Pdf

There are several conclusions a company can make using the updated profit and loss sheet. A big part of an accurate profit and loss report is accurate inventory. You should also check out our free restaurant break-even calculator and learn how to calculate ROI for further guidance.

This is where a perpetual inventory system like BinWise Pro comes in. Integrates seamlessly with point of sale systems and accounting software. It also has an easy-to-use restaurant bill card.

It also keeps your inventory low in real time, so you can recall that information to start making profitable decisions. It also saves hours and hours of tape counting, you know, instead of doing a physical inventory count. If you’ve been in a restaurant, you’ve probably heard of the profit and loss statement (or “income statement”). Undeniably the most important financial statement of all, the Profit and Loss (P&L) provides a clear view of your restaurant’s profitability by listing all your sales and expenses.

But what exactly is profit and loss? What does a restaurant’s profit and loss include? How to analyze the profit and loss of a restaurant?

Projected Income Statement

Whether you are preparing financial projections for a restaurant business plan or are just interested in understanding your restaurant’s financial situation, in this article we will tell you everything you need to know about the profit and loss statement. Let’s dive in!

The profit and loss (P&L), also called the “income statement,” is one of three financial statements that a company must prepare and update regularly. The three financial cases are:

There is no doubt that profit and loss is the most important of all financial reports, because it shows the company’s revenues and expenses for a period of time (month, quarter, or year).

Therefore, we use profit and loss to understand a company’s ability to generate profits and, more generally, to evaluate its financial health. We can, for example, increase a restaurant’s profits by increasing its revenues or reducing its expenses.

Restaurant Income Statement: Fill Out & Sign Online

A restaurant’s profit and loss, like any other business, includes all revenues and expenses over a specific period of time. To create a P&L, we first add all the revenues at the top (gross revenues) and subtract all the expenses (COGs, labor costs, rent, etc.) up to the net profit.

This section will include all of your restaurant’s sales. Therefore, you should add all payment receipts of your customers and any other income you may have earned during this period.

We recommend dividing sales into different categories to achieve greater transparency about your restaurant’s main revenue sources. For example, you can segment sales by product (food vs. beverage). If you run a fast food restaurant, you may also differentiate between dine-in sales and retail sales.

The total variable costs you have to pay to prepare the food and drinks you serve to your customers. For a restaurant, this includes food from restaurant suppliers and beverages (bottles, beer, soda, etc.).

A Complete Guide To Adjusting Financial Statements

Cost of goods sold also includes variable costs like card payment processing fees (2-3% you pay to Visa, MasterCard, Amex, etc.) when your customers pay by card.

This includes all restaurant employee costs: salaries, taxes, benefits (Social Security), and any bonuses. Labor costs can also be differentiated between different teams (e.g. servers, kitchen, management).

Restaurant operating expenses include all costs you incur to run the day-to-day operations of your restaurant. This may include marketing, rent, leasing expenses, accounting, insurance, waste disposal, etc.

There is no right or wrong structure here: choose the presentation that makes the most sense for you to analyze your restaurant’s financial situation. You can for example: operations (waste removal, cleaning services, etc.), marketing, leasing (mortgage payment and utility bills) and others (insurance, accounting, etc.)

Profit And Loss Statement Templates & Forms [excel, Pdf]

Non-operating costs are expenses that are not part of your day-to-day operations. For a restaurant, non-operating costs primarily include: depreciation and amortization expense, debt interest expense and corporate taxes.

A restaurant’s profit and loss statement can take many forms. For example, your accountant may prepare a simplified version of your profits and losses to submit to the IRS as part of your annual tax obligations.

In addition to the mandatory annual tax return that every business must comply with, you should also prepare a more detailed version of your restaurant’s profit and loss and update it regularly to assess your company’s financial health and ability to generate profits.

Here

Télécharger Gratuit Profit And Loss Account Statement In Excel

Example of simple profit and loss statement, example of profit and loss statement template, example of profit & loss statement, restaurant profit and loss statement example, profit of loss statement, example of business profit and loss statement, example of profit and loss statement for small business, restaurant profit and loss statement, template of profit and loss statement, profit and loss statement, profit and loss statement example, profit and loss statement example for restaurant