Early Payoff Mortgage Calculator With Amortization Schedule – When you take out a loan or mortgage, it is important to check your credit. However, calculating payments and planning your schedule can be difficult. This is where Excel’s amortization template comes in handy. A schedule is a table that lists all loan payments over time. The payment amount is obtained from the amortization calculation.

“Pay off” the loan means paying off the balance, including both interest and principal, in regular increments. An Excel amortization template shows you how much you’ll pay in principal and how much you’ll pay in interest. In the beginning, most of your debt will go towards paying interest, but over time, most of your debt will go towards repaying the principal.

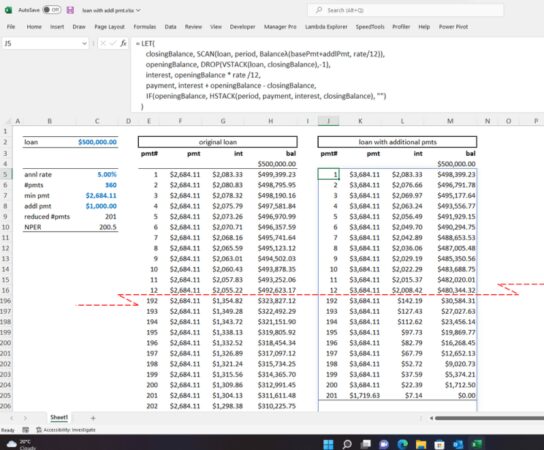

Early Payoff Mortgage Calculator With Amortization Schedule

The analysis of the amortization process below provides a method to quickly determine the paid and unpaid balances. It also lists all scheduled payments over the life of the loan and shows the remaining balance. Enter the numbers for your loan amount, interest rate, loan term and payment term, and the calculator will do the rest. We have prepared different templates that can be used for different loans. Choose what is best for you and start managing your money well. You can also use the built-in amortization template in Excel by following these steps:

Free Amortization Schedule Template

The Microsoft Excel amortization schedule template can be used for many types of loans, including personal loans, mortgages, business loans, and auto loans. Calculate the interest and principal payments for a specified loan amount over a specified period of time. This Excel chart template shows the balance after each payment and the amount of interest paid to date. It will also calculate the number of payments required to pay off your loan in full, so you can plan accordingly.

The loan amortization Excel template can be used for mortgages, one of the most common types of loans. Use this template to calculate the balance due and unpaid, as well as the distribution of interest and payment principal. This will help you determine how much money is left before you actually get the house. You can also see how much you can save by paying off your mortgage.

Use this Excel amortization template to calculate balloon payments. A balloon payment is when you make a series of small payments to reduce the principal and arrange your payments to pay off the loan immediately. This loan calculator calculates the amount and schedule of monthly payments and balloon payments.

Use this discount Excel template to calculate the amount of equity you’ll have left in your home after a few years. Since home loans are essentially second mortgages, you can determine how long it will take to pay off each loan. This template also helps you answer important questions related to selling your home, such as how much you’ll pay in one payment, how much you’ll owe if your home’s value drops, and what to do in the event of default. Mention other costs.

Free Home Mortgage Calculator For Excel

Use this Excel loan amortization template to calculate the total loan amount when you buy a car, taking into account shopping, mortgage, down payments, sales tax, and other expenses. You can calculate how long it will take to pay off your loan and test how much more payments can help you get your car back faster.

Empower your employees to exceed expectations and adapt to changing needs with a flexible platform designed to support the needs of your team.

The platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and deliver more. Report on key metrics and gain real-time visibility into performance with dynamic reporting, dashboards, and workflows designed to keep your team connected and informed.

If your team members have a clear understanding of the work to be done, there is nothing stopping them from working at the same time. Try it now for free. The First Mortgage Payment Calculator can help you determine the new monthly payment amount needed to shorten your repayment period, based on your loan balance, mortgage rate, and current payment amount. By adding extra to your monthly payments, you can pay off your mortgage faster and lower your total interest over the life of your mortgage.

Ultimate Fixed Rate Mortgage Payoff Calculator

The first mortgage payment chart compares the old and new payment terms to show the impact of additional payments. The graph allows you to compare loan values and different fees at any time.

Depending on your mortgage agreement, there may be a limit on the amount you can pay each month on your mortgage. Always check with your lender before making any payments, as penalties may apply.

Over the life of your mortgage, your monthly payments are made in two installments. In addition to repaying the principal, you also pay interest for the month. Since the interest is paid monthly, the remaining balance is used to pay the principal. You can use our mortgage amortization calculator to see how this changes over time.

If you make other payments, be sure to tell your lender that those payments will be credited to your principal. Otherwise, your lender can add the debt to your future interest payments, and you won’t be able to keep interest payments from your principal balance. By adding even a small amount to your monthly payment and adding it to your principal balance, 100% of that amount will turn into equity in your home. Basically, you buy more home each month, lower your mortgage and pay less interest. This process is called accelerated amortization, and it’s one of the easiest ways to pay off your mortgage on time.

Mortgage Calculator With Extra Payments

No matter how you spend your money, make sure you have enough money to cover your rent and other expenses if you lose your job or have an unexpected income. You must have enough money to cover your loan payments. If not, you can lose your home. Home equity is illegal and should not be considered part of your income.

Some lenders charge early payment penalties if you pay off too much of your loan in the first few years of your mortgage term. These benefits can also apply if you pay off, refinance or sell your home. Lenders charge this fee because they can lose interest. Most lenders do not charge a penalty for paying down payments too quickly.

The amount of the payment may vary depending on the mortgage and will be indicated in the fine print of the mortgage agreement. You can contact your lender directly, but you should also check your mortgage agreement or contract.

Before taking out a loan, make sure you understand and clearly explain the terms of each loan.

Mortgage Payment Calculator

Refinancing your loan is a great option that offers more flexibility than sticking to your original mortgage agreement. Changing from a 30-year mortgage to a 15-year mortgage is a common option if you can afford the larger payment. Short-term loans often have lower mortgage rates and can save you more than just the down payment. You can significantly reduce your interest payments and pay off your mortgage in half the time. If you refinance for less time, your monthly payments will be higher and you won’t have the flexibility to pay more as it suits you. It is important to understand the terms and conditions of your loan and how to get a refund.

The calculations and content on this page are for general information purposes only. does not guarantee the accuracy of the information displayed and is not responsible for any results of its use. This is another loan calculator with features. (You can find a calculator for professionals here.) It includes various graphs to help you visualize how the amount in the table will be repaid over the life of the loan. You will also be provided with a comprehensive table showing how your payments will be applied to fees and principal payments. You can also check the effect of adding a periodic compensation option. This tool requires you to click Calculate before the results are displayed.

I see you are using an ad blocker. Or, your browser settings prevent the display of ads.

Economic Calendar How to Manage OCR TPPA Explainer Series Key Banking Indicators Become a Podcast Sponsor – Subscribe Here Subscribe to GDP Banking Live Newsletter Subscribe to Free Email Newsletter Here

Loan Amortization Schedule Calculatorhome Mortgage

Property Sales Results Rental Report “Sprawl” First Rental Rates

Payoff your mortgage early calculator, mortgage calculator with early payoff, amortization calculator with early payoff, early mortgage payoff calculator with amortization, mortgage early payoff calculator amortization schedule, amortization calculator early payoff, mortgage loan payoff early calculator, nerdwallet early mortgage payoff calculator, home mortgage early payoff calculator, early payoff mortgage calculator amortization, mortgage payoff calculator early payments, mortgage payoff calculator with amortization schedule