Difference Between Personal Loan And Debt Consolidation – Debt consolidation and personal loans are two popular financial options for people looking to manage their debt and improve their financial situation. A question I hear all the time is, “Which is better, debt consolidation or personal loans?

There is no right or wrong answer to the question. Both options come with their pros and cons, and the choice between them ultimately depends on one’s particular financial situation.

Difference Between Personal Loan And Debt Consolidation

In this article, we’ll compare debt consolidation and personal loans to help you decide which one is right for your unique needs.

Debt Matters: How To Save Money Every Month With A Personal Loan

A debt consolidation loan is a type of loan that is used to pay off and consolidate multiple unsecured debts into one monthly payment.

This means that instead of paying different interest rates and repayment terms to multiple lenders, you consolidate all of your debts into one monthly payment.

The idea behind a debt consolidation loan is to consolidate several high-interest loans into one low-interest loan, which can help you save money on interest and shorten your overall loan repayment period.

A debt consolidation loan and a debt consolidation plan (DCP) are similar. The only difference is that debt consolidation plans are strongly recommended by banks and cannot be used for all types of unsecured loans.

Create A Smart Debt Consolidation Plan By Using These Suggestionspwbvl.pdf.pdf

Unsecured loans under DCP that can be included in debt consolidation in Singapore include personal loans, credit card loans and lines of credit.

Unsecured loans such as education loans, auto loans, home improvement loans, student loans, business loans, and medical loans are not included in the Debt Consolidation Plan (DCP).

As mentioned above, debt consolidation loans in Singapore consolidate multiple loans into one monthly loan.

Another thing to note is that when you get a debt consolidation loan, the loan can only be used for unsecured debt consolidation. Unsecured loans are loans without collateral, while secured loans are secured by collateral.

Should You Apply For Debt Consolidation Personal Loan?

Debt consolidation loans are best for people with good credit who have multiple debts with high interest rates and want to simplify the debt repayment process by making one monthly payment.

A personal loan is a type of unsecured loan offered by lenders to individuals for various purposes. It’s given to you as a one-time payment and you don’t have to protect the loan, so what you do with the loan is up to you.

The interest rate charged on a personal loan depends on your credit score. If you have a good credit score, you can get a lower interest rate. If you have a bad credit rating, you will be charged a higher interest rate on your loan.

Once your loan is approved, you are expected to repay the loan for a certain period as well as the interest rate.

Debt Consolidation With A Personal Loan

If you don’t qualify for a Singapore debt consolidation loan, remember that you can get a personal loan for debt consolidation because a personal loan can be used for anything.

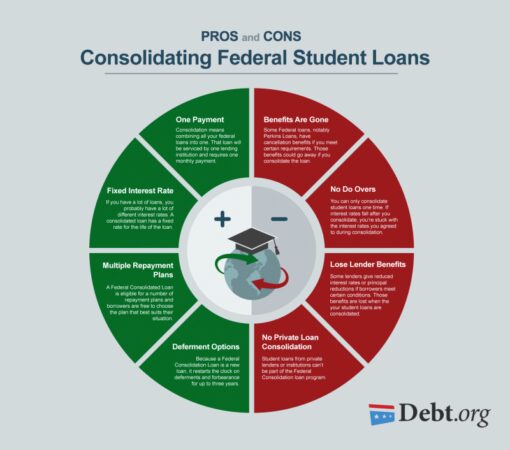

“What’s Better – Debt Consolidation or Personal Loans?” This question can be answered with the pros and cons of each type of loan. Consider the pros and cons before making a decision.

Before applying for a debt consolidation loan or signing up for a debt consolidation plan, there are several important factors to consider:

You must be a Singaporean or permanent resident to qualify for a consolidation loan. You must have a fixed income of $30,000 to $120,000, $2 million in assets, and the amount of debt you want to consolidate must be 12 times your monthly income.

How To Use A Personal Loan To Consolidate Debt

Your credit score plays a big role in determining your loan terms and interest rates. People with good credit scores are more likely to get lower interest rates, while people with poor credit scores may have limited or even denied options.

It’s important to know who you owe. This information can help you decide the best way to consolidate your debt and choose the debt consolidation plan or loan that best suits your needs.

Look for a debt consolidation loan or a plan that offers a lower interest rate than your current debt.

Consider the term of the loan or plan, as well as the monthly payment amount. Make sure the terms are comfortable for you and that they are fair.

Debt Consolidation Loans: Using Debt To Get Out Of Debt Faster

Look for debt consolidation loans or plans with minimal payments. Some lenders charge transfer fees, annual fees and closing costs.

A debt consolidation loan or plan can have a positive or negative impact on your credit score. You can improve your score if you use it as a tool to make your monthly payments easier. However, if you are undisciplined and turn money into bad habits, you will hurt your credit score.

Banks, licensed lenders in Singapore or Credit Consulting Singapore (CCS) are the main places to get debt consolidation loans.

Banks offer debt consolidation plans, but they may have stricter requirements than lenders. In addition to the above requirements, some banks may have additional requirements.

Debt Consolidation: How Can I Get Out Of Debt Safely?

Banks may offer debt consolidation deals. Be sure to shop around for the best loans with the best interest rates.

When you choose to arrange your loan with a lender, the requirements are less stringent than with banks, as there is more flexibility.

However, keep in mind that the maximum interest they can pay is 4%. Approvals and payouts are fast (within hours) and you don’t incur any additional fees other than admin fees capped at 10% and late fees if you’re in default.

It is a non-profit government organization that offers debt consolidation plans. Their requirements are similar to banks, but the good thing is that you are paired with a loan counselor who can help you better plan and manage your debt.

Your Guide To Using Personal Loans For Debt Consolidation

In this case, you should be able to answer the question “Which is better – debt consolidation or personal loans?”

A debt consolidation loan is good if you have multiple debts with a high interest rate, steady income and a reasonable credit score. If you don’t qualify, you can consolidate your debt with a personal loan.

GS Credit, a licensed lender in Singapore, offers debt consolidation loans and personal loans at low interest rates. We help you manage your debts and consolidate them into one monthly payment, so you can be debt-free in less time.

Contact us now to speak with a loan officer or apply for a debt consolidation loan online. Due to the high cost of living and rising inflation in Singapore, you may have taken on a lot of debt. As a result, you may consider debt consolidation or a personal loan to reduce your payment burden.

What Is A Personal Loan?

Whether you use one of the two loans to consolidate your debt, they have their pros and cons. Therefore, it is best to weigh whether a debt consolidation loan or a personal loan is better.

Read this article to understand the difference between debt consolidation and personal loans, their pros and cons, what to consider when applying, and where to get a loan.

A debt consolidation loan is a loan that allows you to combine all of your debts into one loan. This means that instead of paying several loans per month, you will have one loan.

If you have multiple loans with high interest rates, you can consolidate them into loans with low interest rates. It allows you to manage your payments and keep track of your monthly payments.

How Does Debt Consolidation Work

When you’re wondering whether to get a loan consolidation or a personal loan, it’s helpful to understand the difference between the two loans.

Whether you decide to go for a debt consolidation loan or a personal loan in Singapore, both have their pros and cons.

When you have multiple loans from multiple lenders, you skip monthly payments. This will result in late payment, which will result in penalties. However, with debt consolidation loans, you can consolidate your debts into one so you can manage your expenses. This will help you remember the due date of your loan.

Before debt consolidation, you will be dealing with different interest rates on many loan amounts. This usually results in high costs. A joint loan offers you only one interest rate at a lower cost for better savings.

What Is Debt Consolidation?

Sometimes planning to pay off debt can be difficult. You can change this by looking for a debt consolidation loan with lower monthly payments and longer loan terms. This makes the payment schedule flexible.

When you get a debt consolidation loan, your credit score will improve over time. Because you can save without missing monthly payments. And with a good credit score, you can get loans from banks or other financial institutions.

When you get a loan with a low interest rate, you

Difference between debt settlement and debt consolidation, discover personal loan debt consolidation, personal loan debt consolidation calculator, personal loan or debt consolidation, debt consolidation vs personal loan, difference between bankruptcy and debt consolidation, chase personal loan debt consolidation, personal debt consolidation loan, difference between debt consolidation and credit c, difference between debt relief and debt consolidation, unsecured personal loan debt consolidation, debt consolidation personal loan rates