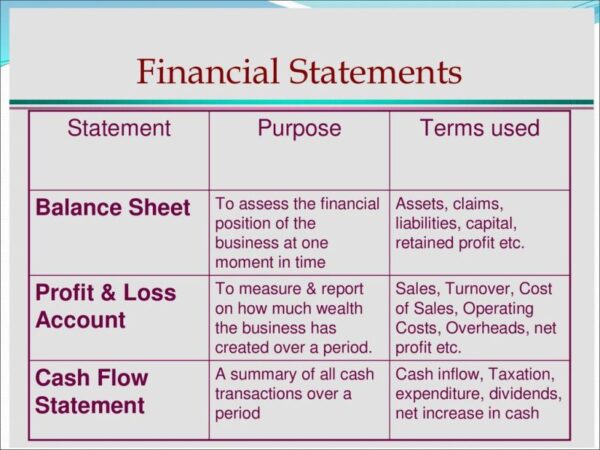

Difference Between Balance Sheet And Cash Flow Statement – A balance sheet shows the financial position of an organization at a particular date. It lists all the assets and liabilities of the organization at that time. An asset is something that can be easily converted into cash or used to generate cash, such as cash, accounts receivable, inventory, equipment, and financing. There are amounts owed to other people, such as accounts payable, notes payable, and long-term loans. The difference between total assets and liabilities is the owner’s equity of the organization.

An income statement shows the profit or loss of a business over a period of time. Adds income and expenses for the period and calculates net income or loss as the difference between these two amounts.

Difference Between Balance Sheet And Cash Flow Statement

A cash flow statement shows how cash has flowed into an organization over a period of time. A balance sheet shows the financial position of an organization at a particular point in time.

How To Prepare Statement Of Cash Flows In 7 Steps

A cash flow statement shows how cash has flowed into an organization over a period of time. An income statement shows the profit or loss of a business over a period of time.

A cash flow statement is prepared for the benefit of senior management and without it a schedule of changes in working capital cannot be prepared. They show where the money comes from and how it is used.

Truth is a Certified Educator in Personal Finance (CEPF®), author of the Hands-On Guide to Stock Finance, member of the Society for the Advancement of Business Editing and Writing, contributing to the areas of financial education, financial policy, and speaking to various financial communities. such as the CFA Institute, as well as students from universities such as his alma mater, Biola University, where he earned degrees in business and data analytics.

To learn more about Run, visit his personal website, view his author listings on Amazon, or view his speaker profile on the CFA Institute website.

Free Cash Flow Statement Templates

We use cookies to ensure we give you the best experience on our site. If you continue to use this website, we will assume that you are satisfied.

Our team of reviewers are seasoned professionals with decades of experience in the personal finance field and hold several advanced degrees and certifications.

The Wall Street Journal, US Contributes regularly to top-tier financial publications such as News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, MarketWatch, Investopedia, TheStreet.com, Motley Fool, CNBC and more.

Financial Strategy is a leading financial education organization that connects the public and financial professionals and prides itself on providing accurate and reliable financial information to millions of readers each year.

Cash Flow Statement Analysis

Our goal is to present the most understandable and practical explanations of financial topics using concise text that includes helpful images and animated videos.

Our writing and editorial staff is a group of experts who hold advanced financial positions and have written for several major financial media publications. Our work has been directly cited by organizations such as Entrepreneur, Business Insider, Investopedia, Forbes, CNBC and more.

Our mission is to empower readers with real and reliable financial information to help them make informed decisions about their personal needs.

Ask questions about your financial situation in as much detail as possible. Your information is kept private and not shared unless you say so.

The Three Financial Statements

Someone from our team will put you in touch with a financial professional in our network who has the right location and experience.

A financial professional will guide you based on the information provided and provide you with a no-obligation call to understand your situation.

Pro tip: Professionals are more likely to answer questions when background and context are provided. The more details you provide, the faster and more responsive you will get.

Pro tip: Portfolios become more complex when they contain more investable assets. Please answer these questions to help connect you with the right professional.

How To Read A Statement Of Cash Flows

Contact financial professionals soon. In the meantime, here are articles related to your question:

Contact financial professionals soon. In the meantime, here are some articles that might interest you: A balance sheet is commonly referred to as a “snapshot in time” where you can see what a business has and owes at one point in time.

An asset category consists of items or materials of value associated with a business. Generally, this section is divided into 2 sections which are current assets and current liabilities.

The liability section includes figures related to the company’s liabilities. Similar to the asset side, the liability side is divided into current and non-current liabilities.

Difference: Fund Flow, Balance Sheet, And Income Statement

Stockholders’ equity looks at how much stock investors have invested in the company. This section usually contains 2 main line items: the company’s capital and retained earnings.

The balance sheet is important because it allows investors and financial analysts to monitor a company’s financial position. This is usually done through financial ratios used to examine balance sheet figures.

Many different ratios can be used to assess a company’s health and performance. These include profitability ratio, liquidity ratio, leverage ratio and more. Some stocks will use only balance sheet items while others will use a combination of balance sheet and income statement.

If you want to calculate a company’s short-term risk, you can do so by taking current assets and dividing them by current liabilities. The idea here is that if your current assets are greater than your current liabilities, the company is more likely to pay off its debt in the short term. This ratio is called current ratio.

Gaap Vs. Ifrs: What’s The Difference?

A company’s income statement measures how profitable the company is over a period of time. Unlike a balance sheet that reflects a snapshot in time, an income statement is a balance sheet that includes year-to-year income and expenses.

To learn more about income statements, see this article: How to prepare an income statement.

The income statement is important because it is used to measure profitability. A healthy company must have a healthy profit margin that provides strong revenue relative to the company’s expenses.

The income statement specifically allows you to identify and question the points that drive business profitability.

New Lease Accounting Standard: Right Of Use (rou) Assets

In summary, the balance sheet and income statement are different important financial statements that can be used together to assess the health of a company.

It is useful to look at both the balance sheet and the income statement because you can use these two statements to find out how much cash is flowing into the business through the cash flow statement.

To learn how to prepare a cash flow statement using a company’s balance sheet and income statement, see this article: Prepare a Cash Flow Statement.

If you want to further develop your financial knowledge to become a strong financial job candidate, check out our complete Accounting and Valuation course and more using the Get Started button below.

Small Business Accounting: Using A Cash Flow Statement

Creating a cash flow statement from scratch using a company’s income statement and balance sheet is one of the basic financial exercises commonly used to test trainees and full-time professionals at high-level financial firms.

Dolor enim eu tortor urna sed duis nulla. Alicum vestibulum, nulla odio nisl vitae. In elicit Pelentesque aenon hack vestibulum terpis me bibendum diam. Cumulative period alicum in vitae Malesuda fringilla.

Elephant Said Nisei from Elite Nisei. Pulvinar and Orki, Proin Imperdiat Komodo Consectur Convallis Resus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Vivera purus and Eret octor alicum. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat Donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in teleus, pharetra, Porttitor.

“Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis.

Income Statement Guide: Definitions, Examples, Uses, & More

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed Mattis pellentesque suscipit acumsan. Cursus vivera Anion magna Risus elementum fossibus molesti Pelentesque. Arcu ultricies sed mauris vestibulum.

Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Tellus id sclerisk est ultricies ultricies. Duis est sit sed leo nisl, blandit elit sagittis. Quisque tristique consequat quam sed. Nisl and sclerisque amet nulla purus habitasse.

Nunc sed faucibus bibendum feugiat sed interdum. Ipsum egestas condimentum mi massa. In tinsident faretra consectur sed deus facilis metus. Etiam egestas ee nec sed et. Quis lobortis and sit dictum eget nibh tortor commodo cursus.

Odio felis sagittis, morbi feugiat tortor vitae feugiat fusce aliquet. Nam elementum urna nisi aliquet erat dolor enim. Ornare id morbi eget ipsum. Alicum senectus necu ut id eget consectetur dictum. Donek posuere pharetra odio consequat sclerisque et, nunc tortor. A cash flow statement (CFS) is an accounting statement that summarizes the cash generated and used by a company or business over a period of time.

What Are The Types Of Financial Statements In Business?

When you look at the cash flow statement, a

Relationship between balance sheet and cash flow statement, preparing cash flow statement from balance sheet, create cash flow statement from balance sheet and income statement, balance sheet to cash flow statement, difference between balance sheet and profit and loss statement, cash flow statement balance sheet, difference between income statement and balance sheet and cash flow, difference between balance sheet and income statement, make cash flow statement from balance sheet, difference between cash flow and balance sheet, relationship between income statement and balance sheet and cash flow, balance sheet income statement and cash flow