Debt Consolidation Loan For Low Credit Score – Maintaining a healthy credit score is essential to your financial well-being. However, many people in Australia face the challenge of bad credit, which can limit financial options and increase financial stress. Fortunately, a debt consolidation loan can provide a possible solution for those with bad credit. In this comprehensive review, we explore the concept of a debt consolidation loan, understand the impact of bad credit, and discuss the benefits, challenges, and alternatives available.

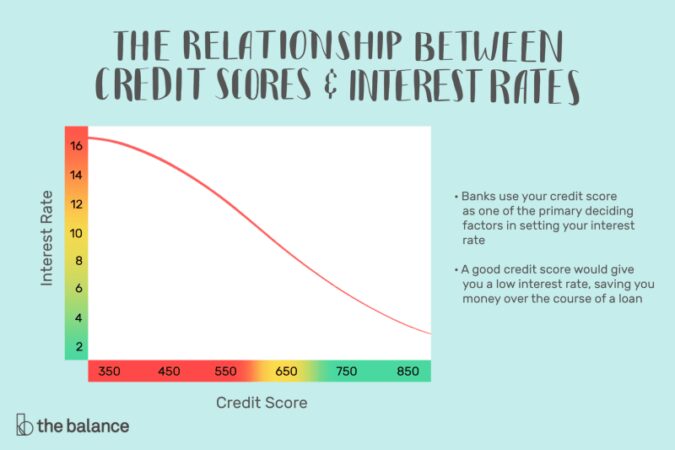

Credit scores represent numbers of a person’s creditworthiness. In Australia, credit scores generally range from 0 to 1,000 or 0 to 1,200, depending on the credit bureau. Many factors affect your credit score, including your payment history, credit utilization, length of credit history, type of credit, and recent credit applications. Bad credit refers to low credit scores caused by late payments, defaults, high credit card balances, or other bad financial behavior. People with poor credit scores may have difficulty obtaining a loan or credit, may face higher interest rates, and may have limited financial opportunities.

Debt Consolidation Loan For Low Credit Score

Debt consolidation is a technique that allows people to combine multiple debts into one loan. This process makes debt management easier by making your monthly payments easier and possibly lowering your interest rate. Debt consolidation allows people to take control of their finances and aim for a debt-free life.

Is A Debt Consolidation Loan Right For You?

There are two main types of debt consolidation loans: secured loans and unsecured loans. Secured loans require collateral, such as a home or car, to form collateral for the borrower. Unsecured loans, on the other hand, do not require collateral, but they usually come with a higher interest rate because they represent more risk to the lender. People with bad credit should carefully consider these options and their associated risks and benefits.

Debt consolidation loans offer several benefits to people with bad credit. One of the main benefits is simplified credit management. You are less likely to miss a deadline because you only have to make one payment per month instead of rushing through multiple payments. Additionally, if your new loan offers you a lower interest rate compared to your existing debt, it can lead to potential savings in the long run. Additionally, if a person makes the loan consolidation payments on time, their credit score can improve over time.

However, there are also potential obstacles to consider. When people with bad credit get a debt consolidation loan, they may face higher interest rates. Lenders see bad credit as high risk and charge high interest rates to reduce that risk. It is important to carefully review the terms of your loan, including any additional fees or charges. Additionally, debt consolidation can temporarily negatively impact your credit score in the short term. However, if you pay responsibly, your credit score can recover over time.

People with bad credit may face some challenges when looking for a credit consolidation loan. Traditional financial institutions such as banks and credit unions often have strict eligibility criteria for people with bad credit. These lenders often rely heavily on credit scores and may be hesitant to lend to people experiencing financial difficulties.

Fast Cash Loan Singapore

However, for people with bad credit, other financial institutions may be available. Online lenders and peer-to-peer lending platforms offer flexible eligibility requirements and accept individuals with less than perfect credit scores. There are also specialized lenders that specialize in helping borrowers with bad credit. Rather than relying solely on credit scores, these lenders evaluate loan applications based on income stability, work history, and affordability.

People with bad credit should consider several factors when choosing a credit consolidation loan. First, it is important to properly assess your financial situation. This includes calculating your total debt, assessing your income stability, and understanding your ability to pay. It is important to choose a loan that fits your financial goals and budget.

It is also important to compare loan options from different financial institutions. Interest rates, loan terms, and fees can vary greatly from lender to lender. By getting multiple offers and considering the terms carefully, people can choose the most beneficial loan for their specific needs. To ensure transparency and avoid surprises, we recommend that you read and understand your loan agreement carefully before entering into an agreement.

Debt consolidation loans are popular, but they’re not right for everyone. People with bad credit have other options, including:

How Personal Loans Affect Your Credit Score

Credit counseling agencies offer debt management programs that teach you how to manage your debts. These plans include negotiating low interest rates and affordable payment plans with borrowers.

Individuals can consolidate credit card debt into a balance transfer credit card with a low interest rate or 0% introductory offer. While this strategy offers temporary relief and potential interest savings, responsible credit card management is essential.

Negotiations with creditors: Contacting creditors directly to discuss adjusting payment terms or considering hardship plans may be an option for people with bad credit. With open communication and a willingness to face financial difficulties, you can create a manageable debt repayment plan.

Taking out a debt consolidation loan is just one step to refinancing. It is important to develop good financial habits and make responsible decisions to improve your credit health and overall financial health.

Debt Consolidation Loans Vs. Personal Loans

Estimating income, expenses, and debts can help people create a reasonable budget and allocate money to pay off debt. Prioritizing paying off debts and avoiding unnecessary expenses are key ingredients to a successful plan.

Financial advisors and credit counseling agencies can provide you with expert guidance tailored to your individual situation. They provide personalized strategies, advice, and ongoing support to help you reach your financial goals and improve your credit life.

In conclusion, debt consolidation loans can be an important tool for people with bad credit to effectively manage their debts. Individuals can make informed decisions by understanding the consequences of bad credit, researching available loan options, and weighing the pros and cons. Choosing the right loan is important because considering other strategies when necessary and developing responsible financial habits will pave the way for financial stability and a brighter future.

It is a good option to consider when considering a debt consolidation loan. Our commitment to transparency sets us apart. It is our goal to provide clear and complete information about our services, prices and terms. it allows you to make informed decisions without worrying about hidden surprises that arise during the process. Compare over 15 lenders to find the best deal for your financial situation.

Best Debt Consolidation Loans Of December 2023

Philana Kwan is the Marketing Coordinator for this company, has an excellent customer service record, and is knowledgeable in all things automotive and finance. When I’m not working, I enjoy learning new things and following the latest trends in marketing and technology.

Understanding Bad Debt Consolidation Explaining the Pros and Cons of Bad Debt Consolidation Loans Bad Debt Consolidation Loans: Overcoming the Challenges Choosing the Right Debt Consolidation Loan Some Debt Reduction Strategies Navigating the Road to Financial Reconstruction

Get the best car loan in 60 seconds. Use our free loan matching tool to explore your options. Get started now Debt consolidation loans are a popular option for people struggling with a lot of debt. These loans allow you to consolidate all your debts into one loan, resulting in lower interest rates and longer repayment terms. However, if you have bad credit, it can be difficult to get a debt consolidation loan. This section explains bad debt consolidation and helps you understand how it works.

A bad credit consolidation loan is a loan designed for people with low credit who have difficulty getting a regular loan. These loans are designed to help people consolidate their debts into one manageable payment. Bad credit consolidation loans usually have higher interest rates than conventional loans, but offer lower interest rates than credit cards.

Debt Consolidation Loan With Bad Credit: How To Do It

A loan consolidation is a loan that combines multiple loans into one loan. These loans usually have low interest rates, fixed monthly payments, and long repayment terms. With a consolidated loan, you can pay off all your existing debts and consolidate your monthly payments into one. Debt consolidation loans include secured loans and unsecured loans. A secured loan requires collateral such as a car or home, but an unsecured loan does not.

Lower monthly payments: Consolidation loans usually have lower interest rates than credit cards, so your monthly payments may be lower.

Simplify your finances: Consolidate your debts into one loan to simplify your finances and focus on your monthly payments.

Improve your credit score: Paying off your debt with a debt consolidation loan can improve your credit score over time.

Debt Consolidation And Ebitda: Streamlining Financial Obligations

Extend your repayment term: Extending your repayment term will lower your monthly payments, but you’ll also pay more interest over time.

Risk of losing collateral: If you take out a debt consolidation loan and default, you run the risk of losing your collateral.

Credit Counseling: A credit counselor can help you budget and negotiate with creditors to lower interest rates and monthly payments.

Debt Settlement: Debt settlement involves negotiating with your creditor to settle your debt for less than what you owe.

Debt Relief: Soft Loans: Alleviating The Burden Of Debt

Bankruptcy: Bankruptcy is a legal process that helps you eliminate debt or make a payment plan to pay it off over time.

Bad debt consolidation loans can be a useful management tool

Debt consolidation loan low credit score, loan for debt consolidation, credit card debt consolidation loan, debt consolidation loan credit score, debt consolidation loan for fair credit, credit score for debt consolidation loan, debt consolidation loan for 500 credit score, debt consolidation credit score, credit debt consolidation loan, minimum credit score for debt consolidation loan, debt consolidation bad for credit score, credit score required for debt consolidation loan