Current Interest Rates Refinance 30 Year Fixed – The table below shows the 30-year mortgage refinance rates in New York. You can use the menus to choose other loan terms, change the loan amount, determine the value of the home, buy loans or change your location.

When buying a home, one of the most confusing aspects of the process is choosing a loan. There are many different financial products to choose from, each with their own advantages and disadvantages. The most popular mortgage product is the 30-year fixed rate mortgage (FRM).

Current Interest Rates Refinance 30 Year Fixed

This article examines 30-year mortgage product comparisons, 30-year benefits, and what to look for when choosing a 30-year mortgage.

Year Mortgage Rates Jump To New High

In recent years, approximately 90% of borrowers have used 30-year FRMs to purchase their homes. The reason why this loan is so popular is the confidence it offers along with the low interest rates.

Economists predicted that the economy would recover in 2010. But the economy has been sluggish for many years with slow growth. The economy contracted in the first quarter of 2014, but economic growth picked up in the second half of 2014. The Federal Reserve eased its asset purchases and oil prices fell. Consumers’ perception of inflation and inflationary expectations are largely determined by the price of natural gas at the pump. As growth accelerates, the consensus is that interest rates will continue to rise over the next two years until 2020 or until a recession occurs. The table below shows interest rate forecasts for 2019 from reputable organizations in the real estate and mortgage market.

NAHB saw 30-year rates rising to 5.08% in 2020, while they expected ARMs to rise from 4.46% to 4.63% in 2019.

Although the data is out of date, the above predictions are posted on this page to show how relatively favorable conditions can be by leading experts from major industry associations and billion dollar companies. The average forecast rate for 2019 was 5.13% and the average for the year was 3.94%.

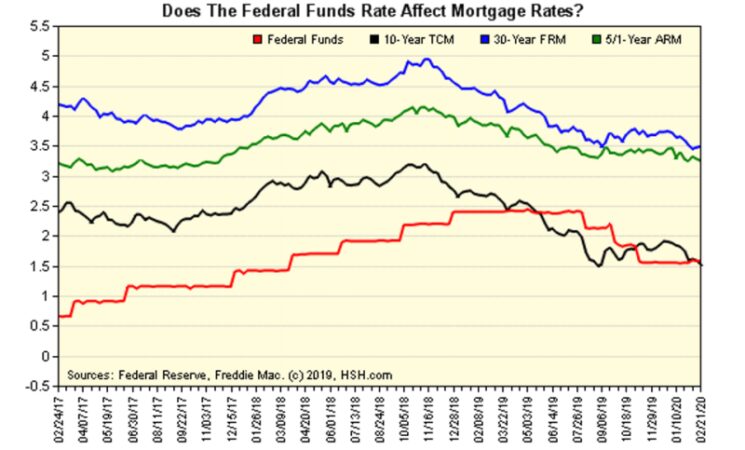

Mortgage Rates Chart

Industry experts can get away on relatively good terms. A real crisis is almost impossible to predict accurately.

The health crisis caused by COVID-19 has caused government shutdowns around the world, causing many economies to shrink at record rates. In the second quarter of 2020, the US economy contracted at a record annual rate of 31.4%.

The global economy has seen the Federal Reserve’s FOMC cut interest rates twice, announcing it would do unlimited quantitative easing and providing guidance indicating the possibility of rate hikes through 2023.

Mortgage rates fell to new record lows as the economy cooled as the Federal Reserve bought bonds and mortgage-backed securities. The average 30-year rate fell to 2.78% in the week of November 5. 2020 is expected to be a record year for mortgages, with Fannie Mae forecasting $4.1 trillion in institutions and $2.7 trillion in refinance loans.

Year, 20 Year Mortgage Refinance Rates Dip: Time To Make A Move?

When choosing a mortgage, there are many mortgage products and terms to choose from, each with different interest rates. Although 30-year rates are at historic lows, recently below 4%, they are still higher than other short-term loan options. 30 year rates are comparable to the following popular products:

15-year fixed rates are usually lower than 30-year fixed rates, and depending on the lender, rate options range from 0.50% to 0.75%. These rates are often lower because the shorter term poses less risk to the lender. Although interest rates are lower, 15-year payments are higher than 30-year payments because the loan must be paid off halfway through the term.

ARMs typically come in at a slightly lower rate than 30-years (although there is a slight twist to that relationship in the mid-2020s). With an ARM, the borrower receives a fixed interest rate for an initial period, usually 1-7 years, until the interest rate reflects broader market conditions. Generally speaking, the lower the interest rate, the lower the interest rate. The most common ARM product is the 5-year adjustable rate mortgage, which usually comes with an interest rate of 0.25% to 1% less than 30%. After the entry period, the loan rate is regularly adjusted every 6 months to the London Offered Annual Interest Rate (LIBOR) or the 11th District Cost of Capital Index (COFI). ARMs come with an interest rate cap, although this cap is usually much higher than the interest rates applied to FRMs.

Although not offered as often today as in years past, many borrowers choose interest-only mortgages. Because interest-bearing loans require no principal payment and do not amortize, the balance never decreases. Because of this, lenders take on more risk and often require higher down payments and higher interest rates. Only mortgage rates are 1% higher than 30-year rates.

Calculate Mortgage Payments: Formula And Calculators

The chart below shows historical data from the Freddie Mac mortgage market survey. It shows 30 years of historical rate data dating back to 1971, with 15 years of data dating back to 1991 and 5/1 ARM data dating back to 2005.

On August 15, 1971, President Nixon closed the golden window due to the cost of Great Society programs and the cost of the Vietnam War.

Inflation rose in the early 1980s before Federal Reserve Chairman Paul Volcker raised interest rates to fight recession and inflation. Since 1981, interest rates have fallen worldwide and mortgage rates have followed suit. Typically, the 30-year FRM tracks moves in the 10-year Treasury, trading about a percentage point higher.

The best time to get a 30-year mortgage is when interest rates are low. Interest rates change significantly over time. At the end of 2020, mid-30s were below 3%. Before the Great Depression, rates were over 6%, and in October 1981 they were 18.45%.

Measuring The Gap: Refinancing Trends And Disparities During The Covid 19 Pandemic

A 30-year FRM is the most popular choice among both homebuyers and those choosing to refinance their mortgages at a lower interest rate.

Looking at the market as a whole, people using 15-year FRMs to refinance make up the overall market slightly more than if they didn’t refinance.

While there are many advantages to the 30-year option, some lenders try to roll the extra payments into the mortgage. Paying closing costs is ultimately inevitable because you have to cover the bank’s costs, and those who claim no “closing costs” usually include those costs in the loan through a higher interest rate. The most common costs or fees that borrowers should be aware of include:

The Federal Reserve began a bond buying program. Protect your credit by locking in today’s low interest rates.

The Most Important Factors Affecting Mortgage Rates

Answer a few questions below and contact a lender who can help you get financing today! Our goal here is to provide you with the tools and confidence provided by Credible Operations, Inc., NMLS Number 1681276, referred to below as “Credible.” you need to improve your finances. Although we promote the products of partner lenders who compensate us for our services, all opinions are our own.

Based on data compiled by Credible, three key mortgage refinance rates were unchanged and one increased from yesterday.

Prices were last updated on September 2, 2022. These prices are based on the assumptions presented here. Actual prices may vary. With 5,000 reviews, Credible maintains an ‘excellent’ Trustpilot rating.

What it means: Rates on 30-year refinances rose slightly today, while rates on all other key terms are steady. Homeowners looking to refinance may want to consider locking in a 10- or 15-year rate — which is half a point lower than long-term rates. But with 20-year rates higher than 30-year rates, buyers who want lower monthly payments should stick with a 30-year refinance.

Mortgage Rates Approach 4% Much Faster Than Expected

Based on data compiled by Credible, three key homebuyer mortgage rates were unchanged and one rose from yesterday.

Prices were last updated on September 2, 2022. These prices are based on the assumptions presented here. Actual prices may vary. The trusted marketplace for personal finance has over 5,000 Trustpilot reviews with an average rating of 4.7 stars (out of a possible 5.0).

What it means: With refinance rates for 30- and 20-year mortgages approaching 6%, homebuyers looking to save more on interest may be looking for shorter terms. Ten- and 15-year interest rates are half a point lower than interest rates for longer repayment terms. Shorter terms come with higher monthly payments, but buyers who can afford those higher payments can save more in interest and be mortgage-free.

To find great mortgage rates, use Credible’s guaranteed site, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use the Credible calculator to calculate your monthly mortgage payments.

Mortgage Rate News

Today’s mortgage rates are below annual highs

Refinance interest rates 30 year fixed, current fixed interest rates, current refinance rates 30 year fixed, refinance interest rates today 15 year fixed, current mortgage refinance rates 30 year fixed, refinance rates 30 year fixed, refinance interest rates today 30 year fixed, current mortgage interest rates 30 year fixed, current va refinance rates 30 year fixed, interest rates refinance 15 year fixed, current refinance interest rates, current interest rates 30 year fixed refinance