- Current Interest Rates For First Time Home Buyers

- How To Buy A House When Interest Rates Are High — Paige Schulte

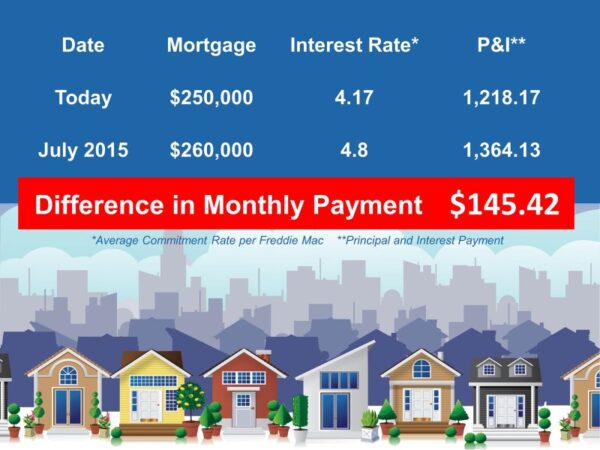

- Buying A Home: The Cost Of Waiting

- Hdb Resales In September Hit By Bto Launch; First Price Drop Since February

- First Time Homebuyer? Here’s Your To Do List! — Dove

- Guide To How Refinancing For Your Mortgage Loan Works?

- Today’s Mortgage Rates: Compare Current Interest Rates

Current Interest Rates For First Time Home Buyers – With inflation on the wane, the Federal Reserve this week raised interest rates not by the dreaded .5 percent, but by half instead.

A closer look at the data shows that a report from the US Department of Commerce shows that inflation is slowly increasing. They grew by 5.5% in November, and 5% in December.

Current Interest Rates For First Time Home Buyers

With inflation slowing, the Federal Reserve this week raised interest rates by half, not 0.5 percent. The interest rate charged on reserve accounts is 4.65 percent.

How To Buy A House When Interest Rates Are High — Paige Schulte

At Duffy’s Pub in Auburn Hills, pints are $3.25, a great way to beat inflation. But John Tyrrell and Gary Aiken say this is a small victory in a losing battle.

“I spent $350 last month to heat my house and keep it at 62 degrees,” Eken said.

Faced with higher rates, they worry not only about inflation, but how the Federal Reserve’s interest rate hike this week to further fight inflation will affect their families.

“And the best for an apartment is $1,100 — and that’s outside of what you want to live in,” he said.

Buying A Home: The Cost Of Waiting

And now new data shows it may be a good idea. For the fourth week in a row, mortgage rates fell.

So why is this happening? Why is it that when the Federal Reserve raises interest rates – the cost of borrowing money – mortgage rates fall? We went to an industry expert to find out.

We asked Alex Elizaj, director and chief strategy officer of United Wholesale Commercial Lending, about how rising interest rates are impacting home loans.

“It affects interest rates, but it doesn’t set them. At the macro level, mortgage rates have a greater impact on the economy as a whole. And they start to rise and fall based on inflation, unemployment and other key economic indicators,” Eliza said. . . .

Hdb Resales In September Hit By Bto Launch; First Price Drop Since February

Also, if you’ve been delaying your home search due to relatively high mortgage rates – you should know that lenders have new products – that allow you to purchase the amount within the first two years of the loan.

“It’s a good product for people who want to save money in advance when they get home,” he said.

The Mortgage Bankers Association said mortgage applications fell 9 percent last week from a week earlier — Elizaj said lower inflation will lead to lower lending rates — giving him optimism that business will continue.

“So I think we’re setting ourselves up for real positives, especially in the second half of 2023,” he said.

First Time Homebuyer? Here’s Your To Do List! — Dove

Oakland University business professor Michael Greiner said inflation is clearly slowing and that the Federal Reserve’s slow rate hikes this week sent a positive message.

“If you look at the expectations of consumers, they’re incredibly negative about the economy as a whole. They believe we’re in a recession when we’re not, the economy has been growing rapidly for the past two quarters now,” Greiner said.

To Duffy, Iken, and Tyrrell, they say they understand why consumers are negative. Although the economy is growing – inflation continues to hurt.

And divisive politics have left them with no confidence in our country’s ability to create an economy for all Americans.

First Time Homebuyer Loans And Programs

“When Democrats and Republicans decide it’s good for both parties to win, we win and we don’t lose,” Tyrrell said. The Federal Reserve has tightened monetary policy through 2022, responding to high and persistent inflation. Borrowing costs for households and firms are generally expected to increase. However, interest rates on fixed rate loans were particularly sensitive to changes in the political regime.

We found that interest rate volatility and the unique nature of mortgage instruments were key contributors to last year’s large mortgage activity.

The Federal Reserve began the current monetary policy cycle by raising the federal funds rate by 0.25 percentage points to 0.25-0.50 percent at its March 2022 meeting. As inflation continues to rise, the central bank continues to raise its target in subsequent meetings. The rate was 4.25-4.50 percent at the end of the year.

The Federal Reserve views changes in the target range of the federal funds rate as a major monetary policy adjustment. However, the central bank has already started reducing the size of its balance sheet, which includes overdrafts and mortgage-backed securities, by restricting the reinvestment of principal payments on investments due in June 2022.

Guide To How Refinancing For Your Mortgage Loan Works?

The response of long-term interest rates to this tightening cycle was less pronounced than the increase in the policy rate. 10-year Treasury It started at about 1.6 percent in 2022, was about 4.2 percent at the end of October, and was 3.8 percent by the end of the year. So while the federal funds rate target increased by 375 basis points (3.75 percentage points), the long-term Treasury benchmark increased only 220 basis points.

One might think that home loan rates closely follow long-term Treasury rates. This was not the case (

The average 30-year fixed mortgage was It started 2022 at 3.1 percent, peaked at 7.1 percent at the end of October, and ended the year at 6.4 percent. While both 10-year Treasuries and mortgages increased during the year, their spreads were 60 basis points at the start of the year, widened to 190 basis points in October and 150 basis points by the end of the year. What causes the wide spread between the two?

The mortgage interest rates you pay to buy or renovate homes are known as “prime rates.” A commonly cited measure of these interest rates is the data source for Chart 1 from Freddie Mac’s First Mortgage Market Study. . 80 percent. Conventional syndicated loans are eligible for investor guarantees through Freddie Mac and Fannie Mae. These two state-sponsored enterprises (SSEs) account for nearly 60 percent of new mortgages through 2022.

Interest Rates Likely To Return Toward Pre Pandemic Levels When Inflation Is Tamed

The basis for prime rates are the secondary market interest rates paid to investors holding uniform mortgage-backed securities (UMBS) guaranteed by Fannie Mae or Freddie Mac. UMBS are created and traded with coupons (interest payments to investors) in increments of 50 basis points. A secondary rate that compares UMBS to a similar rate (usually face value) is known as the “current coupon” rate.

Chart 2 shows the primary mortgage market rate (what homeowners pay) and the secondary market rate (paid to UMBS investors) through 2022. The difference between the two series – or “primary-secondary” – reflects several factors.

First, all borrowers with traditional conforming mortgages pay 25 basis points for loan maintenance. Second, Fannie Mae and Freddie Mac make guarantee payments to ensure that UMBS principal and interest are paid on time. Ultimately, borrowers must cover their costs, including the return on equity, which can fluctuate over time due to the interest rate on the loan. The primary-secondary spread, which averaged around 105 basis points in 2022, did not show a trend that could indicate an increase in long-term Treasury prices over the period.

Chart 2 shows that the largest increase in primary mortgage rates in 2022 was driven by secondary market rates. Conceptually, secondary market rates can be thought of as reflecting the sum of the long-term risk-free rate (for convenience, we’ll show the 10-year Treasury) plus the call cost that allows the borrower to repay their loan. Any time without penalty.

Interest Rate Volatility Contributed To Higher Mortgage Rates In 2022

This continuous prepayment option is costly to the lender because it is often implemented to the benefit of the borrower at the borrower’s expense, as borrowers return to a lower level of borrowing. The difference between the secondary market price and the long-term Treasury prices can be considered as the prepayment price.

Option prices increase with the volatility of the underlying asset. This is because high volatility increases the likelihood that the asset’s price will reach a level that makes the option viable. In this case, mortgage prepayment options have increased in value due to the increased volatility of the underlying interest rate.

Chart 3 plots the difference between the secondary mortgage market rate minus the 10-year Treasury versus a widely cited measure of interest rate volatility – the MOVE index. The MOVE index tracks the level of Treasury rate volatility over a one-month period through options on Treasury securities. This option-implied price volatility can be seen to reflect uncertainty about future interest rates.

Uncertainty over future Treasury rates in 2022 has translated into increased mortgage prepayment values, widening the spread between mortgage-backed securities and Treasuries over longer maturities. By the end of 2022, as markets became more uncertain about future interest rates, option-implied Treasury yields narrowed, and the spread between mortgage-backed securities and Treasuries followed suit.

Today’s Mortgage Rates: Compare Current Interest Rates

In the year While the rise in mortgage rates in 2022 was primarily supported by higher risk-free Treasury yields, it was also supported by higher costs for prepayment loans, reflecting uncertainty about the future path of interest rates.

W. Scott Frame is vice president of the Banking and Finance Group in the Research Division of the Federal Reserve Bank.

Current mortgage rates for first time home buyers, current first time home buyer interest rates, interest rates for first time home buyers, mortgage interest rates for first time buyers, current home interest rates, low interest rates for first time home buyers, best interest rates for first time home buyers, average interest for first time home buyers, rates for first time home buyers, best rates for first time home buyers, interest for first time home buyers, current mortgage interest rates for first time buyers